Union Pacific (UNP) Slashes 2021 Volume Outlook, Stock Slips

At the 2021 Stephens Annual Investor Conference held on Dec 1, Union Pacific UNP reduced its forecast for full-year volumes and operating ratio as supply chain disruptions hit its shipments. Following this, shares of the company dipped 1% at the close of business on Dec 1.

While UNP reiterated its expectation of record financial performance in 2021, it lowered its volume growth forecast to approximately 4% from 5% expected earlier. Previously, in October, while releasing its third-quarter 2021 results, the company had slashed its volume growth forecast to 5% from 7%.

Supply chain disruptions are weighing on Union Pacific’s automotive and intermodal volumes. In the third quarter, automotive and intermodal volumes declined 18% and 6%, respectively. With this, the premium segment (which includes automotive and intermodal) volumes fell 9%. Persistent weakness in the premium segment, which accounted for 30.3% of UNP’s total freight revenues in the September quarter, might dent the company’s top line.

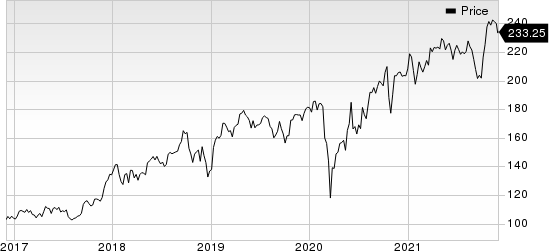

Union Pacific Corporation Price

Union Pacific Corporation price | Union Pacific Corporation Quote

Union Pacific now anticipates operating ratio (operating expenses as a percentage of revenues) to improve around 150 basis points in 2021 from roughly 175 basis points the company had forecast while releasing third-quarter results in October. Additionally, UNP now estimates productivity of approximately $250 million for the full year.

Zacks Rank & Key Picks

Union Pacific carries a Zacks Rank #3 (Hold).

Here are some better-ranked stocks within the broader Transportation sector:

Schneider National SNDR sports a Zacks Rank #1 (Strong Buy). The company has a stellar earnings surprise history, having outperformed the Zacks Consensus Estimate in each of the preceding four quarters, the average beat being 21%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of Schneider National have rallied more than 16% so far this year.

Expeditors International of Washington EXPD also sports a Zacks Rank #1. The company’s earnings have surpassed the Zacks Consensus Estimate in each of the preceding four quarters, the average beat being 29.1%.

Shares of Expeditors have appreciated nearly 30% so far this year.

Landstar System LSTR carries a Zacks Rank #2 (Buy). The company’s earnings have trumped the Zacks Consensus Estimate in each of the trailing four quarters, the average beat being 11.4%.

Shares of Landstar have gained more than 26% so far this year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Union Pacific Corporation (UNP) : Free Stock Analysis Report

Expeditors International of Washington, Inc. (EXPD) : Free Stock Analysis Report

Landstar System, Inc. (LSTR) : Free Stock Analysis Report

Schneider National, Inc. (SNDR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance