Under Armour (UAA) to Gain From Product Innovation & Expansion

Under Armour, Inc.’s UAA strategic focus on its direct-to-consumer (DTC) business, international expansion and product innovation is part of a comprehensive approach to achieve not just immediate growth but also long-term brand robustness and consumer loyalty. Through these initiatives, Under Armour is positioning itself to meet current market demands and anticipate future trends, securing its leadership in the retail and sportswear sectors.

The company has optimized its marketing functions to accelerate decision-making and enhance connections with consumers. It has seen considerable success in boosting social media engagement, which proves to be a potent method for engaging consumers and expanding brand recognition.

The visibility of UAA's brand has significantly increased, driven by strategic branding and marketing efforts, including partnerships with prominent athletes and teams. The company’s progress in digital and social media engagement reflects a contemporary, effective marketing approach that resonates with its target audience.

Under Armour is enthusiastic about its innovation pipeline, especially in areas like footwear and women’s apparel. In the third quarter of fiscal 2024, the company made notable advancements in supply-chain efficiency, including reductions in freight costs and improved inventory management, contributing to better financial health and operational effectiveness.

A key component of UAA’s strategy for engaging customers is the UA Rewards Loyalty Program. This point-based system rewards purchases with exclusive benefits and tailored recommendations. The program has experienced remarkable growth, with nearly 3 million sign-ups in the third quarter of fiscal 2024, exceeding the company’s annual targets.

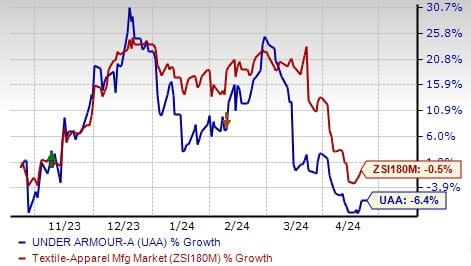

Image Source: Zacks Investment Research

International Segment Sees Growth

Under Armour’s international business is a crucial growth driver, utilizing the global appeal of its brand to enter diverse markets. Present in nearly 100 countries, the company focuses on forming strategic partnerships, expanding its retail operations, and advancing digital initiatives to enhance its market presence.

In the third quarter of fiscal 2024, the international business saw a 7.4% year over year revenue increase, underscoring the potential of these markets. Specifically, revenues in the EMEA region rose 7.1% to $284 million, Asia-Pacific revenues also increased 7.1% to $212 million, and Latin American revenues grew 9.4% to $69.8 million.

DTC Channel as a Critical Element

Under Armour is committed to enhancing its DTC channels, focusing on upgrading the online shopping experience and introducing a full-price brand house design to present a more premium brand image. In the fiscal third quarter, DTC revenues increased 4% year over year to $741 million, with a 2% rise in e-commerce sales, which now account for 45% of the total DTC business. Revenues from owned and operated stores also saw a 5% increase.

Footwear Segment Faces Trouble

The footwear segment at Under Armour faced a year-over-year 7% decline due to a tough comparison with the previous year's significant growth of 25%, alongside softer demand, primarily in North America. This downturn signals potential issues in product appeal or innovation within a key category for the company.

In the past six months, shares of this Zacks Rank #3 (Hold) company have dipped 6.4% compared with the industry’s 0.5% decline.

Key Picks

Some better-ranked companies in the Consumer Discretionary sector are Ralph Lauren Corp. RL, Gildan Activewear Inc. GIL and Duluth Holdings DLTH.

Ralph Lauren, a major designer, marketer and distributor of premium lifestyle products in North America, Europe, Asia and internationally, has a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Ralph Lauren’s fiscal 2024 sales and earnings per share (EPS) indicates year-over-year growth of 2.7% and 22.7%, respectively. The company has a trailing four-quarter earnings surprise of 18.7%, on average.

Gildan Activewear, a manufacturer and marketer of premium quality branded basic activewear, presently carries a Zacks Rank of 2.

The Zacks Consensus Estimate for Gildan Activewear’s current financial-year sales and earnings suggests growth of 2% and 14.4% from the year-ago period’s reported figure. GIL has a negative trailing four-quarter earnings surprise of 0.7%, on average.

Duluth provides casual wear, workwear and accessories for men and women. It currently has a Zacks Rank #2. DLTH has a negative trailing four-quarter earnings surprise of 183.6%, on average.

The Zacks Consensus Estimate for Duluth’s fiscal 2024 sales and EPS indicates increases of 0.8% and 75%, respectively, from the year-ago period’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

Gildan Activewear, Inc. (GIL) : Free Stock Analysis Report

Duluth Holdings Inc. (DLTH) : Free Stock Analysis Report

Under Armour, Inc. (UAA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance