USD/CAD Daily Fundamental Forecast – January 31, 2018

The USDCAD pair moved lower during the course of trading yesterday as the strength of the dollar began to fade slowly from the markets. It remains to be seen whether the markets would go back to the trend seen in the first part of January, when the dollar was sold off all across the board, or whether the market is taking a break from all the selling that we have seen in the dollar.

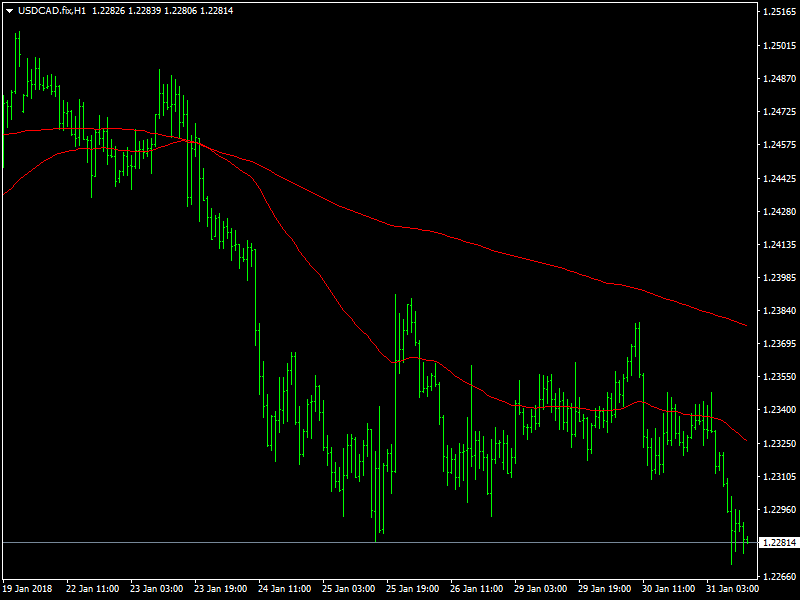

USDCAD Moves Lower

Though the oil prices continued to fall yesterday, that did not seem to have too much of an impact on the USDCAD prices as it also fell down through the 1.33 region and it looks as though it might be targeting regions below the 1.21 region. There has not been much fundamental news or economic data during this period but we are nearing the end of the month and that is why we are seeing such price action which do not seem to have any base with reality.

This is one of the reasons why we warned traders over the moves in the currency markets over the next few days as we believe that they will be influenced more by the month end flows than by the prevailing trends. For the dollar, the key is likely to come later in the day when the FOMC meeting minutes are released but this wont be followed by a press conference.

It is generally expected that these minutes would not have much to add by way of anything new. It is more likely to be the same as they have been saying all along and hence the expectations on this are minimal. We also have the ADP employment data which should act as a precursor for the NFP employment data which is scheduled to come in towards the end of the week. If this data comes in strong, then we should see a bounce in the pair while on the other hand, if the data comes week, then we should see the pair moving towards the 1.21 region in quick time. We also have the GDP data from Canada which should see the CAD under a lot of focus for today.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance