USD/CAD Daily Fundamental Forecast – March 22, 2018

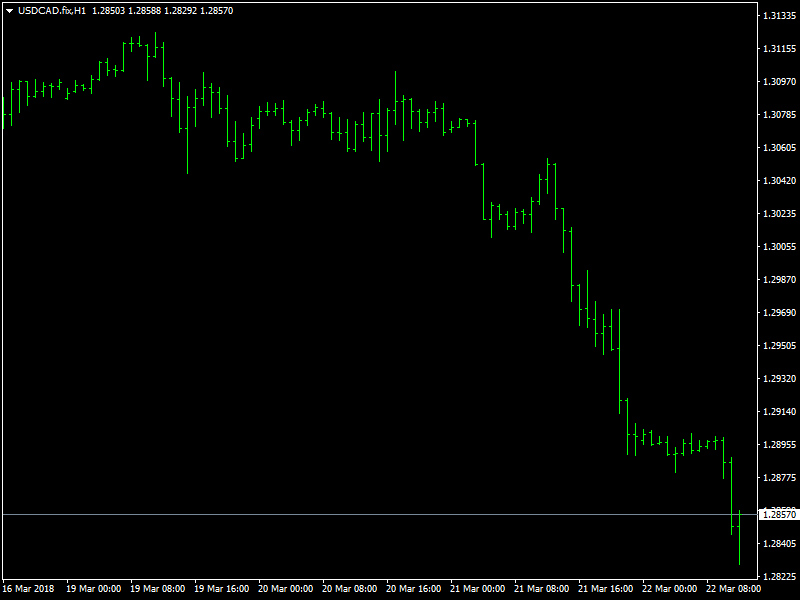

The pair weakened further during the course of trading over the last 24 hours as the dollar got sold off all across the board yesterday. The CAD also gained in strength and a combination of these events has forced the pair to crash through the 1.30 region during trading and the pair now trades just above the 1.28 region as of this writing.

USDCAD Crashes Lower

It is going to be an interesting time in this pair over the short term as we believe that the pair is back into the range after trying to stage a breakout. We were hopeful that the break through the 1.30 region would signal a large bullish drive for the pair and this would lead the pair to move higher in due course of time. But the fact that the pair has fallen back and fallen hard has led to doubts over the strength of the move higher and this is likely to throw off the other bullish investors as well.

The drive lower was mainly due to the weakness in the dollar as the Fed did hike rates as the markets had expected but the Fed Chief Powell stopped short of laying down a timeline for the future rate hikes. This was not approved by the dollar bulls and hence the dollar sold off which pushed the pair lower. The oil prices also got a boost from this impact and the higher oil prices have also helped to support the CA. As a result of these events and also due to reports that the NAFTA talks would be much more open and in favor of Canada, the pair has dropped lower in a quick manner.

Looking ahead to the rest of the day, we do not have any major economic news or data from the US or Canada and hence, we are likely to see the pair bounce from the 1.28 region which would be more of a correction of the drop lower.

This article was originally posted on FX Empire

More From FXEMPIRE:

E-mini S&P 500 Index (ES) Futures Technical Analysis – March 22, 2018 Forecast

Stellar’s Lumen Technical Analysis – Lumen Turns Bearish – 22/03/2018

eToro Raises $100m to Support Global Expansion and the Development of Blockchain-Backed Technologies

Daily Market Forecast, March 22, 2017 – EUR/USD, Gold, Crude Oil, USD/JPY, GBP/USD

S&P 500; US Indexes Fundamental Daily Forecast – Catalyst Today is China Tariff Announcement

Crypto Update: Cryptocurrencies Negative in Mid-Day Trading, U.S Tax Season Approaching for Traders

Yahoo Finance

Yahoo Finance