Upcoming presidential election could drastically alter stock market returns. Or will it?

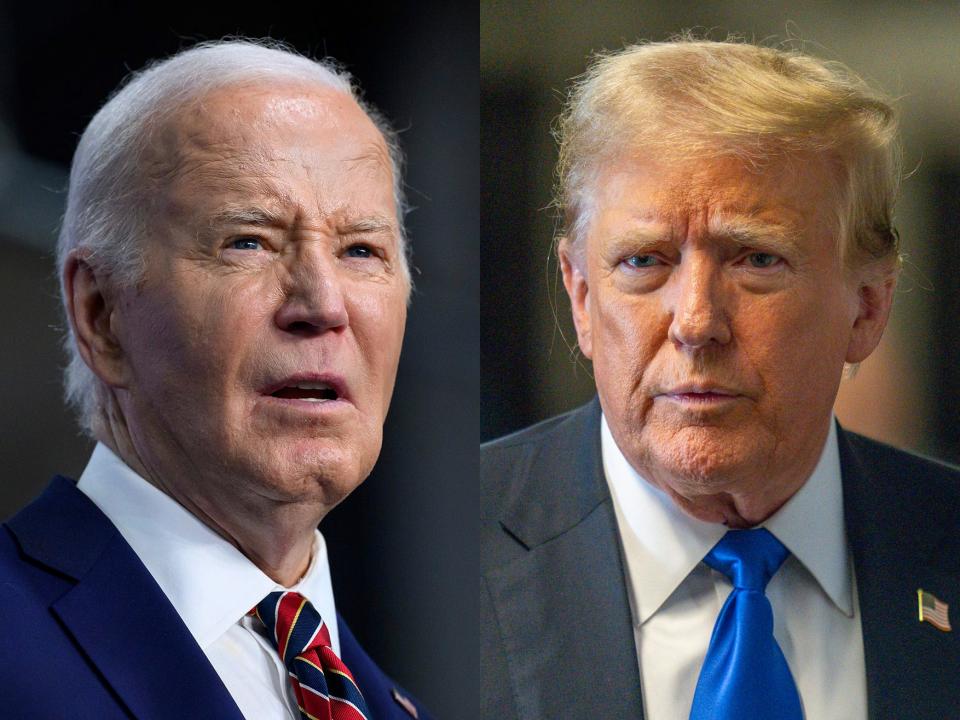

The upcoming presidential election pitting presumptive candidates Donald Trump and Joe Biden is generating plenty of excitement and angst, with some Americans vowing to leave the country if their candidate doesn’t prevail.

But does this mean you should pack up your investment portfolio and send it overseas? Probably not. In fact, some recent analyses of past election cycles suggest that presidential elections aren’t all that important in driving stock-market outcomes and certainly less so than economic and inflation trends, corporate earnings and other traditional factors. Elections, in short, usually don’t move the market all that much, up or down.

“We presumed that there would be more volatility in election years, but it turned out not necessarily to be the case,” said Dan Lefkovitz, a stock-market strategist at researcher Morningstar who recently discussed market performance around the past four presidential elections.

How has the stock market reacted to past presidential elections?

U.S. Bank investment strategists recently studied market data from the past 75 years and identified a few patterns that tended to repeat during election cycles. One takeaway is that presidential elections don't exert much medium- or long-term impact on the stock market, with investment results influenced more by economic and inflation trends.

That said, there were three election-outcome scenarios that U.S. Bank did cite as significant.

One would be a Democrat victory for the White House, coupled with Republicans gaining or keeping control of both the House and Senate — that tends to be positive for stock prices.

So too with a Democratic victory for the White House and split party control of the House and Senate, the current scenario. Conversely, the analysis found that stock-market returns lagged a bit when Republicans won the White House and Democrats controlled both chambers of Congress.

In the various other election scenarios, U.S. Bank spotted no clear investment trends.

Fidelity Investments, in its own analysis, found that stocks historically have generated positive returns "under nearly every partisan combination," while also finding that a divided government has been associated with better market returns. The reason? It might be because "government gridlock creates less policy uncertainty," compared to scenarios where one party can more easily push through its agenda without much objection or compromise.

What about economic trends — what’s the sweet spot there?

According to U.S. Bank, rising economic growth and falling inflation have been associated with above-average long-term returns, while slowing economic growth and rising inflation typically point to below-average market results.

“For investors, staying focused on these patterns is probably more insightful than potential election outcomes when it comes to forecasting market performance,” U.S. Bank said in its commentary.

The Fidelity report similarly urged investors to focus on economic fundamentals and not on political hype, while rejecting "popular myths" that sometimes suggest "one party or the other is 'better' for market returns . . . the historical data does not bear out these theories."

What about industries or sectors that could be affected?

You would think that some industries would be clearly favored by a Republican or Democrat in power, but there are some caveats worth considering here, too. For example, the energy sector, meaning traditional oil and gas companies, actually has been a top-performing sector under Biden, “which is surprising given his focus on renewables,” Lefkovitz said. “Technology has done very well under Biden as well.”

One of his takeaways: It’s difficult to predict the results of an election, what sort of policies might be enacted and how investors will react. Other factors, such as corporate profits and cash flows, likely will exert more impact over the long haul, he said.

But don't investors already have a track record to follow, under both Biden and Trump?

Yes, this election likely will pit a sitting president against a former incumbent, but that doesn’t mean stocks will mirror their earlier results.

“We can’t just assume that the market will react the same if Trump wins as it did in 2016 or the same if Biden wins as it did in 2020, because markets are always learning and adapting,” Lefkovitz said.

Rob Haworth, senior investment strategy director at U.S. Bank Wealth Management, largely echoed that comment. He said, in the company's election report, that the differences between the candidates, from an investment perspective, “are not as significant as many would expect.”

For example, he noted that Trump as president levied tariffs on China while Biden maintained most of those tariffs and added more. He predicted both Trump and Biden likely would pursue policies designed to stimulate the economy, although with different combinations of tax incentives and spending priorities.

Besides, White House policies don’t always translate into investment results, he added, observing that renewable-energy stocks fared relatively well under Trump while traditional oil companies have performed well under Biden.

What about midterm elections — do they matter much?

They seem to matter more than presidential elections.

U.S. Bank found that big stocks in the Standard & Poor's 500 index consistently outperformed in the year after midterms compared with non-midterm years. Historically, stocks in the index have risen about 8.1% annually, but they have generated a 16.3% average return over the 12 months following a midterm election.

Less important was which party controlled Congress following midterm elections. In terms of stock-market results, U.S. Bank didn't find much difference there.

All this doesn't imply that the upcoming presidential election won't affect your finances. It clearly could, in terms of tax rates and deductions, incentives for purchases like electric vehicles, and so on. And the potential for election results not to be accepted this time around adds another layer of uncertainty.

But in terms of stock-market impact, staying focused on economic, inflationary and other traditional factors "is probably more insightful than potential election outcomes," the U.S. Bank report said.

Reach the writer at russ.wiles@arizonarepublic.com.

This article originally appeared on Arizona Republic: As the Biden-Trump election nears, how will the stock market react?

Yahoo Finance

Yahoo Finance