Unveiling Three Japanese Growth Companies With At Least 13% Insider Ownership

Amid a backdrop of heightened market activity and speculation on currency interventions in Japan, investors remain keenly observant of the shifts within the Japanese economy and its stock market. In such an environment, companies with substantial insider ownership can signal strong confidence from those closest to the business, potentially aligning well with investor interests looking for grounded opportunities in these turbulent times.

Top 10 Growth Companies With High Insider Ownership In Japan

Name | Insider Ownership | Earnings Growth |

Hottolink (TSE:3680) | 27% | 59.7% |

Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 42.9% |

Medley (TSE:4480) | 34% | 28.7% |

Micronics Japan (TSE:6871) | 15.3% | 39.8% |

Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

SHIFT (TSE:3697) | 35.4% | 32.5% |

ExaWizards (TSE:4259) | 21.9% | 91.1% |

Money Forward (TSE:3994) | 21.4% | 64.4% |

Astroscale Holdings (TSE:186A) | 20.9% | 90% |

freee K.K (TSE:4478) | 23.9% | 72.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Avant Group

Simply Wall St Growth Rating: ★★★★★☆

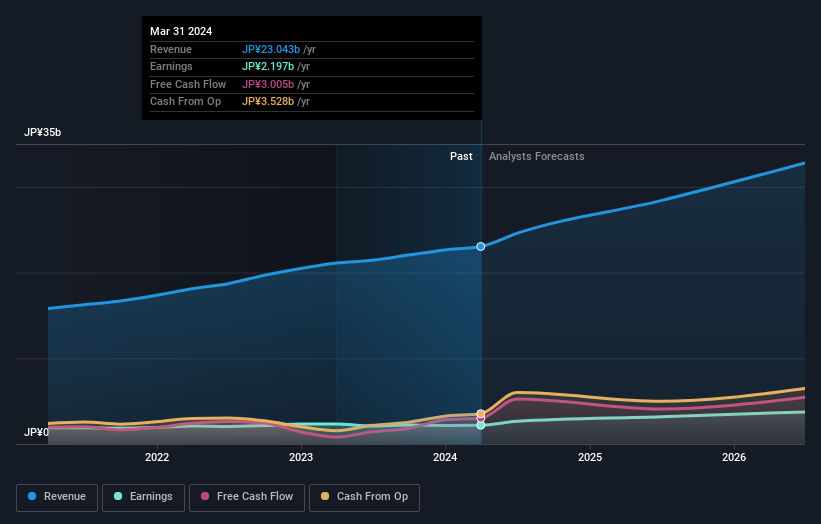

Overview: Avant Group Corporation operates in providing accounting, business intelligence, and outsourcing services with a market capitalization of ¥52.82 billion.

Operations: The firm's operations span accounting, business intelligence, and outsourcing services.

Insider Ownership: 33.8%

Avant Group, a growth company in Japan, is trading at 62.5% below its estimated fair value, signaling potential undervaluation. The firm's earnings are forecasted to grow by 21.77% annually over the next three years, outpacing the Japanese market's average. Additionally, its revenue growth at 15.6% annually also exceeds the market prediction of 4.4%. Recent actions include a share buyback program where Avant repurchased shares for ¥477.64 million to enhance shareholder value, reflecting strong insider confidence and commitment to company growth.

Tri Chemical Laboratories

Simply Wall St Growth Rating: ★★★★★☆

Overview: Tri Chemical Laboratories Inc., operating in Japan, specializes in the production of chemical products used in semiconductors, coatings, optical fibers, solar cells, and compound semiconductors with a market capitalization of ¥136.97 billion.

Operations: The company generates revenue through the production of chemicals used in various sectors including semiconductors, coatings, optical fibers, solar cells, and compound semiconductors.

Insider Ownership: 17.4%

Tri Chemical Laboratories in Japan, with high insider ownership, is poised for robust growth. The company's earnings are expected to surge by 37.56% annually over the next three years, significantly outpacing the Japanese market projection of 9% per year. Similarly, its revenue growth forecast at 28.4% annually also exceeds market expectations of 4.4%. Despite trading at a substantial discount of 39.8% below its fair value and experiencing high share price volatility recently, concerns linger due to a decline in profit margins from last year and a low forecasted Return on Equity of 19.9%.

BayCurrent Consulting

Simply Wall St Growth Rating: ★★★★☆☆

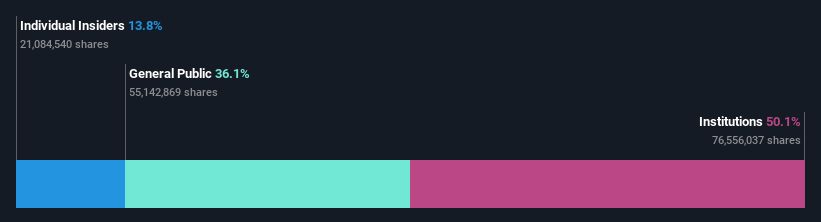

Overview: BayCurrent Consulting, Inc. offers consulting services across various sectors in Japan and has a market capitalization of approximately ¥655.89 billion.

Operations: The firm delivers consulting services across diverse sectors in Japan, with a market capitalization of roughly ¥655.89 billion.

Insider Ownership: 13.9%

BayCurrent Consulting, with substantial insider ownership, presents a mixed growth outlook. While its earnings and revenue are expected to grow by approximately 18% annually, this is below the significant growth threshold but still outperforms the Japanese market averages. Recently completing a share buyback for ¥3.6 billion underscores a proactive capital management strategy. Despite trading at nearly half its estimated fair value, high share price volatility and substantial non-cash earnings suggest caution.

Turning Ideas Into Actions

Navigate through the entire inventory of 98 Fast Growing Japanese Companies With High Insider Ownership here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSE:3836 TSE:4369 and TSE:6532.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance