Urban Outfitters (URBN) Q1 Earnings Beat, Sales Improve Y/Y

Urban Outfitters, Inc. URBN reported impressive results for first-quarter fiscal 2025, wherein the top and bottom lines surpassed the Zacks Consensus Estimate. Also, these metrics improved from the prior-year quarter. Urban Outfitters is focusing on improving its profitability and customer base through strategic pricing adjustments and enhanced marketing strategies, particularly in digital channels.

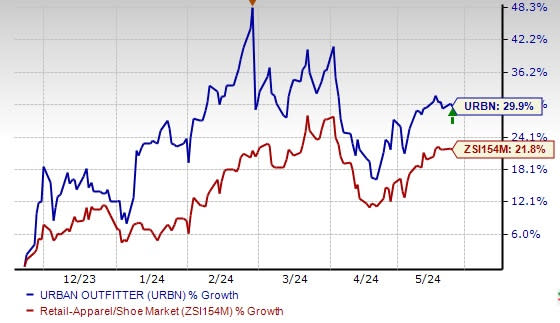

Shares of this Philadelphia, PA-based player have gained 29.9% in the past six months compared with the industry’s 21.8% growth.

Urban Outfitters, Inc. Price, Consensus and EPS Surprise

Urban Outfitters, Inc. price-consensus-eps-surprise-chart | Urban Outfitters, Inc. Quote

Deeper Insight

This lifestyle specialty retailer delivered adjusted earnings per share of 69 cents, surpassing the Zacks Consensus Estimate of 49 cents. Also, the bottom line increased 40.8% from the comparable quarter of the prior fiscal year. On a reported basis, the company posted earnings of 65 cents a share.

Total net sales increased 7.8% year over year to $1,200.7 million, surpassing the consensus estimate of $1,169 million.

Net sales in the Retail segment rose 5.8% year over year, with comparable sales increasing 4.6%. This growth in comparable Retail segment sales was fueled by strong high-single-digit growth in digital sales and modest low-single-digit growth in retail store sales. Specifically, comparable Retail net sales rose 17.1% at Free People and 10.4% at Anthropologie but fell 13.7% at Urban Outfitters.

In the Wholesale segment, net sales grew 3.4% year over year primarily due to a 6.3% rise in Free People's wholesale sales, which was attributed to increased sales to department stores and specialty customers, though this was somewhat offset by a decline in Urban Outfitters' wholesale sales. The Nuuly segment saw a significant increase in net sales by 51.4% mainly due to a 45% rise in the average number of active subscribers from the prior-year quarter. We estimated the Nuuly segment’s sales to increase 40.9% year over year in the fiscal first quarter.

Image Source: Zacks Investment Research

An Insight Into Margins

In the quarter under review, adjusted gross profit rose 11.2% from the prior-year quarter to $413 million. Also, the adjusted gross margin expanded 110 basis points (bps) to 34.4%, mainly owing to higher initial merchandise markups across all brands primarily due to the company's cross-functional initiatives. This increase was somewhat mitigated by higher merchandise markdowns, particularly at the Urban Outfitters brand, and an increase in logistics expenses. We estimated the adjusted gross margin to be 33.6% in the quarter under review.

Selling, general and administrative (SG&A) expenses were up 11.3% from the first-quarter fiscal 2025 level to $333.8 million. As a percentage of net sales, SG&A deleveraged 90 bps to 27.8% mainly due to heightened marketing costs, which supported double-digit growth in customer traffic and increased sales across the Free People, FP Movement, Anthropologie and Nuuly brands. Additionally, there was a rise in store payroll expenses to support growth in comparable sales at retail stores. Our model estimated SG&A expenses to increase 11.9% year over year in the fiscal first quarter.

URBN recorded an adjusted operating income of $79.2 million, up from $71.4 million in first-quarter fiscal 2025. As a rate of sales, the adjusted operating margin increased 20 bps year over year to 6.6%.

Store Update

In the first quarter of fiscal 2025, this Zacks Rank #3 (Hold) player opened eight retail locations, consisting of four Urban Outfitters stores, two Anthropologie stores and two Free People stores (including one FP Movement store). Additionally, the company closed four retail locations, which included two Urban Outfitters stores, one Anthropologie store and one Free People store.

As of Apr 30, 2024, URBN operated 264 Urban Outfitters stores in the United States, Canada and Europe and websites; 238 Anthropologie Group stores in the United States, Canada and Europe, catalogs and websites; 199 Free People stores (including 39 FP Movement stores) in the United States, Canada and Europe, catalogs and websites; nine Menus & Venues restaurants; seven Urban Outfitters franchisee-owned stores; and two Anthropologie Group franchisee-owned stores.

Other Financial Details

Urban Outfitters ended the quarter with cash and cash equivalents of $174 million and a total shareholders’ equity of $2.16 billion. As of Apr 30, 2024, the total inventory fell 1.9% year over year. Total Retail segment inventory decreased 2.3%, with the Retail segment’s comparable inventory declining 4.7%. The Wholesale segment’s inventory increased 2.1%.

URBN provided net cash of $58.6 million from operating activities in the three-month period ending Apr 30, 2024. During the three months, the company did not repurchase any common shares. As of Apr 30, 2024, 19.2 million common shares were remaining under the program.

Eye These Solid Picks

Some better-ranked stocks are The Gap, Inc. GPS, Casey's General Stores, Inc. CASY and Abercrombie & Fitch Co. ANF.

The Gap is a premier international specialty retailer offering a diverse range of clothing, accessories and personal care products. It has a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

The Zacks Consensus Estimate for GPS’s current fiscal-year earnings and sales indicates declines of 0.3% and 4.2%, respectively, from the year-ago reported figures. GPS has a trailing four-quarter average earnings surprise of 180.9%.

Casey's offers a comprehensive range of products and services to meet the needs of its customers. It currently has a Zacks Rank #2.

The Zacks Consensus Estimate for Casey's current financial-year earnings indicates growth of 10.4% from the year-earlier reported levels. CASY has a trailing four-quarter average earnings surprise of 12%.

Abercrombie is a specialty retailer of premium, high-quality casual apparel. It currently has a Zacks Rank of 2. ANF has a trailing four-quarter average earnings surprise of 715.6%.

The Zacks Consensus Estimate for Abercrombie’s current fiscal-year earnings and sales indicates growth of 22.5% and 5.9%, respectively, from the prior-year actuals.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

The Gap, Inc. (GPS) : Free Stock Analysis Report

Urban Outfitters, Inc. (URBN) : Free Stock Analysis Report

Casey's General Stores, Inc. (CASY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance