Unpacking Q1 Earnings: Expedia (NASDAQ:EXPE) In The Context Of Other Consumer Internet Stocks

As the Q1 earnings season wraps, let's dig into this quarter's best and worst performers in the consumer internet industry, including Expedia (NASDAQ:EXPE) and its peers.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 43 consumer internet stocks we track reported a slower Q1; on average, revenues beat analyst consensus estimates by 2.6%. while next quarter's revenue guidance was in line with consensus. Stocks, especially growth stocks where cash flows further in the future are more important to the story, had a good end of 2023. But the beginning of 2024 has seen more volatile stock performance due to mixed inflation data, and while some of the consumer internet stocks have fared somewhat better than others, they collectively declined, with share prices falling 0.5% on average since the previous earnings results.

Expedia (NASDAQ:EXPE)

Originally founded as a part of Microsoft, Expedia (NASDAQ:EXPE) is one of the world’s leading online travel agencies.

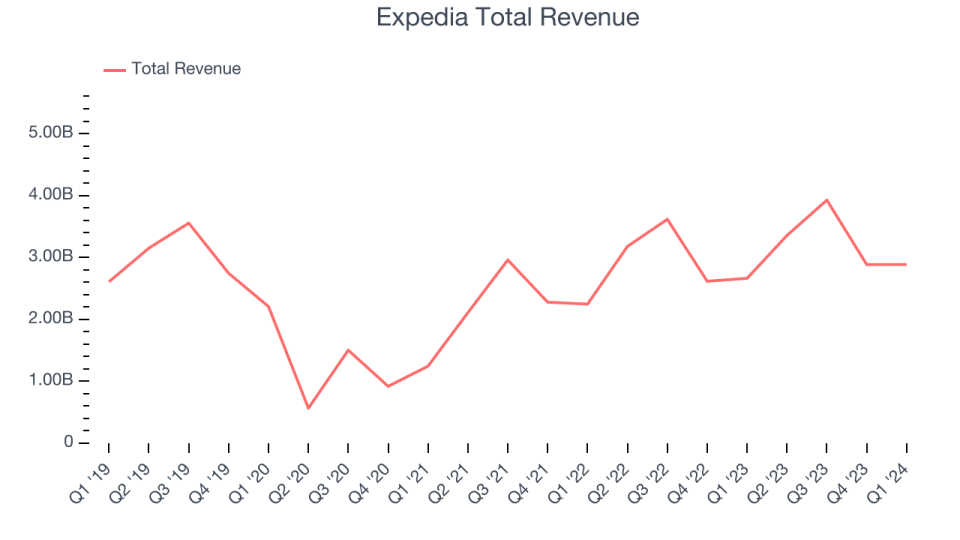

Expedia reported revenues of $2.89 billion, up 8.4% year on year, topping analysts' expectations by 2.8%. It was a mixed quarter for the company, with a decent beat of analysts' revenue estimates but slow revenue growth.

“Our first quarter results met our guidance with a revenue and earnings beat but with less robust gross bookings. We saw continued momentum in B2B, Brand Expedia and Advertising. However, Vrbo’s recovery following the recent re-platforming has been slower than anticipated, which has put pressure on gross bookings,” said Peter Kern, Vice Chairman and CEO, Expedia Group.

The stock is down 17.3% since the results and currently trades at $112.5.

Is now the time to buy Expedia? Access our full analysis of the earnings results here, it's free.

Best Q1: MercadoLibre (NASDAQ:MELI)

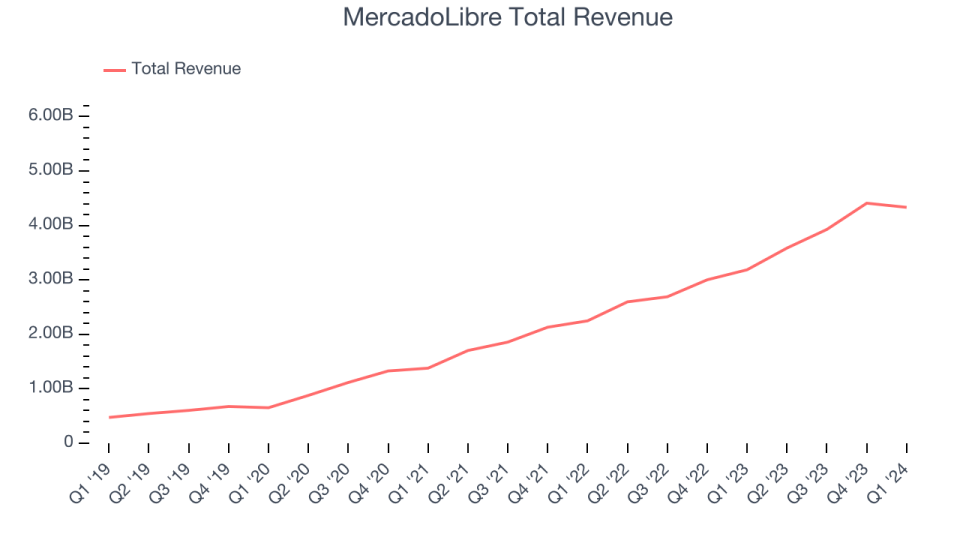

Originally started as an online auction platform, MercadoLibre (NASDAQ:MELI) is a one-stop e-commerce marketplace and fintech platform in Latin America.

MercadoLibre reported revenues of $4.33 billion, up 36% year on year, outperforming analysts' expectations by 12.1%. It was a stunning quarter for the company, with an impressive beat of analysts' revenue estimates and exceptional revenue growth.

The stock is up 17.7% since the results and currently trades at $1,774.49.

Is now the time to buy MercadoLibre? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Skillz (NYSE:SKLZ)

Taking a new twist at video gaming, Skillz (NYSE:SKLZ) offers developers a platform to create and distribute mobile games where players can pay fees to compete for cash prizes.

Skillz reported revenues of $25.24 million, down 43.1% year on year, falling short of analysts' expectations by 12.6%. It was a weak quarter for the company, with a decline in its users and slow revenue growth.

Skillz had the weakest performance against analyst estimates and slowest revenue growth in the group. The company reported 121,000 monthly active users, down 43.5% year on year. The stock is up 1.1% since the results and currently trades at $6.48.

Read our full analysis of Skillz's results here.

eHealth (NASDAQ:EHTH)

Aiming to address a high-stakes and often confusing decision, eHealth (NASDAQ:EHTH) guides consumers through health insurance enrollment and related topics.

eHealth reported revenues of $92.96 million, up 26.1% year on year, surpassing analysts' expectations by 15.3%. It was a mixed quarter for the company, with an impressive beat of analysts' revenue estimates but a decline in its users.

eHealth pulled off the biggest analyst estimates beat among its peers. The company reported 1.18 billion users, down 4.7% year on year. The stock is up 12.9% since the results and currently trades at $5.41.

Read our full, actionable report on eHealth here, it's free.

EverQuote (NASDAQ:EVER)

Aiming to simplify a once complicated process, EverQuote (NASDAQ:EVER) is an online insurance marketplace where consumers can compare and purchase various types of insurance from different providers

EverQuote reported revenues of $91.07 million, down 16.6% year on year, surpassing analysts' expectations by 13.4%. It was a very strong quarter for the company, with an impressive beat of analysts' revenue estimates and optimistic revenue guidance for the next quarter.

The stock is up 13.4% since the results and currently trades at $24.22.

Read our full, actionable report on EverQuote here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance