US Silica Holdings Inc (SLCA) Q1 2024 Earnings: Adjusted EPS Meets Analyst Projections Amidst ...

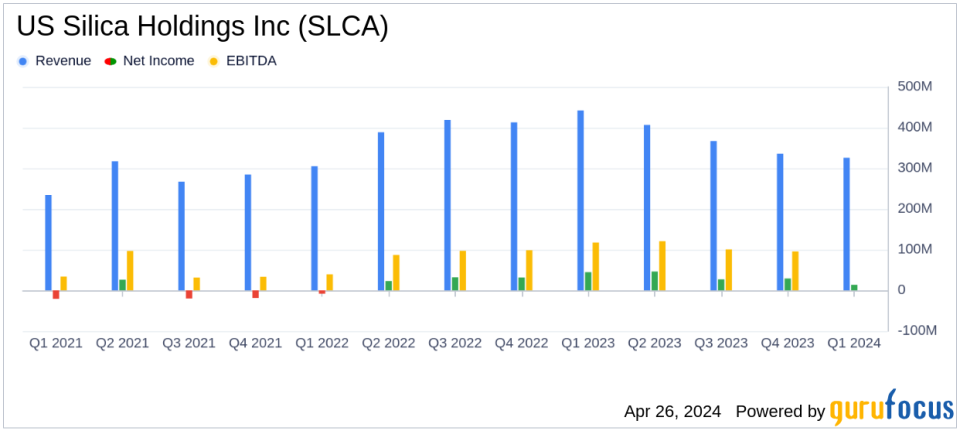

Reported Revenue: $325.9M for Q1 2024, showing a decrease of 26% year-over-year and falling short of estimates of $336.59M.

Net Income: $13.7M for Q1 2024, down 69% year-over-year and below the estimated $16.30M.

Earnings Per Share (EPS): Reported GAAP EPS of $0.17 and adjusted EPS of $0.20, with the adjusted figure meeting the estimated EPS of $0.20.

Cash Flow: Generated $40.9M from operations in Q1 2024, supporting strategic debt reduction and operational enhancements.

Debt Management: Extinguished an additional $25M of debt through a voluntary term loan principal repayment, improving financial stability.

Industrial and Specialty Products Segment: Revenue increased by 5% sequentially with a 7% year-over-year increase in contribution margin, indicating enhanced operational efficiency.

Acquisition Announcement: Entered into a definitive agreement to be acquired by Apollo Funds for $1.85 billion, promising significant cash value to shareholders.

On April 26, 2024, US Silica Holdings Inc (NYSE:SLCA), a prominent supplier of sand for hydraulic fracturing and industrial applications, released its first quarter financial results through its 8-K filing. The company reported an adjusted earnings per share (EPS) of $0.20, aligning with analyst estimates, despite facing several operational challenges.

US Silica Holdings Inc operates through two segments: Oil and Gas Proppants, and Industrial and Specialty Products, with the former being the major revenue contributor. Despite a challenging environment characterized by lower natural gas prices impacting pricing and margins, the company managed to increase total tonnage sold by 6% sequentially.

Financial Performance Highlights

The company's revenue for the quarter stood at $325.9 million, a slight decrease from $336.0 million in the previous quarter and a significant drop from $442.2 million year-over-year. The net income was reported at $13.7 million, or $0.17 per diluted share, which included charges related to debt extinguishment. Excluding these charges, the adjusted EPS was $0.20.

The Oil & Gas segment saw a 9% sequential decline in revenue to $183.2 million, while the Industrial and Specialty Products segment posted a 5% increase to $142.8 million, benefiting from improved operational efficiencies and favorable pricing. The company's strategic focus on reducing costs and enhancing operational efficiency was evident in the increased contribution margin of the Industrial and Specialty Products segment, which rose by 7% year-over-year.

Operational and Strategic Developments

During the quarter, US Silica continued to optimize its financial structure by repricing its term loan, reducing the total interest rate by 85 basis points, and extinguishing an additional $25 million of debt. These moves are part of a broader strategy to strengthen the balance sheet and enhance shareholder value.

In a significant corporate development, US Silica announced a definitive agreement to be acquired by Apollo Funds for approximately $1.85 billion, a transaction that underscores the value the company has created and provides a cash exit for shareholders. This acquisition aligns with the company's long-term strategy and ensures the continuation of its operational ethos and customer-centric approach.

Looking Ahead

Despite the challenges posed by market conditions, US Silica's management remains focused on executing its strategic initiatives, including operational enhancements and cost management. The company's robust cash flow generation, as evidenced by the $40.9 million cash flow from operations this quarter, positions it well to navigate future uncertainties.

As US Silica transitions under the new ownership of Apollo Funds, stakeholders can anticipate a continuation of strategic initiatives aimed at driving growth and operational efficiency. The company's commitment to innovation, as seen in the adoption of the Guardian frac fluid filtration system, and its strategic customer agreements are expected to play pivotal roles in its ongoing success.

For detailed financial figures and further information, refer to US Silica's official earnings release and financial statements.

Explore the complete 8-K earnings release (here) from US Silica Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance