USD/CAD Daily Fundamental Forecast – October 30, 2017

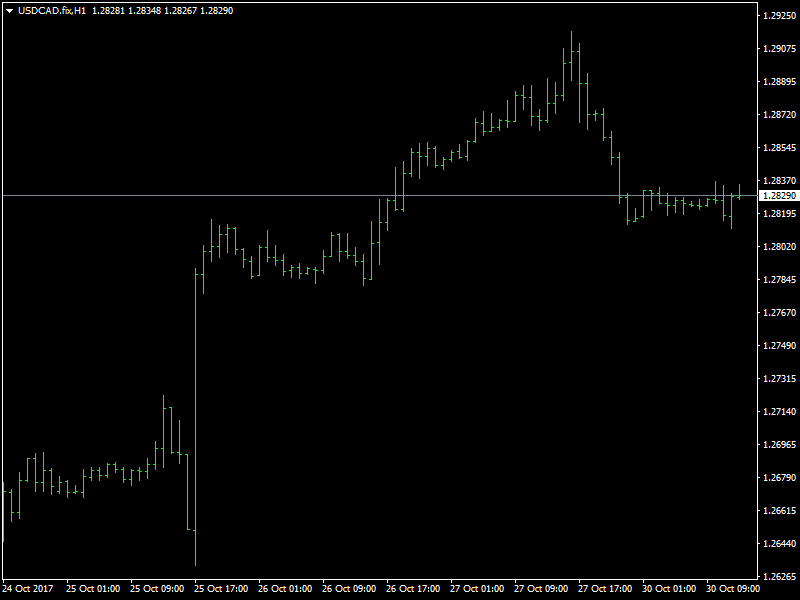

The USDCAD pair continued to rise slowly and made a brief trip beyond the 1.29 region during the course of trading on Friday on the back of some steady and sustained strength in the dollar during this period. But later on in the day, the dollar slipped due to news about the next Fed chair and the pair slipped below the 1.29 region where it trades now as of this writing.

USDCAD Corrects As Dollar Weakens Slightly

The dollar has been gaining strength towards the end of last week as the euro began to weaken due to the decision of the ECB to continue with the QE program for another year. This helped to push the investors towards the dollar and with the Fed still keeping the door open for the next rate hike in December, this seems to be a good option for investors at this point of time. Also, there were reports that said that Trump was looking at making John Taylor the next Fed Chair and this helped to strengthen the dollar even further.

But as we drew towards a close last week, some reports emerged that Powell would be the front runner for the post of the next Fed Chair and this meant that a hawk would not be in that position next year. This raised the possibility that there may not be as many rate hikes next year as the market expects and this led to a correction in the strength of the dollar during the late hours of Friday and this helped the pair to close near the lows of the day.

Looking ahead to the rest of the day, we do not have any major news from Canada or the US for the day and so we can expect some consolidation to happen below 1.29 for the rest of the day as the market positions itself for the large tranche of news from both the US and Canada later in the week.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance