Unveiling 3 Premier Dividend Stocks Yielding Up To 4.7%

Amidst a backdrop of fluctuating global influences and domestic economic indicators, the Indian stock market has shown resilience, recovering from recent declines and focusing on upcoming macroeconomic data. In such a dynamic environment, dividend stocks can offer investors potential stability and regular income, making them an attractive consideration in the current market scenario.

Top 10 Dividend Stocks In India

Name | Dividend Yield | Dividend Rating |

Balmer Lawrie Investments (BSE:532485) | 4.46% | ★★★★★★ |

Bhansali Engineering Polymers (BSE:500052) | 4.15% | ★★★★★★ |

D. B (NSEI:DBCORP) | 4.38% | ★★★★★☆ |

Castrol India (BSE:500870) | 3.85% | ★★★★★☆ |

ITC (NSEI:ITC) | 3.13% | ★★★★★☆ |

HCL Technologies (NSEI:HCLTECH) | 3.63% | ★★★★★☆ |

Indian Oil (NSEI:IOC) | 8.53% | ★★★★★☆ |

PTC India (NSEI:PTC) | 3.72% | ★★★★★☆ |

VST Industries (BSE:509966) | 3.56% | ★★★★★☆ |

Redington (NSEI:REDINGTON) | 3.45% | ★★★★★☆ |

Click here to see the full list of 19 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

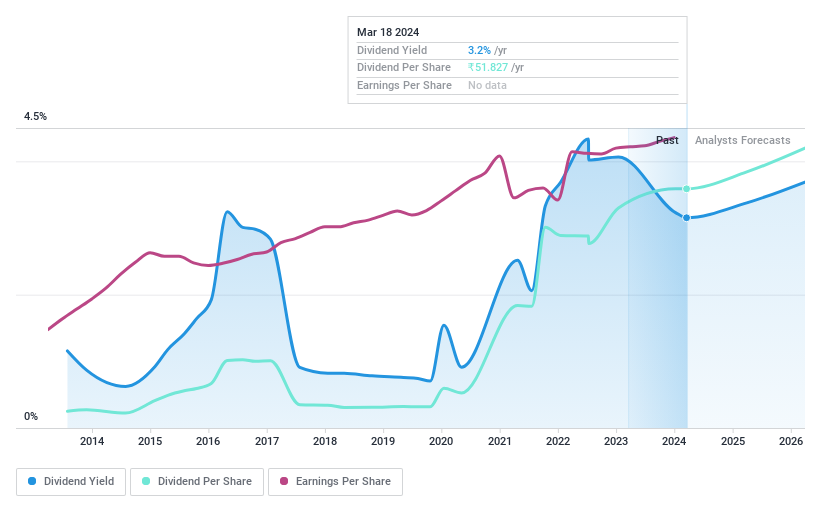

HCL Technologies

Simply Wall St Dividend Rating: ★★★★★☆

Overview: HCL Technologies Limited is a global company specializing in software development, business process outsourcing, and infrastructure management services, with a market capitalization of approximately ₹3.88 trillion.

Operations: HCL Technologies Limited generates revenue primarily through three segments: HCL Software at $1.41 billion, IT and Business Services at $9.80 billion, and Engineering and R&D Services at $2.12 billion.

Dividend Yield: 3.6%

HCL Technologies, a significant player in the technology sector, declared an interim dividend of INR 18 per share for FY 2024-2025, reflecting its commitment to returning value to shareholders. Despite a robust dividend history, the payout ratio stands at 89.1%, suggesting a high proportion of earnings distributed as dividends. This level raises concerns about sustainability if earnings were to face pressure. However, with cash flows covering dividends comfortably (cash payout ratio at 65.1%), and a consistent track record of revenue and profit growth (annual growth of approximately 5.9% over the past five years), HCL Technologies maintains its appeal among dividend investors in India’s tech landscape.

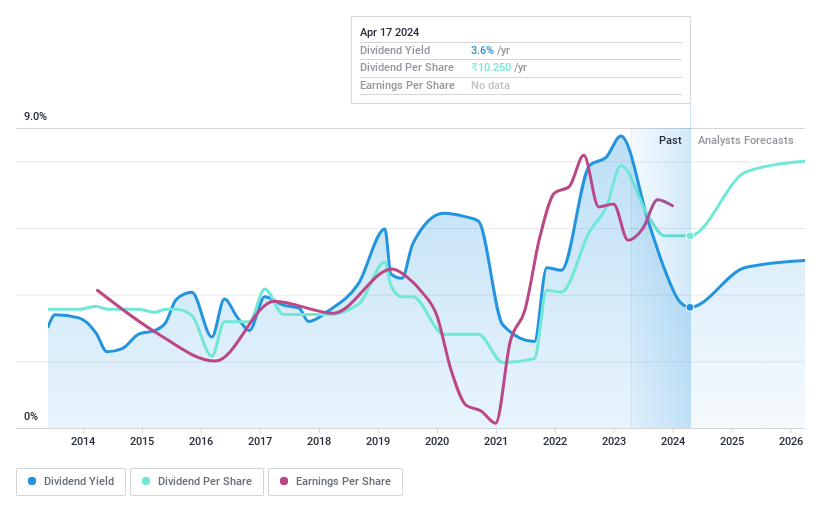

Oil and Natural Gas

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Oil and Natural Gas Corporation Limited, operating both domestically and internationally, is engaged in the exploration, development, and production of crude oil and natural gas, with a market capitalization of approximately ₹3.28 trillion.

Operations: Oil and Natural Gas Corporation Limited generates revenue primarily through Refining & Marketing (₹56.75 billion), and Exploration and Production with Onshore (₹4.39 billion) and Offshore (₹9.43 billion) operations in India, alongside international sales amounting to ₹0.96 billion.

Dividend Yield: 4.7%

Oil and Natural Gas Corporation Limited (ONGC) has shown a mixed performance in dividend reliability, with payments being volatile over the past decade. Despite this, dividends are well-supported by earnings and cash flows, with a payout ratio of 31.3% and a cash payout ratio of 32.5%, respectively. The company's recent final dividend recommendation is INR 2.50 per share for FY 2023-24. Additionally, ONGC's involvement in potential acquisitions indicates strategic moves to diversify operations, which could impact future financial stability and dividend policies.

Delve into the full analysis dividend report here for a deeper understanding of Oil and Natural Gas.

Our expertly prepared valuation report Oil and Natural Gas implies its share price may be too high.

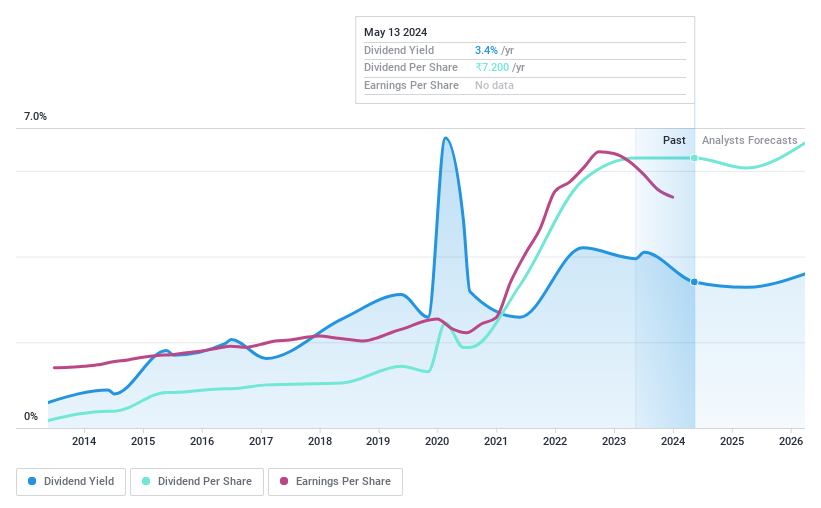

Redington

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Redington Limited operates as a supply chain solutions provider both in India and internationally, with a market capitalization of approximately ₹163.23 billion.

Operations: Redington Limited generates its revenue from providing supply chain solutions across India and globally.

Dividend Yield: 3.4%

Redington's dividend yield stands at 3.45%, ranking in the top 25% of Indian dividend payers, despite a history of volatility in its dividend payments over the past decade. The company maintains a low payout ratio of 40.4% and a cash payout ratio of 58.8%, indicating that dividends are well-covered by both earnings and cash flows. Trading at a price-to-earnings ratio of 13.4x, Redington offers value compared to its industry peers. Recent financial results show steady earnings growth, with the board set to consider future dividends on June 4, 2024.

Dive into the specifics of Redington here with our thorough dividend report.

Our valuation report here indicates Redington may be undervalued.

Summing It All Up

Dive into all 19 of the Top Dividend Stocks we have identified here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:HCLTECHNSEI:ONGC and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance