Unveiling SEHK Stocks: Q Technology Group And 2 Others Estimated Below Intrinsic Value

Amidst a challenging global economic landscape, Hong Kong's market has shown resilience, though it has not been immune to the pressures felt worldwide. As investors navigate these complex conditions, identifying stocks that appear undervalued relative to their intrinsic value could offer potential opportunities for discerning portfolios.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

Name | Current Price | Fair Value (Est) | Discount (Est) |

Plover Bay Technologies (SEHK:1523) | HK$3.00 | HK$5.72 | 47.5% |

Kuaishou Technology (SEHK:1024) | HK$51.45 | HK$98.78 | 47.9% |

Gaush Meditech (SEHK:2407) | HK$13.84 | HK$26.14 | 47.1% |

Zijin Mining Group (SEHK:2899) | HK$16.08 | HK$29.03 | 44.6% |

Innovent Biologics (SEHK:1801) | HK$37.40 | HK$67.24 | 44.4% |

Melco International Development (SEHK:200) | HK$5.78 | HK$11.38 | 49.2% |

REPT BATTERO Energy (SEHK:666) | HK$14.26 | HK$27.26 | 47.7% |

Zhaojin Mining Industry (SEHK:1818) | HK$13.06 | HK$24.87 | 47.5% |

Zylox-Tonbridge Medical Technology (SEHK:2190) | HK$10.60 | HK$19.08 | 44.4% |

CGN Mining (SEHK:1164) | HK$2.65 | HK$4.87 | 45.5% |

Let's uncover some gems from our specialized screener

Q Technology (Group)

Overview: Q Technology (Group) Company Limited operates as an investment holding company that designs, researches, develops, manufactures, and sells camera and fingerprint recognition modules in Mainland China, Hong Kong, India, and other international markets with a market capitalization of approximately HK$5.06 billion.

Operations: The company generates revenue primarily through the sale of camera modules and fingerprint recognition modules, which amounted to CN¥11.57 billion and CN¥0.78 billion respectively.

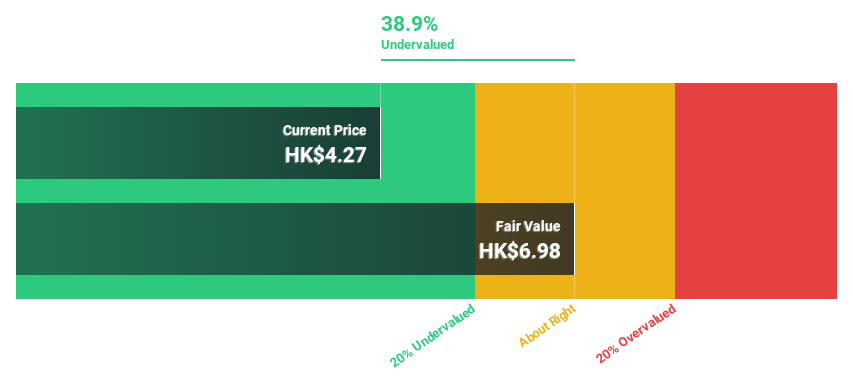

Estimated Discount To Fair Value: 38.9%

Q Technology (Group) has shown a mix of performance indicators that suggest a nuanced valuation based on cash flows. While its revenue growth at 8.1% per year is modestly above the Hong Kong market average of 7.9%, its profit margins have declined from 1.2% to 0.7% over the past year, indicating potential efficiency issues or increased costs. However, earnings are expected to grow significantly over the next three years, outpacing the market's forecast growth rate of 11.8%. This projected earnings acceleration, coupled with recent robust sales volumes in camera and fingerprint recognition modules, could point towards an undervaluation if these growth forecasts hold true and operational efficiencies are improved.

WuXi XDC Cayman

Overview: WuXi XDC Cayman Inc. is an investment holding company that specializes in contract research, development, and manufacturing services across China, North America, Europe, and other international markets, with a market capitalization of approximately HK$20.17 billion.

Operations: The company generates revenue primarily from its pharmaceuticals segment, totaling CN¥2.12 billion.

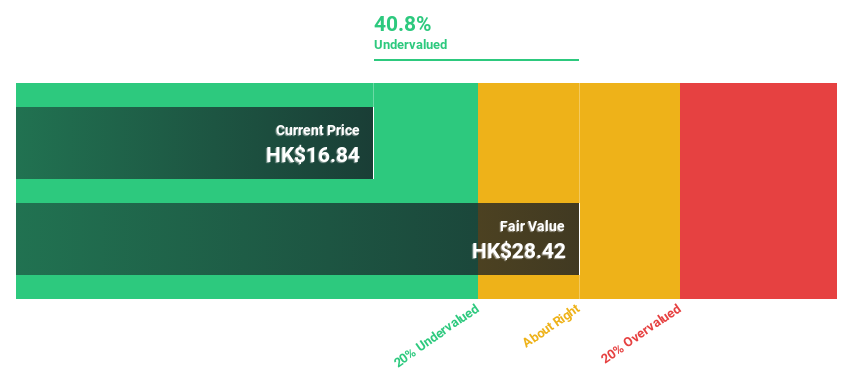

Estimated Discount To Fair Value: 40.8%

WuXi XDC Cayman's financial performance in 2023 showcased a substantial increase, with sales more than doubling to CNY 2.12 billion and net income rising to CNY 283.54 million. The company has demonstrated high-quality earnings with significant non-cash components, and its revenue is expected to grow by 25.4% annually, outpacing the Hong Kong market's 7.9%. Despite this, its forecasted Return on Equity of 17.5% suggests potential underperformance in capital efficiency compared to benchmarks.

MicroPort Scientific

Overview: MicroPort Scientific Corporation is an investment holding company that manufactures and markets medical devices across China, North America, Europe, Asia, and South America with a market capitalization of HK$11.41 billion.

Operations: The company's revenue is primarily generated from its Orthopedics Devices Business at HK$238.37 million, followed by Cardiac Rhythm Management at HK$207.04 million, Endovascular and Peripheral Vascular Devices at HK$168.22 million, Cardiovascular Devices (excluding CRM & Surgical Robot Device & Heart Valve Business) at HK$158.88 million, Neurovascular Devices at HK$94.17 million, Heart Valve Business at HK$47.52 million, Surgical Robot Devices Business at HK$14.81 million, and Surgical Devices Business at HK$7.76 million.

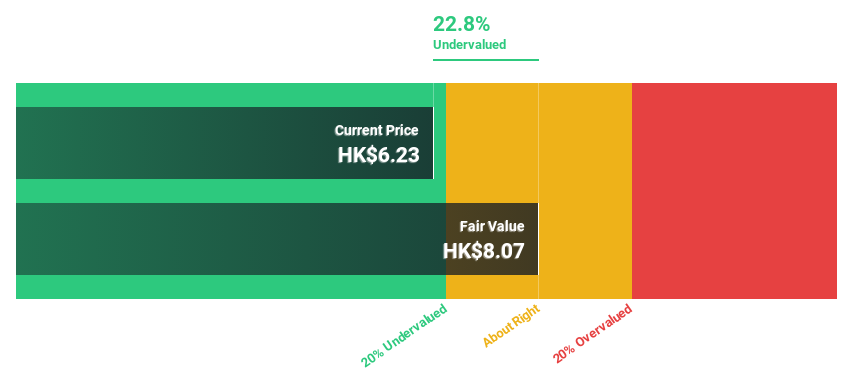

Estimated Discount To Fair Value: 22.8%

MicroPort Scientific is poised for a turnaround, with expectations to shift from a net loss of US$477.63 million in 2023 to profitability within the next three years, driven by anticipated robust annual profit growth that outstrips average market projections. Despite this optimistic profit trajectory, its revenue growth forecast at 14.9% annually lags behind the 20% benchmark but still exceeds the Hong Kong market's average of 7.9%. However, its projected Return on Equity remains modest at 8.1%, indicating potential challenges in achieving high capital efficiency.

Turning Ideas Into Actions

Delve into our full catalog of 43 Undervalued SEHK Stocks Based On Cash Flows here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1478SEHK:2268SEHK:853 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance