Fed Chair Powell: 'The U.S. federal government is on an unsustainable fiscal path'

Federal Reserve Chair Jerome Powell has repeatedly called out the ballooning U.S. national debt. He did so again while testifying to Congress on Tuesday.

"The U.S. federal government is on an unsustainable fiscal path,” Powell told the Senate Banking Committee, noting that “debt as a percentage of GDP is growing, and now growing sharply... And that is unsustainable by definition.

He continued: “We need to stabilize debt to GDP. The timing the doing that, the ways of doing it —through revenue, through spending — all of those things are not for the Fed to decide.”

Powell later added that the “single biggest thing” that drives the “unsustainability” is health care delivery. “We spend 17% of GDP, everyone else spends 10%. ... It’s not that benefits themselves are too generous. We deliver them in inefficient ways.”

‘We'll wait until the last minute‘

A former U.S. budget official also recently warned that America’s $22 trillion deficit that’s being ignored by lawmakers could come back to bite in a big way.

“This year, there is very little sign of any engagement on major budget issues,” Joseph Minarik, former chief economist at the Office of Management and Budget during the Clinton administration told Yahoo Finance’s The Ticker (video above). “It looks like we'll wait — as we have historically — we'll wait until the last minute.”

But waiting isn’t advisable because “we're running very large deficits,” added Minarik. “Our debt is growing faster than our collective income. It's not a very pretty picture.”

Minarik, who is now the senior vice president and director of research at the Committee for Economic Development, believed that soon politicians would soon shift their focus to the election cycle — which effectively means that plans to tackle the budget are likely to be shelved.

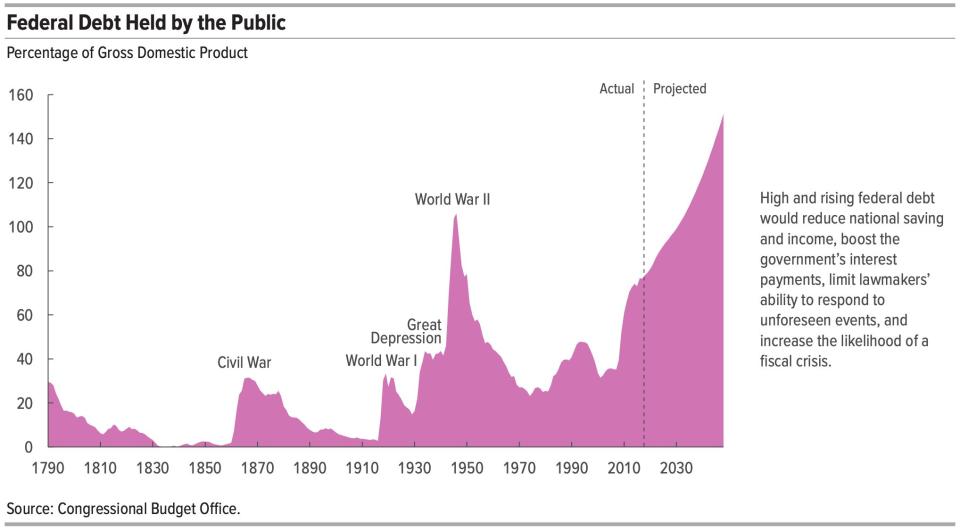

Federal debt could soon exceed 100% of GDP

The highest level of public debt ever was in 1946, when former president Harry Truman took office after World War Two. The public debt as a percentage of GDP was 106%.

The country had just emerged victorious from a war and debt was falling, the labor market was revitalized by millions of men returning from the war, and Truman lessened the debt load by massively scaling back spending (even though it was politically unpopular).

Trump entered office with the second-highest level of debt-to-GDP ratio at 77%. The administrations policies are clearly adding to the deficit.

Under the Trump administration and beyond, if the U.S. continues at the current pace with current laws, we will see unprecedented levels of debt a report by the Congressional Budget Office found.

“Debt would rise to 96 percent of GDP by 2028, and six years later, in 2034, it would surpass the peak of 106 percent recorded in 1946,” the report noted.

And “by 2048, federal debt would reach 152 percent of GDP,” and be on track to become even bigger.

The CBO also warned that if lawmakers pass any legislation to prevent a “significant increase in individual income taxes in 2026,” the result would be even bigger increases in debt.

‘Very, very little being discussed in Washington’

The bottom line is that America’s national debt is ballooning and no one’s doing anything about it, according to Minarik.

“It's really unfortunate that we've gotten to the point where election season seems to be about three years and 11 months long,” said Minarik. “We're going towards October 1, which will be the beginning of fiscal year 2020, and will take us just about right up to election day.

And there's very, very little being discussed in Washington about trying to come up with a budget agreement to achieve very much of anything.”’

READ MORE:

How the ballooning $22 trillion national debt will affect Americans

'Unhinged madman': Former U.S. budget director says Trump is 'conducting 4 wars on the economy'

2019 tax refund size down nearly 17% on average, IRS reports

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, andreddit.

Yahoo Finance

Yahoo Finance