It's Unlikely That First Graphene Limited's (ASX:FGR) CEO Will See A Huge Pay Rise This Year

Key Insights

First Graphene to hold its Annual General Meeting on 20th of November

Total pay for CEO Mike Bell includes AU$381.5k salary

The overall pay is 61% above the industry average

Over the past three years, First Graphene's EPS grew by 1.5% and over the past three years, the total loss to shareholders 51%

The underwhelming share price performance of First Graphene Limited (ASX:FGR) in the past three years would have disappointed many shareholders. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. These are some of the concerns that shareholders may want to bring up at the next AGM held on 20th of November. They could also influence management through voting on resolutions such as executive remuneration. We think shareholders might be reluctant to increase compensation for the CEO at the moment, according to our analysis below.

Check out our latest analysis for First Graphene

Comparing First Graphene Limited's CEO Compensation With The Industry

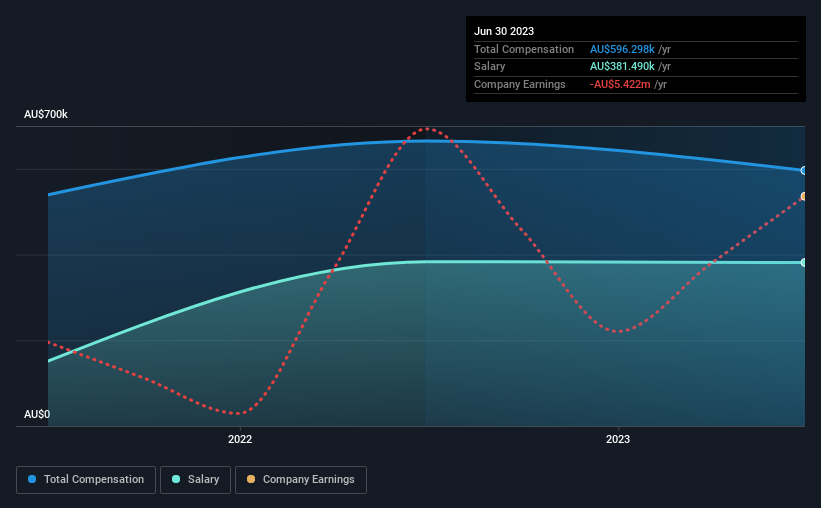

According to our data, First Graphene Limited has a market capitalization of AU$48m, and paid its CEO total annual compensation worth AU$596k over the year to June 2023. That's a notable decrease of 10% on last year. We note that the salary portion, which stands at AU$381.5k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the Australian Chemicals industry with market capitalizations below AU$314m, we found that the median total CEO compensation was AU$369k. Accordingly, our analysis reveals that First Graphene Limited pays Mike Bell north of the industry median. Furthermore, Mike Bell directly owns AU$91k worth of shares in the company.

Component | 2023 | 2022 | Proportion (2023) |

Salary | AU$381k | AU$383k | 64% |

Other | AU$215k | AU$282k | 36% |

Total Compensation | AU$596k | AU$665k | 100% |

Talking in terms of the industry, salary represented approximately 82% of total compensation out of all the companies we analyzed, while other remuneration made up 18% of the pie. In First Graphene's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

First Graphene Limited's Growth

Over the past three years, First Graphene Limited has seen its earnings per share (EPS) grow by 1.5% per year. Its revenue is up 39% over the last year.

It's hard to interpret the strong revenue growth as anything other than a positive. And in that context, the modest EPS improvement certainly isn't shabby. We'd stop short of saying the business performance is amazing, but there are enough positives to justify further research, or even adding the stock to your watch-list. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has First Graphene Limited Been A Good Investment?

Few First Graphene Limited shareholders would feel satisfied with the return of -51% over three years. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Despite the growth in its earnings, the share price decline in the past three years is certainly concerning. The stock's movement is disjointed with the company's earnings growth, which ideally should move in the same direction. If there are some unknown variables that are influencing the stock's price, surely shareholders would have some concerns. These concerns should be addressed at the upcoming AGM, where shareholders can question the board and evaluate if their judgement and decision making is still in line with their expectations.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 5 warning signs for First Graphene you should be aware of, and 2 of them are concerning.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance