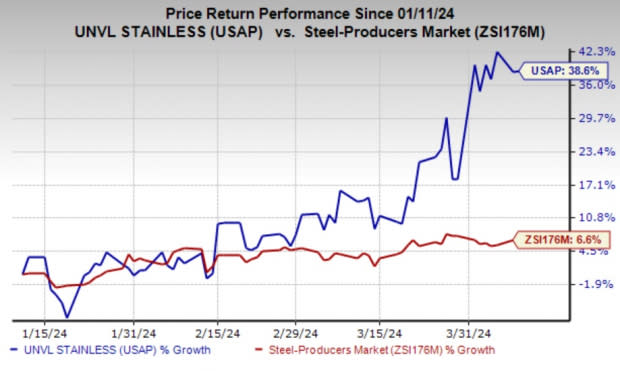

Universal Stainless (USAP) Rallies 39% in 3 Months: Here's Why

Universal Stainless & Alloy Products, Inc.’s USAP shares have gained 38.6% in the past three months. The company also outperformed the industry’s rise of 6.6% over the same time frame. It has also topped the S&P 500’s nearly 9% rise over the same period.

Image Source: Zacks Investment Research

Let’s take a look at the factors behind the stock’s price appreciation.

What’s Driving Universal Stainless?

In the fourth quarter of 2023, USAP exhibited robust performance, marking a notable turnaround from the prior-year quarter’s figure. With earnings of 27 cents per share against a loss of 41 cents a year ago, the company showcased significant progress — a testament to its resilient strategy and strategic advancements.

USAP racked up remarkable sales growth, reaching a record $79.8 million, up 42% from the prior-year quarter’s levels. The upside was primarily driven by outstanding performances in the specialty alloys and premium alloys segments, which saw impressive year-over-year surges of 37% and 56%, respectively. Particularly notable was the aerospace sector, where sales surged approximately 55% to a record $61.9 million, underscoring USAP's strong position in this critical market segment.

USAP's strategic focus on diversification and innovation is evident in its sales distribution across various end markets. While aerospace is a cornerstone of its success, the company demonstrated adaptability and resilience by achieving growth in sectors such as heavy equipment and general industrial, thereby strengthening its overall market presence.

Universal Stainless' forward-thinking approach is reflected in its substantial backlog, with premium alloys accounting for more than a third of its current backlog. Coupled with sustained solid demand in aerospace, this positions the company favorably for continued success in 2024 and beyond.

USAP has a trailing four-quarter average earnings surprise of 44.4%. The Zacks Consensus Estimate for 2024 earnings is pegged at $1.50 per share, indicating a surge of 183% from the previous year's levels.

Universal Stainless & Alloy Products, Inc. Price and Consensus

Universal Stainless & Alloy Products, Inc. price-consensus-chart | Universal Stainless & Alloy Products, Inc. Quote

Zacks Rank & Key Picks

Universal Stainless currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are Ecolab Inc. ECL, sporting a Zacks Rank #1 (Strong Buy), and Carpenter Technology Corporation CRS and Innospec Inc. IOSP, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Ecolab has a projected earnings growth rate of 22.65% for the current year. The Zacks Consensus Estimate for ECL’s current-year earnings has been revised upward by 5.4% in the past 60 days. ECL beat on earnings in each of the last four quarters, delivering an average surprise of 1.7%. The company’s shares have rallied 36.7% in the past year.

The consensus estimate for CRS’ current fiscal year earnings is pegged at $4 per share, indicating a year-over-year surge of 250.9%. CRS beat on earnings in each of the last four quarters, delivering an average surprise of 12.2%. The company’s shares have risen 83.8% in the past year.

The consensus estimate for IOSP’s current fiscal year earnings is pegged at $6.72 per share, indicating a 10.3% year-over-year increase. IOSP beat on earnings in each of the last four quarters, delivering an average surprise of 10.5%. The company’s shares have risen 18.4% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Universal Stainless & Alloy Products, Inc. (USAP) : Free Stock Analysis Report

Innospec Inc. (IOSP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance