USD/CAD Daily Fundamental Forecast – March 23, 2018

The focus of the markets have been turned away from the dollar and the CAD and the result of that is the fact that we have been having some consolidation and ranging in the USDCAD pair over the last 24 hours. The focus is now on what is likely to turn out to be a large and long drawn global trade war and this is likely to in turn increase the risk and the uncertainty around the globe.

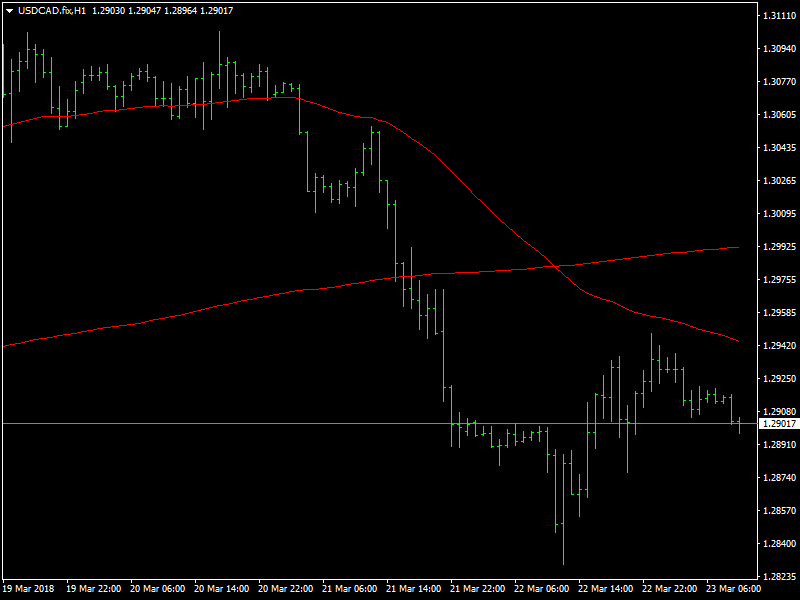

USDCAD Stable

If and when this happens, no one knows what would be the reaction of the FX markets and what would happen to the dollar as well. On the one hand, it is likely to remain strong as the focus of all the efforts of the US administration would be shifted inwards and this is likely to strengthen the US manufacturing and the US markets while on the other hand, this could lead to an upset of the global trade balance and this is unlikely to benefit anyone for long.

It is this confusion and uncertainty that has been plaguing the markets over the last 24 hours as there does not seem to be any end in sight for this trade war and it is only likely that it is going to escalate in the coming days with each side choosing to increase their retaliation for the others’ actions. This is going to make the market confused and ugly and it is in the middle of all this that we are going to receive some important data from Canada later in the day today.

We are going to see the inflation data from Canada in the form of CPI and also the retail sales data and it remains to be seen how much of an impact this piece of data will have in the markets, considering the fact that the focus of the markets would be well and truly on the trade actions of the countries around the world.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance