Union Square Park Capital Management's Strategic Acquisition of Eagle Pharmaceuticals Shares

Overview of the Recent Transaction

On October 3, 2024, Union Square Park Capital Management, LLC (Trades, Portfolio) made a significant move in the pharmaceutical sector by acquiring 1,191,490 shares of Eagle Pharmaceuticals Inc (EGRX). This transaction marked a new holding for the firm, purchased at a price of $1.99 per share. The total investment impacted the firm's portfolio by 2.06%, establishing a substantial position in Eagle Pharmaceuticals.

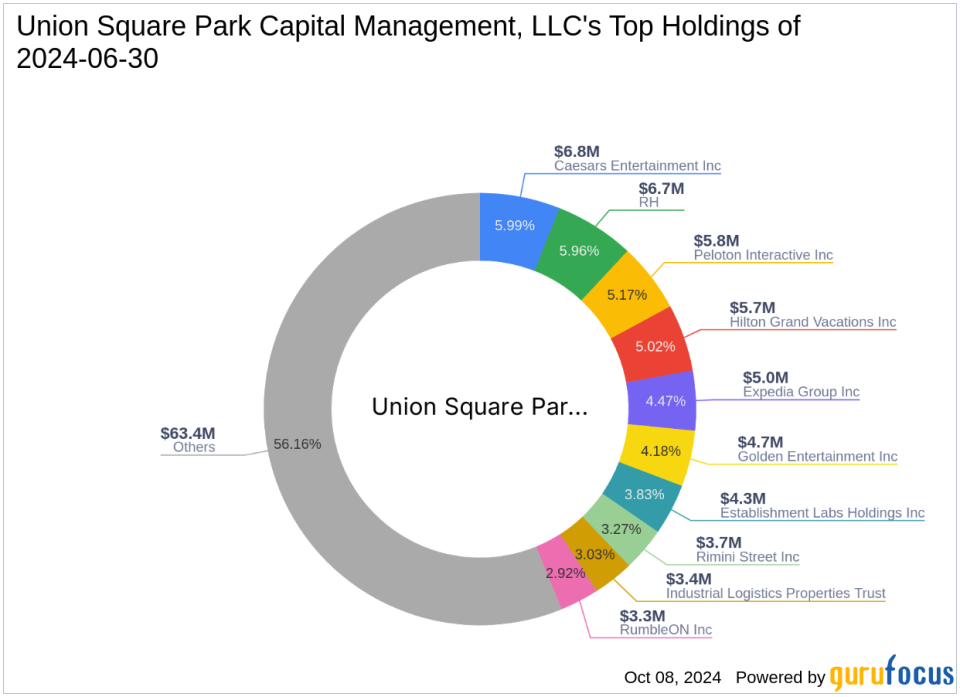

Insight into Union Square Park Capital Management, LLC (Trades, Portfolio)

Located at 1251 Avenue of the Americas, New York, NY, Union Square Park Capital Management, LLC (Trades, Portfolio) is a prominent investment firm. With a portfolio comprising 31 stocks and a total equity of $113 million, the firm focuses primarily on the Consumer Cyclical and Real Estate sectors. Their top holdings include notable companies such as Caesars Entertainment Inc (NASDAQ:CZR) and Expedia Group Inc (NASDAQ:EXPE). The firm's investment philosophy emphasizes strategic market positions and growth potential in its selections.

About Eagle Pharmaceuticals Inc

Eagle Pharmaceuticals Inc, trading under the symbol EGRX, is a specialty pharmaceutical company based in the USA. Since its IPO on February 12, 2014, the company has focused on developing and commercializing injectable products aimed at critical care, orphan diseases, and oncology. Despite a challenging market, with a current market capitalization of $12.96 million and a stock price of $1, Eagle Pharmaceuticals continues to innovate in its field.

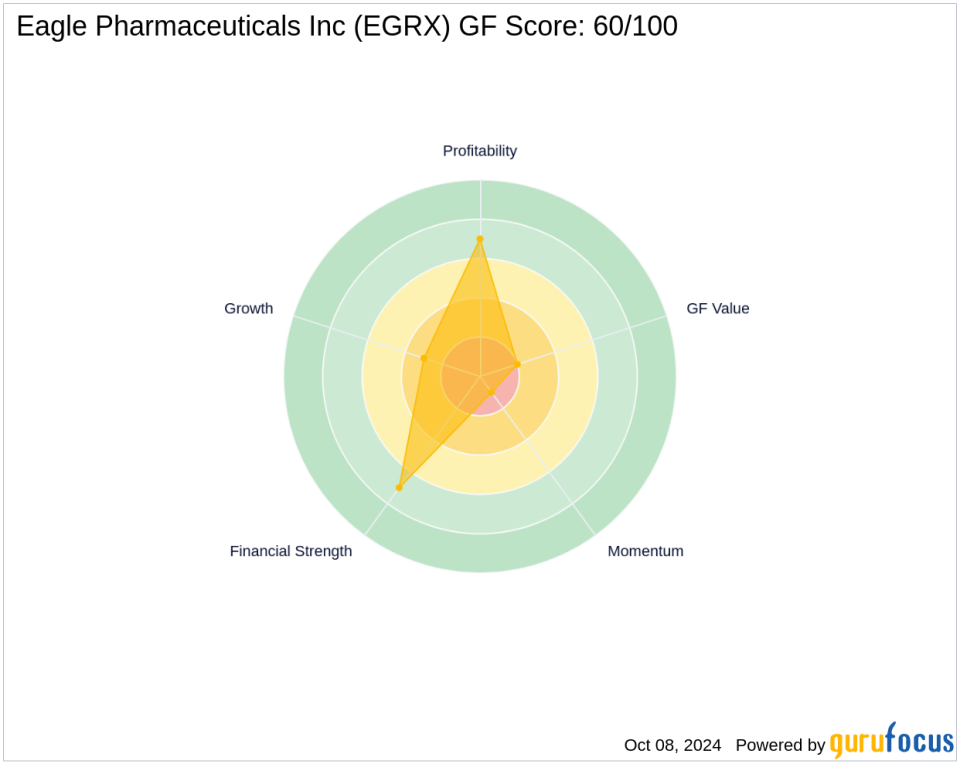

Financial and Market Analysis of Eagle Pharmaceuticals

Eagle Pharmaceuticals has faced significant market challenges, reflected in its stock price decline of 49.75% since the transaction, a 93.55% drop since its IPO, and a year-to-date decrease of 82.33%. The company holds a GF Score of 60/100, indicating potential concerns about its future performance. Financially, the company has a Profitability Rank and a Financial Strength of 7/10, but its Growth Rank is notably lower at 3/10.

Impact of the Trade on Union Square Park Capital Managements Portfolio

The acquisition of Eagle Pharmaceuticals shares represents a new and notable addition to Union Square Park Capital Management's portfolio, accounting for 2.06% of its total investments and 9.17% of its holdings in the stock. This strategic move diversifies the firm's investments and increases its exposure to the pharmaceutical sector, aligning with its broader investment strategy.

Market Reaction and Stock Performance Post-Transaction

Following the transaction, Eagle Pharmaceuticals' stock has not performed well, with significant declines across various metrics. The stock's valuation challenges are compounded by its inability to be evaluated against the GF Value, due to a lack of sufficient data. This suggests a cautious approach to the stock in the near term.

Future Outlook and Strategic Positioning

The decision by Union Square Park Capital Management to invest in Eagle Pharmaceuticals likely stems from a belief in the company's long-term potential despite its current market struggles. The firm might be positioning for a turnaround or significant developments within Eagle Pharmaceuticals that could lead to substantial future value.

Conclusion

Union Square Park Capital Management's recent acquisition of Eagle Pharmaceuticals shares is a calculated move that aligns with its investment strategy and adds a new dimension to its portfolio. While the current performance of Eagle Pharmaceuticals poses challenges, the potential for future gains remains a key factor in this strategic investment decision.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance