United Airlines (UAL) Gains on Narrower-Than-Expected Q3 Loss

United Airlines UAL incurred a loss (excluding $2.46 from non-recurring items) of $1.02 per share in the third quarter of 2021, narrower than the Zacks Consensus Estimate of a loss of $1.65. The amount of loss has narrowed by 87.5% from the year-ago period. This is the seventh consecutive quarterly loss incurred by the company as air-travel demand continues to be below the pre-pandemic levels despite improving.

Operating revenues of $7,750 million surpassed the Zacks Consensus Estimate of $7639.7 million. The top line surged more than 200% year over year with passenger revenues accounting for 85.6% of the top line, soaring more than 300% to $6,637 million. This reflects the improvement in air-travel demand from the pandemic-led lows. The airline’s CEO, Scott Kirby, said that the Delta-variant woes delayed the company’s recovery. But the carrier is poised to take advantage of the recovery in business travel and the re-opening of European borders next month, Kirby added. This optimistic outlook and the third-quarter outperformance drove shares of United Airlines up 2.2% in after-market trading on Oct 19.

Nevertheless, with air-travel demand continuing to be below the pre-pandemic levels, total revenues declined 31.9% from the third quarter of 2019 (pre-pandemic). Passenger revenues dropped 36.7% from the 2019 level, while cargo revenues jumped 84% to $519 million. Revenues from other sources dipped 3.7% from the third quarter of 2019 to $594 million.

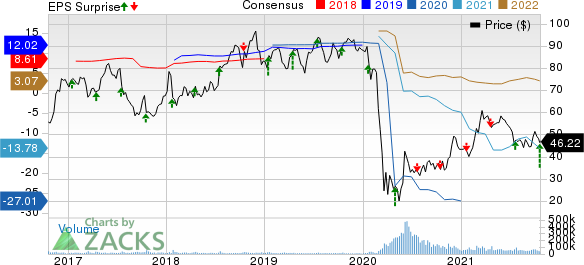

United Airlines Holdings Inc Price, Consensus and EPS Surprise

United Airlines Holdings Inc price-consensus-eps-surprise-chart | United Airlines Holdings Inc Quote

Operating Results

Below we present all comparisons (in % terms) with third-quarter 2019.

Consolidated passenger revenue per available seat mile (PRASM: a key measure of unit revenues) decreased 11.7% from the 2019 level to 12.32 cents. Total revenue per available seat mile (TRASM) declined 5.1% to 14.38 cents. On a consolidated basis, average yield per revenue passenger mile dipped 0.2% to 16.18 cents.

Consolidated airline traffic, measured in revenue passenger miles, fell 36.5%, while capacity, measured in available seat miles, decreased 28.2%. Consolidated load factor (percentage of seat occupancy) deteriorated to 76.1% from 86.1% in the third quarter of 2019 as traffic declined more than the drop in capacity. Average aircraft fuel price per gallon increased 5.9% to $2.14. Fuel gallons consumed were down 29.5%.

Adjusted operating expenses fell 17.6% to $6,068 million. Consolidated unit cost or cost per available seat mile (CASM) excluding fuel, third-party business expenses, profit-sharing and special charges, ascended 14.9%.

United Airlines exited the third quarter with cash and cash equivalents of $19,256 million compared with $11,269 million at the end of 2020. Long-term debt at the end of the reported quarter was $31,520 million compared with $24,836 million at the end of December 2020. This Zacks Rank #3 (Hold) company exited the quarter with total available liquidity of approximately $21 billion.

Outlook

United Airlines expects fourth-quarter capacity to decline approximately 23% from the comparable period in 2019. Total revenues are anticipated to decline 25-30% from the fourth quarter of 2019. The company estimates CASM, excluding fuel, third-party business expenses, profit-sharing and special charges, to increase 12-14% from the fourth-quarter 2019 level. It expects the metric to be lower next year compared with the 2019 level. Fuel price is predicted to be $2.39 per gallon in the fourth quarter. Anticipating growth in international traffic, the carrier expects to increase 2022 capacity by 5% from the 2019 level. United Airlines forecasts capital expenditures to be approximately $3 billion in 2021.

Sectorial Snapshot

Within the broader Transportation sector, Delta Air Lines DAL, J.B. Hunt Transport Services JBHT and Kansas City Southern KSU recently reported third-quarter 2021 results.

Delta, carrying a Zacks Rank #4 (Sell), reported third-quarter earnings (excluding $1.59 from non-recurring items) of 30 cents per share, outpacing the Zacks Consensus Estimate of 15 cents. Revenues of $9,154 million also beat Zacks Consensus Estimate of $8,370.6 million.

J.B. Hunt, carrying a Zacks Rank #2 (Buy), reported third-quarter earnings of $1.88 per share, surpassing the Zacks Consensus Estimate of $1.77. Total operating revenues of $3144.8 million outperformed the Zacks Consensus Estimate of $3002.1 million. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Kansas City Southern, carrying a Zacks Rank #4, reported third-quarter earnings (excluding 31 cents from non-recurring items) of $2.02 per share, missing the Zacks Consensus Estimate of $2.07. Quarterly revenues of $744 million, however, surpassed the Zacks Consensus Estimate of $725.9 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

J.B. Hunt Transport Services, Inc. (JBHT) : Free Stock Analysis Report

Kansas City Southern (KSU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance