Unemployment rate tumbles to 4.6%, lowest since August 2007

In a stunning development, the Bureau of Labor Statistics just revealed that the US unemployment rate unexpectedly dropped to 4.6% in November. This is the lowest level since August 2007.

Economists were expecting the rate to be unchanged from October’s 4.9%.

“The trend in employment growth remains more than strong enough to keep the unemployment rate trending down,” Jim O’Sullivan, of High Frequency Economics, said.

Some of this decline was due to the 446,000 Americans that dropped out of the labor force, which brought the labor force participation rate down to 62.7% during the month from 62.8% a month ago.

“The drop in unemployment is statistically significant, unusually, but we’d still treat it with caution,” Ian Shepherdson, of Pantheon Macroeconomics, said. “The labor force jumped sharply in the third quarter, but the increases always looked unsustainable and now appear to be reversing, at least in part.”

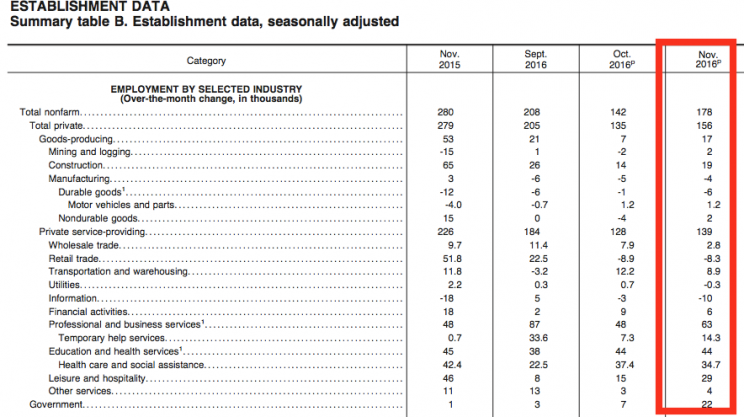

During the month, US companies added 178,000 non-farm payrolls, which was a tad lighter than the 180,000 forecast by economists. Growth was driven by private payrolls, which increased by 156,000.

“Weakness in retail trade (-8k; previous: -9k) and a somewhat subdued pace in trade, transport and utilities employment continue to disappoint our expectations,” Barclays’ Michael Gapen observed. “The decline in retail trade was concentrated in traditional brick-and-mortar stores, with the fall especially large in clothing retailers. We suspect that this decline in employment marks a further shift toward online venues for retail goods, rather than a signal of impending weakness in consumption.”

Average hourly earnings increased by just 2.5% year-over-year, which was weaker than the 2.8% pace expected.

“A watchful eye will remain on wages as more pro-growth policies are expected to be initiated in 2017,” Wells Fargo’s Sam Bullard said ahead of the report.

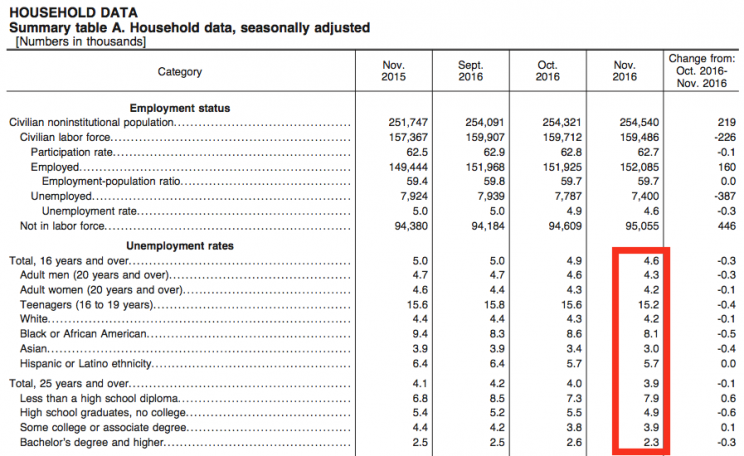

Here’s a look at unemployment rates by demographic.

Unemployment rates fell for all ethnicities except for Hispanic/Latino, which was unchanged at 5.7% for the month. Those with less than a high school diploma saw their unemployment rate jump to 7.9% from 7.3% a month ago.

To be a bit more precise, the unemployment rate fell to 4.640% in November from 4.876% in October.

Below is a look at jobs created by industry.

Manufacturing continues to be a weak spot for jobs in the US. During the month, manufacturing payrolls fell by 4,000.

Manufacturing jobs will be closely watched in the coming months and years as President-elect Donald Trump has promised his constituents that he would create jobs in this sector. This week, he made headlines by convincing Carrier, a manufacturer of air conditioners, to keep jobs in the US.

Other employment data continue to reflect a healthy economy with lots of job growth. On Wednesday, ADP’s employment report showed that the US economy created around 216,000 jobs in November. Monthly surveys from the Richmond Fed, Dallas Fed, and NY Fed all signaled ongoing job growth.

It seems Trump will be inheriting an economy that’s in great shape.

–

Sam Ro is managing editor at Yahoo Finance.

Read more:

Yahoo Finance

Yahoo Finance