Universal Logistics Holdings Surpasses Analyst Earnings Expectations in Q1 2024

Revenue: Reported $491.9 million, up 12.5% year-over-year, surpassing estimates of $416.50 million.

Net Income: Achieved $52.5 million, significantly exceeding the estimated $19.20 million.

Earnings Per Share (EPS): Recorded at $1.99, substantially higher than the estimated $0.73.

Operating Income: Increased to $75.1 million, up from $38.2 million in the previous year.

EBITDA: Grew to $96.9 million from $56.7 million last year, with EBITDA margin improving to 19.7% from 13.0%.

Dividend: Declared a quarterly dividend of $0.105 per share.

Segment Performance: Contract Logistics segment excelled with a 48.4% increase in revenues to $313.5 million, while the Intermodal segment faced challenges, reporting a 30.9% decrease in revenues to $76.7 million.

On April 25, 2024, Universal Logistics Holdings Inc (NASDAQ:ULH) announced its first quarter financial results for the year, significantly outperforming analyst expectations. The company reported a robust increase in earnings per share (EPS) and revenue, as detailed in its 8-K filing. Universal Logistics Holdings, a leading provider of customized transportation and logistics solutions, declared a quarterly dividend amidst this strong financial performance.

Financial Highlights

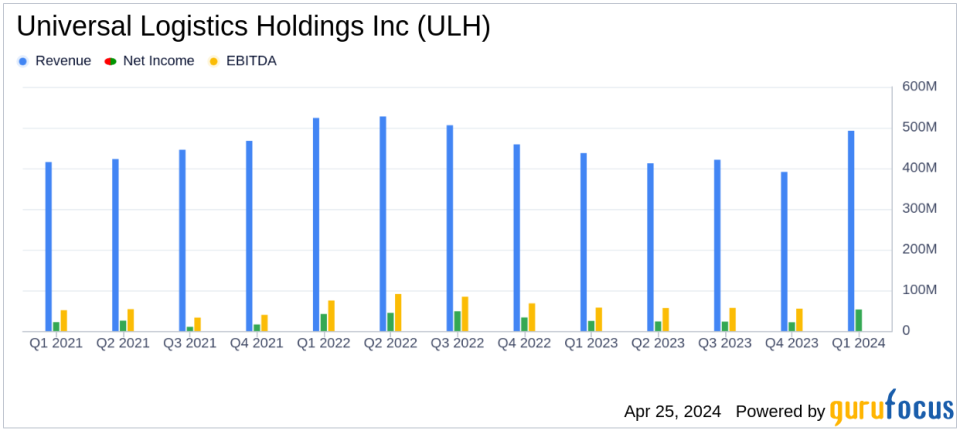

For the first quarter of 2024, Universal Logistics Holdings reported operating revenues of $491.9 million, a 12.5% increase from the previous year, surpassing the estimated $416.50 million. The EPS dramatically increased to $1.99, outstripping the analyst estimate of $0.73. This remarkable growth in EPS represents a $1.04 increase per share year-over-year. The company also reported a net income of $52.5 million, more than double the estimated $19.20 million, and a significant rise from $24.9 million in the first quarter of 2023.

Operating income for the quarter stood at $75.1 million, up from $38.2 million in the prior year. The EBITDA also saw a substantial rise, reaching $96.9 million compared to $56.7 million in the first quarter of 2023, reflecting an improved EBITDA margin of 19.7%.

Segment Performance

The contract logistics segment was a standout, with operating revenues increasing by 48.4% to $313.5 million. This segment's operating income rose to $81.5 million, achieving an operating margin of 26.0%. However, not all segments fared as well. The intermodal segment experienced a decrease in revenues by 30.9% to $76.7 million and reported an operating loss of $8.0 million. The trucking and company-managed brokerage segments also faced declines in revenues and operational challenges.

Company's Strategic Outlook

CEO Tim Phillips expressed satisfaction with the quarter's results, highlighting the strength of the contract logistics segment and its role as a differentiator in the business model. Despite challenges in the intermodal and brokerage segments, Phillips remains optimistic about the company's strategy to manage costs, increase productivity, and return underperforming operations to profitability.

Financial Position and Dividend Declaration

As of March 30, 2024, Universal Logistics Holdings reported cash and cash equivalents of $11.1 million and marketable securities of $11.8 million. The company's total debt stood at $418.4 million. Additionally, the Board of Directors declared a quarterly dividend of $0.105 per share, payable on July 1, 2024, to shareholders of record as of June 3, 2024.

Conclusion

Universal Logistics Holdings Inc's first-quarter results for 2024 have not only exceeded analyst expectations but also demonstrated the company's ability to leverage its strengths in contract logistics to drive substantial growth. While challenges remain in certain segments, the company's proactive management strategies and robust financial health suggest a positive outlook for the remainder of the year.

For further details, investors and interested parties are encouraged to review the full 8-K filing and join the upcoming earnings conference call.

Explore the complete 8-K earnings release (here) from Universal Logistics Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance