Unveiling US Growth Companies With High Insider Ownership In July 2024

As of July 2024, the U.S. stock market continues to exhibit resilience, with the S&P 500 and Nasdaq Composite reaching new heights amid anticipations of rate cuts by the Federal Reserve. In this climate, growth companies with high insider ownership can be particularly intriguing, as significant insider stakes often signal confidence in the company's future prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.3% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 22.1% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Duolingo (NasdaqGS:DUOL) | 15% | 48.1% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.7% | 60.9% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

BBB Foods (NYSE:TBBB) | 22.9% | 94.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

LifeMD

Simply Wall St Growth Rating: ★★★★★☆

Overview: LifeMD, Inc. is a direct-to-patient telehealth company in the United States, facilitating connections between consumers and healthcare professionals, with a market capitalization of approximately $279.54 million.

Operations: The company generates revenue primarily through two segments: Telehealth, which brought in $108.79 million, and Worksimpli, contributing $54.77 million.

Insider Ownership: 13.1%

LifeMD, recently added to multiple Russell indexes, demonstrates a robust growth trajectory with expected revenue increases and a forecast to turn profitable within three years. Despite recent insider selling, its strategic expansions into virtual healthcare and partnerships for advanced health monitoring underline its innovative edge. However, investors should note the high volatility in its share price and recent earnings showing a widening net loss of US$6.77 million from last year's US$4.01 million.

Get an in-depth perspective on LifeMD's performance by reading our analyst estimates report here.

Our expertly prepared valuation report LifeMD implies its share price may be lower than expected.

Oddity Tech

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Oddity Tech Ltd. is a consumer tech company that develops digital-first brands in the beauty and wellness sectors, operating both in the United States and internationally, with a market cap of approximately $2.30 billion.

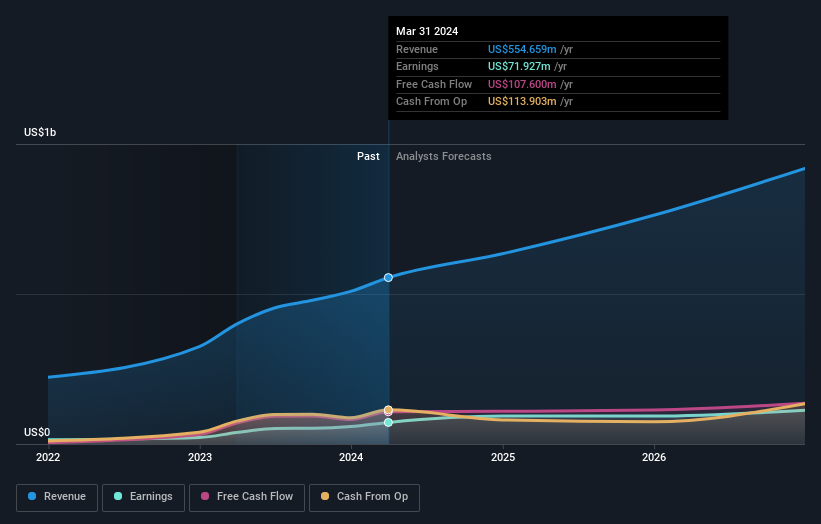

Operations: The company's revenue from personal products amounts to approximately $554.66 million.

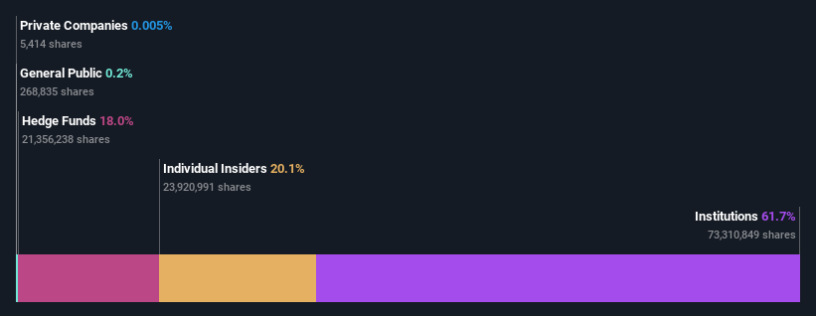

Insider Ownership: 29.3%

Oddity Tech, with high insider ownership, shows promising growth prospects. Recently, the company raised its 2024 revenue guidance to between US$626 million and US$635 million and initiated a substantial share repurchase program valued at up to US$150 million. Despite a highly volatile share price in recent months, Oddity Tech's earnings have grown significantly over the past year by 87.8%. The firm's revenue is expected to grow at 17.3% per year, outpacing the U.S market average of 8.7%. However, its forecasted annual profit growth is below significant levels at 19% per year.

Dive into the specifics of Oddity Tech here with our thorough growth forecast report.

Our valuation report unveils the possibility Oddity Tech's shares may be trading at a discount.

Warby Parker

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Warby Parker Inc. operates in the United States and Canada, specializing in the provision of eyewear products, with a market capitalization of approximately $1.84 billion.

Operations: The company generates revenue primarily from the sale of optical supplies, totaling approximately $697.80 million.

Insider Ownership: 20%

Warby Parker, characterized by high insider ownership, has shown resilience with a revised 2024 revenue forecast between US$753 million and US$761 million, indicating a growth of about 12.5% to 13.5% year-over-year. Despite recent losses narrowing significantly in Q1 2024 compared to the previous year, the company still faces challenges in achieving profitability. However, insider transactions over the past three months suggest confidence among key stakeholders, with more shares purchased than sold.

Next Steps

Dive into all 179 of the Fast Growing US Companies With High Insider Ownership we have identified here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGM:LFMD NasdaqGM:ODD and NYSE:WRBY.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance