USD/CAD Daily Fundamental Forecast – September 29, 2017

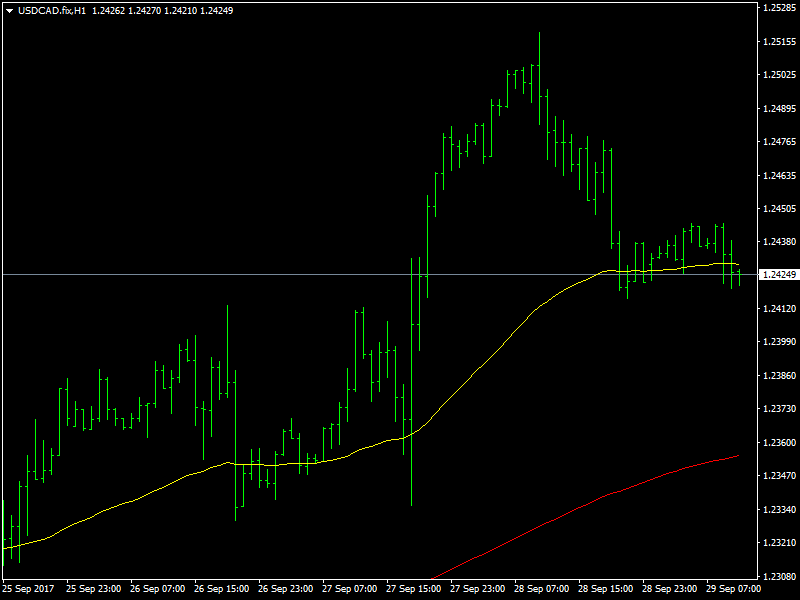

The USDCAD pair moved lower in trading yesterday as the rebound in the dollar lost steam and the dollar was on the backfoot all across the board yesterday. We had warned of such a move in our forecast yesterday as the pair was in a crucial trading region which would have determined whether the downtrend would be resuming or whether the pair would continue the bounce for another 200 pips.

USDCAD Likely to Resume Downtrend

The CAD received a jolt on the day before as the BOC Governor Poloz said that he does not have any specific timeline for the next rate hike. This comment from him when the market was looking towards a rate hike by the end of the year seem to have blown the bullish run in the CAD and this led to the USDCAD rising by around 100 pips. But all that it did was to bring it to a region of strong resistance and this was the battleground for the bulls and the bears.

The dollar weakened on cue and this led the pair to move lower again yesterday despite the fact that the oil prices also fell yesterday which meant that they did not lend the needed support to the CAD. The price action from yesterday now hints that the downtrend in this pair is likely to resume again and if it does, then we could see a quick visit back to the lows of the range again in the short term.

Looking ahead to the rest of the day, we have the GDP data from Canada while we do not have any economic release from the US. A strong GDP data is likely to support the CAD even further and in that case, we can see the pair moving below 1.24 once again and this should mark the resumption of the downtrend.

This article was originally posted on FX Empire

More From FXEMPIRE:

E-mini NASDAQ-100 Index (NQ) Futures Technical Analysis – September 29, 2017 Forecast

Dow Jones 30 and NASDAQ 100 Price Forecast September 29, 2017, Technical Analysis

Profit-Taking, Quarterly Position-Squaring Pressures U.S. Dollar

E-mini NASDAQ-100 Index (NQ) Futures Technical Analysis – September 28, 2017 Forecast

Yahoo Finance

Yahoo Finance