Uniti Group Inc. (UNIT) Q1 2024 Earnings: Surpasses Net Income Expectations and Announces ...

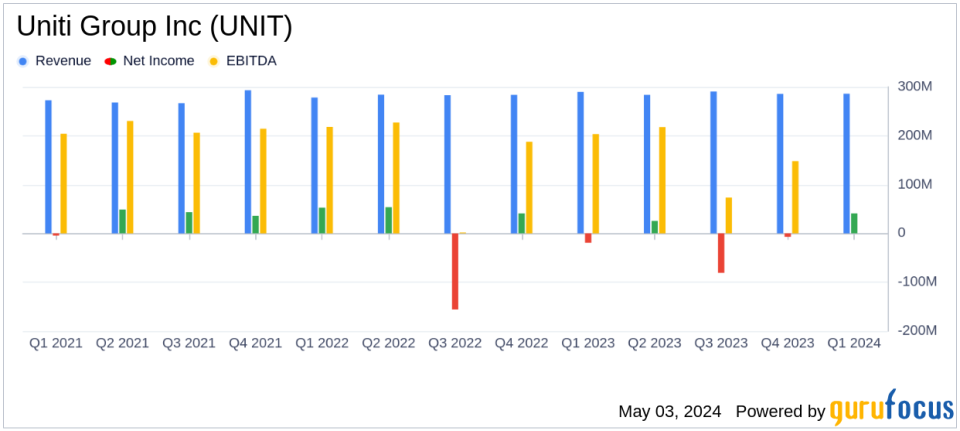

Net Income: Reported at $41.3 million for the first quarter, significantly above the estimated $27.57 million.

Earnings Per Share (EPS): Achieved $0.16 per diluted common share, above the estimate of $0.12.

Revenue: Totalled $286.4 million, slightly below the estimated $288.67 million for the quarter.

Adjusted EBITDA: Reached $228.6 million with an Adjusted EBITDA margin of approximately 80%.

Dividend: Declared a quarterly cash dividend of $0.15 per common share, payable on June 28, 2024.

Merger Announcement: Announced a transformational merger with Windstream, aiming to expand network reach and enhance financial profile.

Liquidity: Ended the quarter with approximately $470.1 million in unrestricted cash and cash equivalents.

On May 3, 2024, Uniti Group Inc. (NASDAQ:UNIT) disclosed its first-quarter financial results for 2024, revealing a robust performance with net income significantly surpassing analyst expectations. The company also announced a transformational merger with Windstream, positioning itself as a leading player in the fiber broadband sector. The detailed earnings report is available in Uniti's 8-K filing.

Company Overview

Uniti Group Inc., a real estate investment trust (REIT), specializes in the acquisition and construction of mission-critical communications infrastructure. The company owns approximately 140,000 route miles of fiber primarily in the Southeastern U.S. Uniti operates through two segments: leasing and fiber, with leasing comprising about 75% of its total revenue, largely attributed to a master lease agreement with Windstream.

Financial Performance Highlights

For Q1 2024, Uniti reported consolidated revenues of $286.4 million, slightly below the estimated $288.67 million. However, the company's net income reached $41.3 million, or $0.16 per diluted share, outperforming the anticipated $27.57 million. This represents a significant improvement compared to the previous year and indicates strong operational efficiency and cost management.

Strategic Developments and Market Position

The announced merger with Windstream is set to expand Uniti's network reach to 1.5 million homes, enhancing its fiber-to-the-home buildouts and financial profile. According to CEO Kenny Gunderman, this merger is a strategic move to capitalize on the increasing demand for fiber broadband, driven by applications like Generative AI, which underscore the critical nature of fiber infrastructure.

Financial Health and Future Outlook

Uniti's balance sheet shows a healthy liquidity position with approximately $470.1 million in unrestricted cash and cash equivalents. The company's leverage ratio stood at 6.07x, based on net debt to annualized Adjusted EBITDA. Looking ahead, Uniti has updated its full-year 2024 outlook, projecting revenues between $1,154 million and $1,174 million, and net income attributable to common shareholders between $116 million and $136 million.

Investor Considerations

Uniti's performance this quarter, particularly its surpassing of net income estimates and strategic merger announcement, presents a potentially attractive opportunity for investors. The company's focus on expanding its fiber infrastructure and leveraging emerging technological demands places it in a favorable position within the competitive REIT sector.

Conclusion

Uniti Group Inc.'s Q1 2024 results demonstrate a solid start to the year, underscored by financial growth and strategic expansion. The merger with Windstream is expected to further solidify Uniti's market position as a premier provider of fiber solutions, supporting sustained growth and shareholder value in the evolving telecommunications landscape.

For detailed financial figures and future projections, stakeholders are encouraged to review the full earnings filing.

Explore the complete 8-K earnings release (here) from Uniti Group Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance