US stocks rise as tech sector leads rally amid high hopes for Nvidia earnings

Stocks rose Tuesday, with tech shares continuing their rebound ahead of key earnings.

Nvidia and Snowflake are set to report second-quarter results on Wednesday.

Hopes for dovish rhetoric at the Fed's Jackson Hole summit are also adding upside.

US stocks were mostly higher Tuesday, extending gains sparked by expectations around upcoming earnings reports and the Federal Reserve's Jackson Hole meeting.

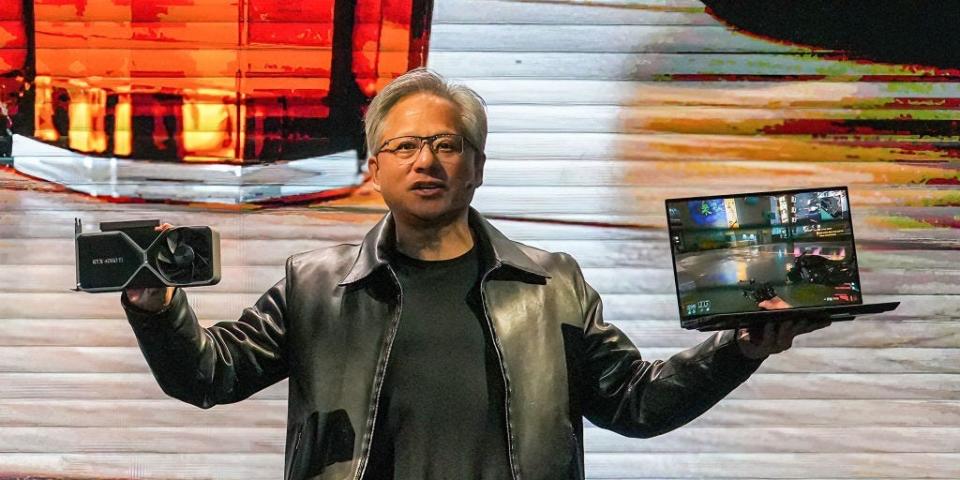

Following a three week sell-off, markets are rising ahead of financial results from key tech players in the artificial intelligence sector. Alongside Snowflake, chip giant Nvidia is set to release its earnings on Wednesday, fueling hopes for a revived rally.

On Friday, Fed Chairman Jerome Powell is scheduled to give his speech at the central bank summit in Wyoming, providing guidance for the Fed's future monetary policy and the central bank's outlook for the economy.

While the surge in the 10-year Treasury yield has made some analysts expect a dovish approach on Friday, the Fed has yet to achieve its 2% inflation rate, which means it could stay hawkish and signal more tightening of monetary policy still to come.

Here's where US indexes stood shortly after the 9:30 a.m. opening bell on Tuesday:

S&P 500: 4,414.71, up 0.35%

Dow Jones Industrial Average: 34,429.94, down 0.1% (-33.75 points)

Nasdaq Composite: 13,597.52, up 0.74%

Here's what else is going on today:

Americans need to commit 43% of their income to purchase a home, as mortgage rates reach a two-decade high.

Warren's Berkshire Hathaway reported owning $1 trillion in assets, three times that of what Apple owns.

Today's AI stock mania has outpaced the dot-com bubble, and a crash may be coming, Bill Smead said.

Car loan delinquencies are on the rise as American's face greater consumer-debt stress.

Here are two charts of how Mexico has become the US' leading trade partner, eclipsing Canada and China.

In commodities, bonds, and crypto:

Oil prices traded higher. West Texas Intermediate crude oil rose 0.1% to $80.81 a barrel. Brent, the international benchmark, edged 0.1% higher to $84.57 a barrel.

Gold was nearly flat at $1,923.10 an ounce.

The yield on the 10-year Treasury edged up to 4.35%.

Bitcoin rose 1% to $26,090.

Read the original article on Business Insider

Yahoo Finance

Yahoo Finance