Unveiling 3 Premier German Dividend Stocks With Yields Up To 5.7%

Amid a backdrop of fluctuating global markets, Germany's DAX index has shown resilience, modestly increasing by 0.32% this week. This performance comes as investors navigate through the complexities of mixed economic signals and central bank activities across Europe. In such a market environment, dividend stocks remain a focal point for those seeking potential stability and steady returns.

Top 10 Dividend Stocks In Germany

Name | Dividend Yield | Dividend Rating |

Allianz (XTRA:ALV) | 5.32% | ★★★★★★ |

Edel SE KGaA (XTRA:EDL) | 6.73% | ★★★★★★ |

Deutsche Post (XTRA:DHL) | 4.72% | ★★★★★★ |

Deutsche Telekom (XTRA:DTE) | 3.41% | ★★★★★☆ |

MLP (XTRA:MLP) | 4.61% | ★★★★★☆ |

INDUS Holding (XTRA:INH) | 4.60% | ★★★★★☆ |

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 6.06% | ★★★★★☆ |

SAF-Holland (XTRA:SFQ) | 4.76% | ★★★★★☆ |

Mercedes-Benz Group (XTRA:MBG) | 8.09% | ★★★★★☆ |

Uzin Utz (XTRA:UZU) | 3.17% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

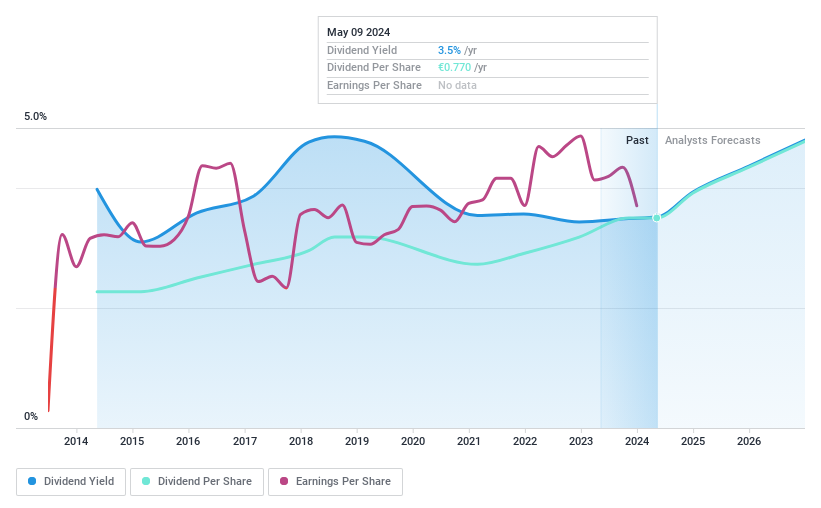

Deutsche Telekom

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Deutsche Telekom AG operates a comprehensive range of integrated telecommunication services globally, with a market capitalization of approximately €111.71 billion.

Operations: Deutsche Telekom AG generates revenue primarily through its operations in the United States (€72.18 billion), Germany (€25.34 billion), Europe (€11.97 billion), along with contributions from Systems Solutions (€3.94 billion) and Group Headquarters & Group Services (€2.27 billion).

Dividend Yield: 3.4%

Deutsche Telekom's dividend yield of 3.41% is below the top quartile in Germany, yet its dividends are well-supported, with a cash payout ratio of 19.3% and an earnings payout ratio of 87%. Despite this solid coverage, the company's recent earnings report showed a significant drop in net income from €15.36 billion to €1.98 billion year-over-year. The firm remains active in industry conferences, potentially signaling ongoing strategic initiatives to bolster its market position despite financial fluctuations and a high debt level.

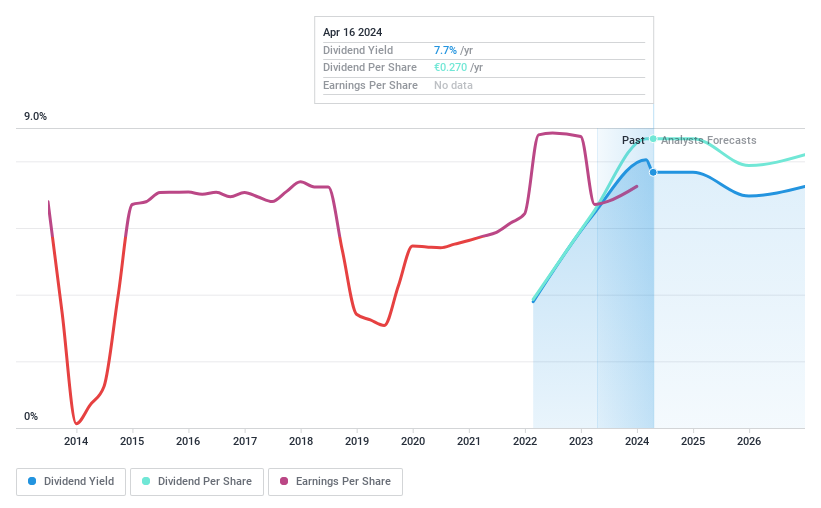

MPC Münchmeyer Petersen Capital

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MPC Münchmeyer Petersen Capital AG is a publicly owned investment manager with a market capitalization of approximately €157.21 million, focusing on diverse investment portfolios.

Operations: MPC Münchmeyer Petersen Capital AG generates its revenue primarily through Management Services at €30.83 million, followed by Transaction Services at €7.73 million.

Dividend Yield: 5.8%

MPC Münchmeyer Petersen Capital AG, trading at a significant discount to its estimated fair value, offers a compelling dividend yield of 5.77%, which is well above the German market average. The dividends are sustainably covered by both earnings and cash flows with payout ratios of 72.6% and 73.6% respectively. Despite this strong coverage, the company's dividend history is short, having initiated payments just two years ago with an unstable track record in dividend growth. Recent financials show robust year-over-year earnings growth from €8.63 million to €9.6 million in sales and net income improvement from €3.72 million to €5.88 million in Q1 2024, underlining potential financial stability under new CEO Constantin Baack starting June 13, 2024.

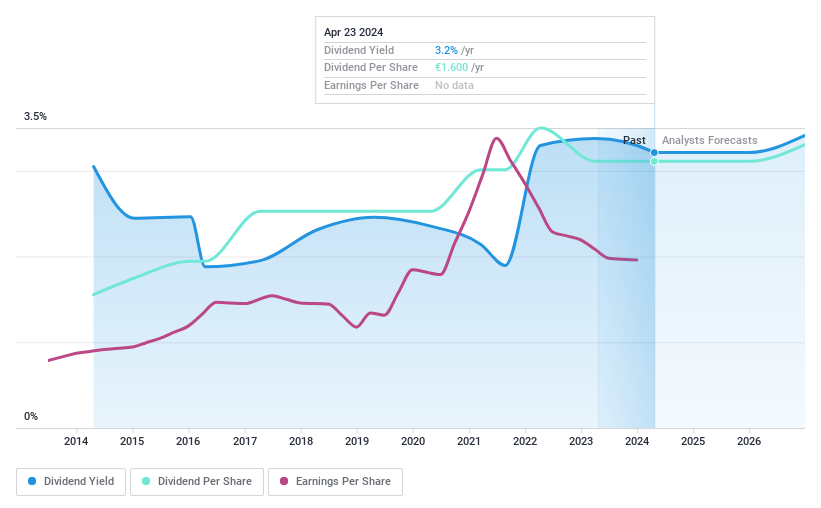

Uzin Utz

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Uzin Utz SE is a company that develops, manufactures, and sells construction chemical system products across Germany, the United States, the Netherlands, and other international markets, with a market capitalization of approximately €259.78 million.

Operations: Uzin Utz SE generates revenue through various segments, with €210.21 million from Germany - Laying Systems, €83.83 million from Western Europe, €82.87 million from Netherlands - Laying Systems, €73.33 million from the USA, €36.31 million from Netherlands - Wholesale, €35.16 million from Germany - Surface Care and Refinement, and €32.53 million from Germany - Machinery and Tools; additional revenues include €25.98 million from Southern/Eastern Europe.

Dividend Yield: 3.2%

Uzin Utz SE, with a dividend yield of 3.17%, falls below the top tier in Germany but maintains a stable and sustainable payout. Its dividends, supported by a payout ratio of 35.7% and cash flow coverage at 23.9%, demonstrate reliability over the past decade. Despite recent declines in yearly sales from €487.13 million to €479.34 million and net income from €22.58 million to €25.31 million, the company's earnings are expected to grow annually by 5.64%. The price-to-earnings ratio stands favorable at 11.3x compared to the German market average of 18.4x, indicating potential undervaluation.

Where To Now?

Click here to access our complete index of 32 Top Dividend Stocks.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:DTE XTRA:MPCK and XTRA:UZU.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance