Unveiling Three Top Dividend Stocks In Singapore With Yields Up To 8.1%

As the global market navigates through dynamic shifts in media rights and investments, such as FIFA's potential $1 billion deal with Apple, investors are closely watching how these large-scale agreements might influence market trends and opportunities. In this context, understanding the stability and potential returns of dividend stocks becomes particularly pertinent for those looking to bolster their portfolios amidst evolving economic landscapes.

Top 10 Dividend Stocks In Singapore

Name | Dividend Yield | Dividend Rating |

Singapore Exchange (SGX:S68) | 3.73% | ★★★★★☆ |

Civmec (SGX:P9D) | 6.23% | ★★★★★☆ |

Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | 3.71% | ★★★★★☆ |

BRC Asia (SGX:BEC) | 8.12% | ★★★★★☆ |

Asia Enterprises Holding (SGX:A55) | 7.04% | ★★★★★☆ |

UOB-Kay Hian Holdings (SGX:U10) | 6.62% | ★★★★★☆ |

UOL Group (SGX:U14) | 3.54% | ★★★★★☆ |

New Toyo International Holdings (SGX:N08) | 8.51% | ★★★★★☆ |

Bumitama Agri (SGX:P8Z) | 6.43% | ★★★★★☆ |

Ban Leong Technologies (SGX:B26) | 6.91% | ★★★★★☆ |

Click here to see the full list of 36 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

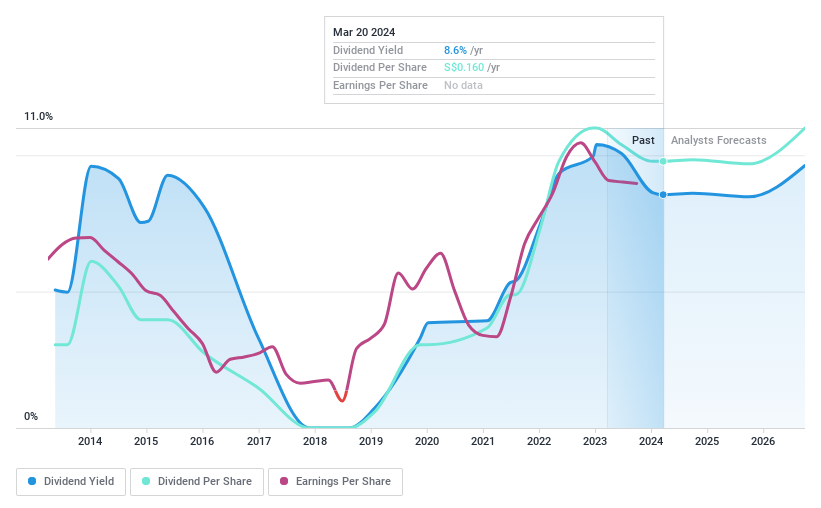

BRC Asia

Simply Wall St Dividend Rating: ★★★★★☆

Overview: BRC Asia Limited operates in the prefabrication of steel reinforcement for concrete, serving markets in Singapore, Australia, Brunei, Hong Kong, Indonesia, Malaysia, Thailand, India and internationally with a market capitalization of SGD 540.47 million.

Operations: BRC Asia Limited generates revenue primarily from two segments: trading, which contributes SGD 413.27 million, and fabrication and manufacturing, accounting for SGD 1.21 billion.

Dividend Yield: 8.1%

BRC Asia offers a competitive dividend yield of 8.12%, ranking in the top 25% in the Singapore market, with its dividends well-covered by both earnings and cash flows, showing payout ratios of 38% and 28.1% respectively. However, investors should note its high debt levels and a history of unstable and volatile dividend payments over the past decade. Recent actions include declaring a final and special dividend each at S$0.055 per share for FY2023 during their AGM on January 31, 2024.

Delve into the full analysis dividend report here for a deeper understanding of BRC Asia.

Our valuation report unveils the possibility BRC Asia's shares may be trading at a discount.

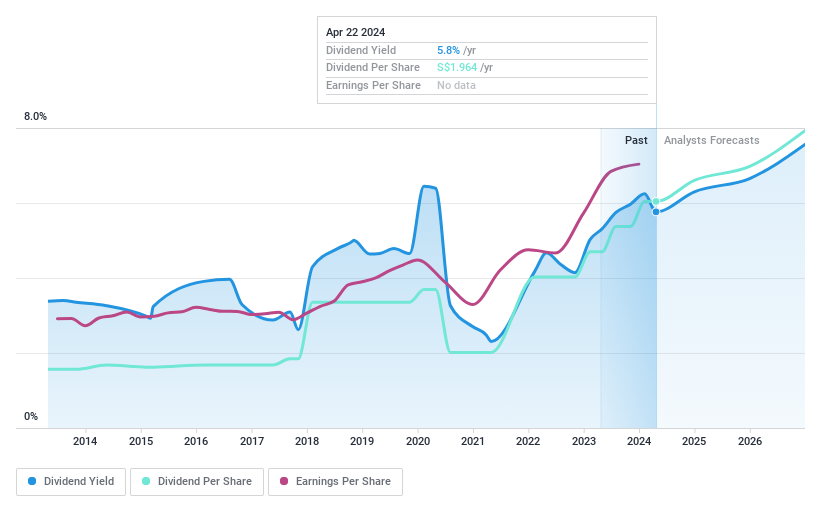

DBS Group Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DBS Group Holdings Ltd operates as a commercial bank offering financial services across Singapore, Hong Kong, Greater China, South and Southeast Asia, and internationally, with a market capitalization of approximately SGD 96.90 billion.

Operations: DBS Group Holdings Ltd generates revenue primarily through Institutional Banking and Consumer Banking/Wealth Management, contributing SGD 9.27 billion and SGD 8.67 billion respectively, along with Treasury Markets at SGD 0.71 billion.

Dividend Yield: 5.8%

DBS Group Holdings, trading at a 50.1% discount to fair value, shows a mixed dividend profile with a current payout ratio of 49.6%, expected to improve in three years (71%). Despite this coverage by earnings, its dividend history has been inconsistent over the past decade, reflecting both increases and volatility. Recently, DBS reported a significant rise in net income to S$10.06 billion for FY2023 and proposed an increased final dividend of S$0.54 per share pending shareholder approval at the upcoming AGM.

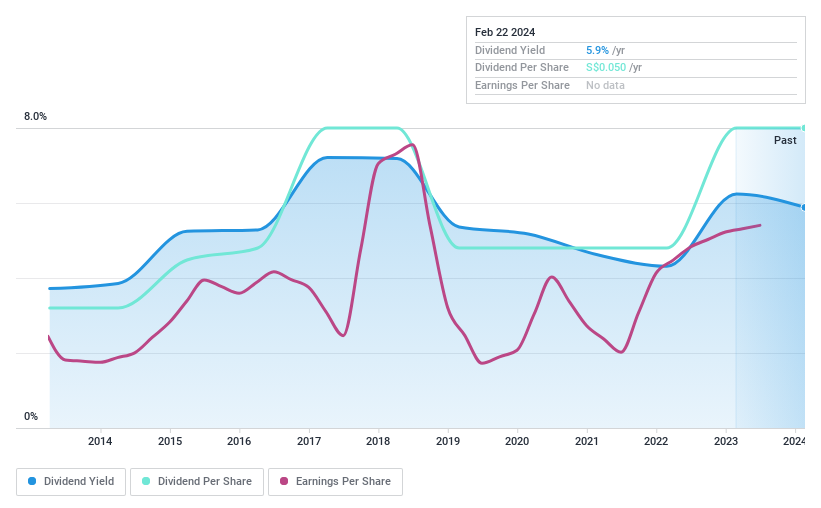

LHT Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: LHT Holdings Limited operates in the manufacturing and trading of wooden pallets and timber-related products across Singapore, Malaysia, and other international markets, with a market capitalization of SGD 61.76 million.

Operations: LHT Holdings Limited generates revenue primarily through the sale of pallets and packaging (SGD 35.67 million), with additional income from timber-related products (SGD 1.40 million), pallet rental and other services (SGD 4.58 million), and Technical Wood® and related products (SGD 1.81 million).

Dividend Yield: 4.3%

LHT Holdings has demonstrated a fluctuating dividend history over the past decade, with recent special dividends of SGD 0.13 per share announced on April 4, 2024, and February 23, 2024. Despite this volatility, the company maintains a sustainable payout with a coverage by earnings at a payout ratio of 61.3% and by cash flows at 63.3%. However, its dividend yield of 4.31% remains below the top quartile in Singapore's market average of 6.34%.

Summing It All Up

Unlock more gems! Our Top Dividend Stocks screener has unearthed 33 more companies for you to explore.Click here to unveil our expertly curated list of 36 Top Dividend Stocks.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:BEC SGX:D05 and SGX:BEI.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance