USD/CAD Daily Fundamental Forecast – November 23, 2017

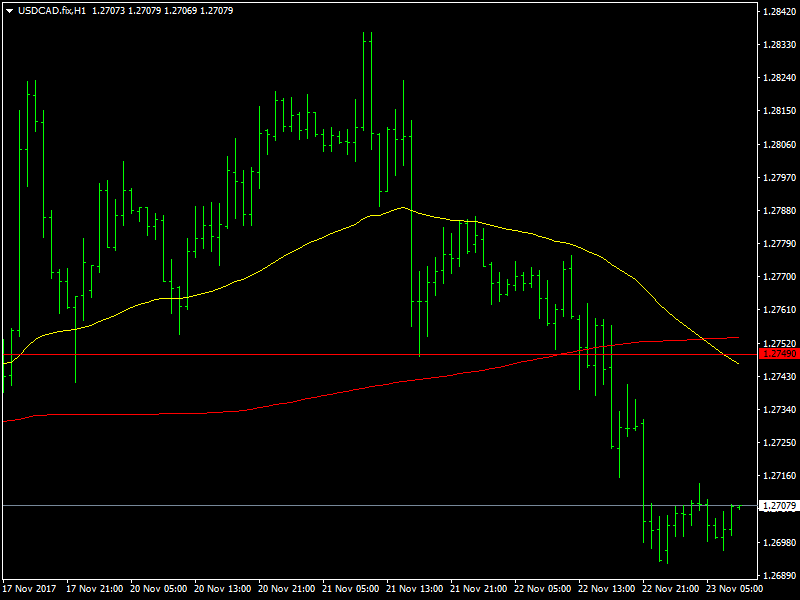

The USDCAD pair crashed lower yesterday on the back of some steady weakness in the dollar during the course of the day. It turned out to be a bad day for the dollar which only got worse after the FOMC minutes were released late in the day. The weakness in the dollar helped to push the pair towards the 1.27 region and the pair even broke through the region for a brief while before recovering.

USDCAD Moves Lower on Dollar Weakness

The main event of the day yesterday was the FOMC meeting minutes from the US. The market was looking out for hints for the interest rate hike in December and also wanted to know what the Fed thinks about further rate hikes in 2018. While the minutes did confirm that there would be a rate hike in December, it raised some doubts about the timing of the future rate hikes. Some of the Fed members were not happy with the way that the inflation data was progressing and they also expressed concern about some of the incoming data.

This part of the FOMC minutes was dovish and the market chose to focus on that, instead of the December rate hike and this led to some dollar selling late in the day. This, coupled with the continued strength shown by the oil prices, led the pair lower as the strong oil prices lent some support to the CAD. This weakness in the dollar is likely to last for the short term and what this means is that the pair is likely to continue in the range between 1.25 and 1.28 for some time to come.

Looking ahead to the rest of the day, it is the Thanksgiving day holiday in the US and they would be out for today and tomorrow as well. This means that the liquidity is likely to be low during the US session. We have the retail sales data from Canada and if this comes out stronger, then we are likely to see even more correction in this pair.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance