Uncover 3 Canadian Dividend Stocks Yielding Up To 4%

The Canadian market, much like its global counterparts, has been experiencing a period of volatility. Factors such as inflation concerns and geopolitical tensions have led to fluctuations in stock prices and interest rates. Amid these uncertainties, dividend stocks can be an attractive option for investors looking for steady income streams. These stocks, particularly those yielding up to 4%, could offer some degree of stability in the current economic climate marked by shifting policy expectations and corporate earnings growth outlooks.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

IGM Financial (TSX:IGM) | 6.74% | ★★★★★★ |

Bank of Nova Scotia (TSX:BNS) | 6.60% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 7.02% | ★★★★★★ |

iA Financial (TSX:IAG) | 4.02% | ★★★★★☆ |

Enghouse Systems (TSX:ENGH) | 3.41% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.06% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 4.14% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 3.95% | ★★★★★☆ |

Acadian Timber (TSX:ADN) | 6.77% | ★★★★★☆ |

Secure Energy Services (TSX:SES) | 3.56% | ★★★★★☆ |

Click here to see the full list of 37 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

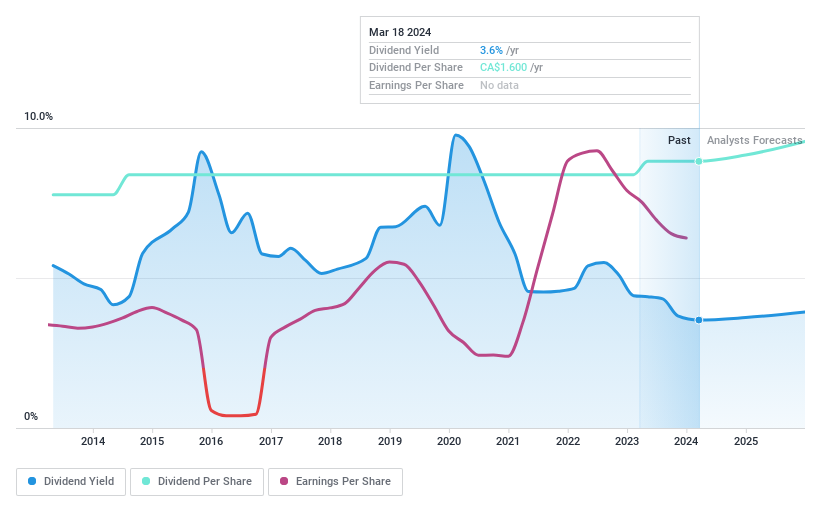

Russel Metals

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Russel Metals Inc., with a market cap of CA$2.45 billion, is a metal distribution and processing company operating extensively in Canada and the United States.

Operations: Russel Metals Inc., a metal distribution and processing firm, generates its revenue primarily from three segments: Steel Distributors contributing CA$466.3 million, Energy Field Stores with CA$987.2 million, and the largest segment being Metals Service Centers bringing in CA$3.03 billion.

Dividend Yield: 4.1%

Russel Metals' recent redemption of its 6% senior unsecured notes, financed through cash on hand, underlines the firm's robust liquidity position with C$629 million in cash as of December 2023. The company declared a dividend of C$0.40 per share in February 2024 and has a low cash payout ratio (24.7%), indicating well-covered dividend payments. While earnings are forecast to decline by an average of 3.9% per year for the next three years, analysts anticipate a stock price rise by 25.3%.

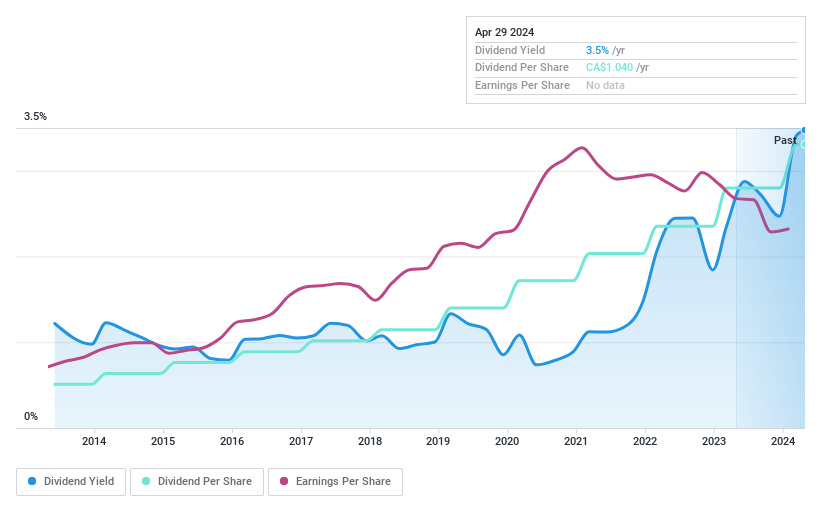

Enghouse Systems

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Enghouse Systems Limited is a global enterprise that develops software solutions, with a market capitalization of approximately CA$1.65 billion.

Operations: Enghouse Systems Limited generates its revenue primarily from two segments: the Asset Management Group, which brought in CA$184.48 million, and the Interactive Management Group with earnings of CA$283.60 million.

Dividend Yield: 3.4%

Enghouse Systems' Board recently approved a dividend increase to C$0.26 per share, marking an 18.2% rise from the previous payout. The firm's Q1 2024 report showed a revenue of C$120.49 million and net income of C$18.13 million, both higher than last year's figures. With a payout ratio at 69.3%, earnings comfortably cover its dividends, which have been stable over the past decade despite being low compared to top Canadian dividend payers (3.41% vs 6.46%). Analysts predict a stock price increase of 25.8%.

Take a closer look at Enghouse Systems' potential here in our dividend report.

Our valuation report unveils the possibility Enghouse Systems' shares may be trading at a discount.

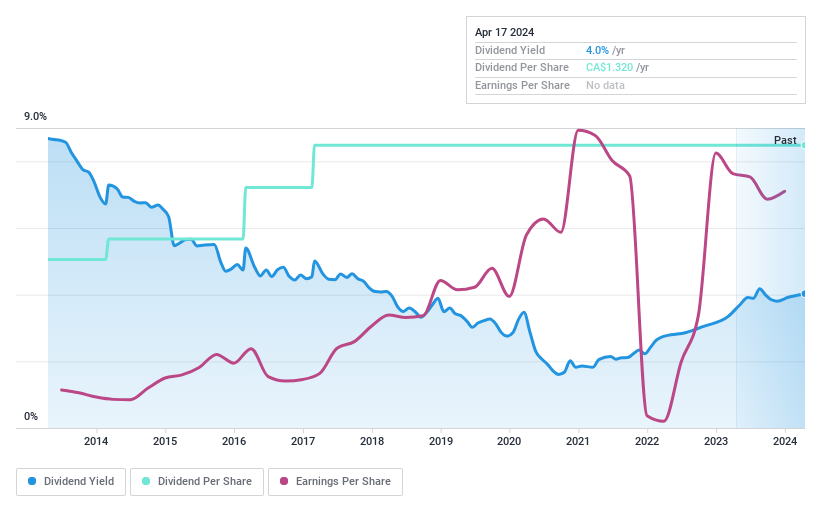

Richards Packaging Income Fund

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Richards Packaging Income Fund, a North American company that designs, manufactures, and distributes packaging containers and healthcare supplies and products, has a market capitalization of CA$358.12 million.

Operations: Richards Packaging Income Fund generates its revenue primarily from the Wholesale - Miscellaneous segment, which brought in CA$425.93 million.

Dividend Yield: 4%

Richards Packaging Income Fund's cash distribution for March 2024 was CAD 0.11 per unit, maintaining a consistent dividend payout in recent months. The firm reported full-year sales of CAD 425.93 million and net income of CAD 38.89 million in 2023, with earnings per share at CAD 3.55 from continuing operations. With a low payout ratio (37.2%), dividends are well covered by earnings and cash flows (Cash Payout Ratio:18%). Despite its stable dividend growth over the past decade, its yield (4.03%) is lower than top Canadian dividend payers' average.

Seize The Opportunity

Investigate our full lineup of 37 Top Dividend Stocks right here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:RUS TSX:ENGH and TSX:RPI.UN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance