It's Unlikely That H&R Real Estate Investment Trust's (TSE:HR.UN) CEO Will See A Huge Pay Rise This Year

The anaemic share price growth at H&R Real Estate Investment Trust (TSE:HR.UN) over the past few years has probably not impressed shareholders and may be due to earnings not growing over that period. Some of these issues will occupy shareholders' minds as the AGM rolls around on 29 June 2021. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. In our analysis below, we show why shareholders may consider holding off a raise for the CEO's compensation until company performance improves.

See our latest analysis for H&R Real Estate Investment Trust

How Does Total Compensation For Tom Hofstedter Compare With Other Companies In The Industry?

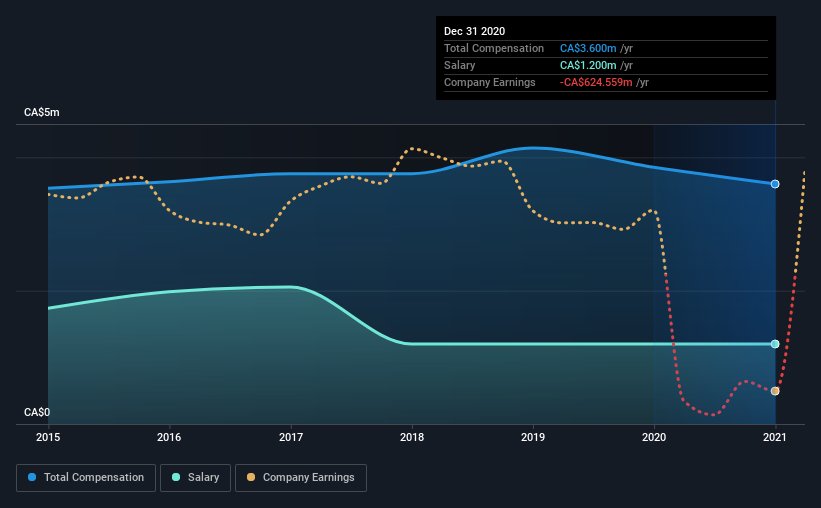

Our data indicates that H&R Real Estate Investment Trust has a market capitalization of CA$5.0b, and total annual CEO compensation was reported as CA$3.6m for the year to December 2020. That's a slight decrease of 6.5% on the prior year. While we always look at total compensation first, our analysis shows that the salary component is less, at CA$1.2m.

In comparison with other companies in the industry with market capitalizations ranging from CA$2.5b to CA$7.9b, the reported median CEO total compensation was CA$2.5m. Hence, we can conclude that Tom Hofstedter is remunerated higher than the industry median. Furthermore, Tom Hofstedter directly owns CA$61m worth of shares in the company, implying that they are deeply invested in the company's success.

Component | 2020 | 2019 | Proportion (2020) |

Salary | CA$1.2m | CA$1.2m | 33% |

Other | CA$2.4m | CA$2.7m | 67% |

Total Compensation | CA$3.6m | CA$3.9m | 100% |

Talking in terms of the industry, salary represented approximately 36% of total compensation out of all the companies we analyzed, while other remuneration made up 64% of the pie. There isn't a significant difference between H&R Real Estate Investment Trust and the broader market, in terms of salary allocation in the overall compensation package. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at H&R Real Estate Investment Trust's Growth Numbers

H&R Real Estate Investment Trust's funds from operations (FFO) deteriorated further this year coming in at-CA$16m at the last update, compared to last year's FFO of -CA$841k. It saw its revenue drop 1.7% over the last year.

Its a bit disappointing to see that the company has failed to grow its . This is compounded by the fact revenue is actually down on last year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has H&R Real Estate Investment Trust Been A Good Investment?

H&R Real Estate Investment Trust has generated a total shareholder return of 0.02% over three years, so most shareholders wouldn't be too disappointed. Although, there's always room to improve. Accordingly, a proposal to increase CEO remuneration without seeing an improvement in shareholder returns might not be met favorably by most shareholders.

In Summary...

While it's true that the share price growth hasn't been bad, it's hard to overlook the lack of earnings growth and this makes us question whether there will be any strong catalyst for the stock to improve. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We identified 3 warning signs for H&R Real Estate Investment Trust (2 don't sit too well with us!) that you should be aware of before investing here.

Switching gears from H&R Real Estate Investment Trust, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance