Unveiling 3 Premier Japanese Dividend Stocks With Yields Up To 4.5%

Amid a backdrop of historic yen weakness and dovish monetary policy, Japan's stock markets have shown resilience with notable gains in the Nikkei 225 and TOPIX indices. In this context, exploring high-yield dividend stocks can be particularly compelling for investors seeking steady income streams combined with potential market growth.

Top 10 Dividend Stocks In Japan

Name | Dividend Yield | Dividend Rating |

Koei Tecmo Holdings (TSE:3635) | 3.44% | ★★★★★★ |

Yamato Kogyo (TSE:5444) | 3.73% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.02% | ★★★★★★ |

Nissin (TSE:9066) | 3.96% | ★★★★★★ |

HITO-Communications HoldingsInc (TSE:4433) | 3.36% | ★★★★★★ |

Innotech (TSE:9880) | 3.88% | ★★★★★★ |

Star Micronics (TSE:7718) | 3.26% | ★★★★★★ |

DoshishaLtd (TSE:7483) | 3.26% | ★★★★★★ |

Toyo Kanetsu K.K (TSE:6369) | 3.50% | ★★★★★★ |

Nichimo (TSE:8091) | 4.05% | ★★★★★★ |

Click here to see the full list of 301 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

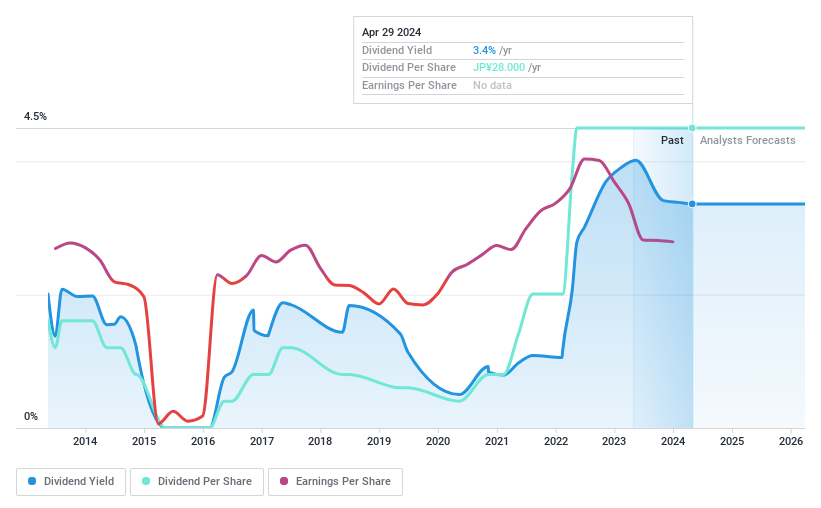

Daishinku

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Daishinku Corp. specializes in the production and sale of electronic components and equipment, operating both in Japan and internationally, with a market capitalization of ¥26.89 billion.

Operations: Daishinku Corp.'s revenue is derived from the production and sale of electronic components and equipment across both domestic and international markets.

Dividend Yield: 3.4%

Daishinku's dividend yield of 3.36% is competitive, ranking in the top 25% in the Japanese market. The company maintains a reasonable payout ratio of 58.1%, with dividends well-covered by both earnings and cash flows (cash payout ratio at 55.4%). However, investors should note Daishinku's historical dividend volatility and the impact of significant one-off items on its financial results, which may raise concerns about future dividend stability and reliability. Recent executive changes could also influence strategic directions affecting payouts.

Dive into the specifics of Daishinku here with our thorough dividend report.

Our valuation report here indicates Daishinku may be overvalued.

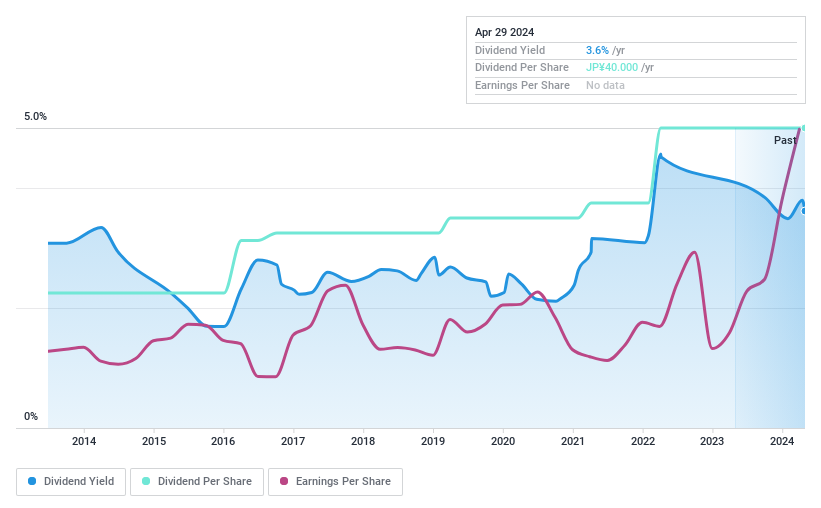

Advan Group

Simply Wall St Dividend Rating: ★★★★★★

Overview: Advan Group Co., Ltd. operates in Japan, specializing in the import and sale of building materials, with a market capitalization of approximately ¥39.49 billion.

Operations: Advan Group Co., Ltd. generates its revenue primarily from the import and sale of building materials within Japan.

Dividend Yield: 3.6%

Advan Group Co., Ltd. has demonstrated a stable and reliable dividend track record over the past decade, with a current yield of 3.62%, placing it among the top dividend payers in Japan. The dividends are well-supported by earnings, evidenced by a low payout ratio of 28.2%, and cash flows with a cash payout ratio of 63.7%. Recent share buyback programs, including the repurchase of shares worth ¥1,165.64 million, underscore efforts to enhance shareholder returns and capital efficiency through July 31, 2024.

Delve into the full analysis dividend report here for a deeper understanding of Advan Group.

Our valuation report here indicates Advan Group may be undervalued.

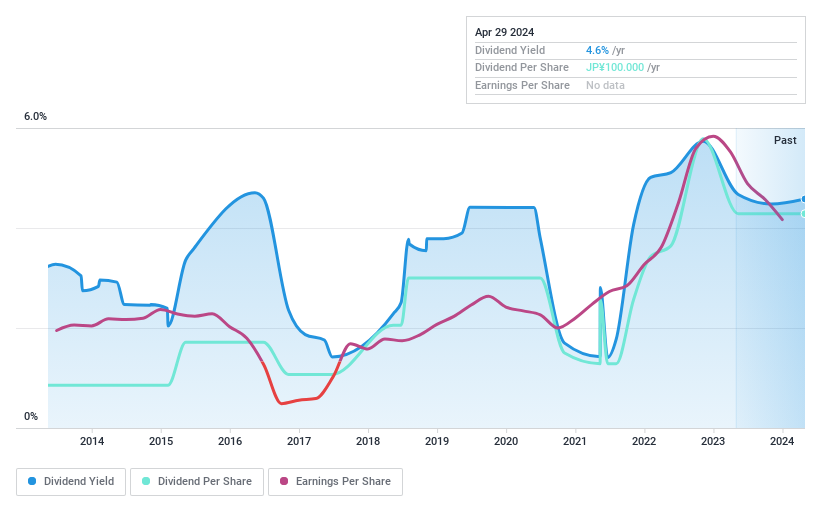

Sanshin Electronics

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sanshin Electronics Co., Ltd. operates in the sale and trade of electronic components and devices both domestically in Japan and internationally, with a market capitalization of approximately ¥26.64 billion.

Operations: Sanshin Electronics Co., Ltd. engages in the sale and trade of electronic components and devices across both domestic and international markets.

Dividend Yield: 4.6%

Sanshin Electronics offers a dividend yield of 4.58%, ranking it in the top 25% of Japanese dividend payers. Despite its strong current yield, the company's dividend history shows volatility with significant drops over the past decade. It trades at 66.5% below estimated fair value, suggesting potential undervaluation. Financially, while dividends are well-covered by both earnings and cash flows (payout ratio at 80%, cash payout ratio at 18.2%), high debt levels and historical payment inconsistencies may concern investors seeking stability.

Make It Happen

Navigate through the entire inventory of 301 Top Dividend Stocks here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSE:6962 TSE:7463 and TSE:8150.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance