UMB Financial's (UMBF) Arm to Sell Broker-Dealer Business

UMB Financial Corporation’s UMBF subsidiary, UMB Fund Services, is planning to sell its broker-dealer distribution business to ACA Group. This transaction will allow UMB Fund Services to give undivided attention to its core business and improve fund administration and fund accounting, as well as transfer agency businesses. The deal is expected to close in the final quarter of 2024.

ACA Group is the leading governance, risk and compliance advisor in financial services. Its distribution channel, ACA foreside (“ACA”), is one of the leading third-party distributors by number of funds in the industry. At present, ACA oversees the distribution and services of $2 trillion in assets across hundreds of fund families.

UMB Fund Service's divestiture of its distribution business to ACA will lead to the growth of the latter’s internal distribution team. This also involves incorporating new asset management clients offering mutual funds, exchange-traded funds and closed-end fund products. Consequently, this transaction will add more than $48 billion in client assets to ACA. Additionally, UMB Fund service's clients will gain access to ACA’s wide-ranging advisory support, along with its top-tier technology.

Executive vice president and executive director for Registered Funds of UMB Fund Services, Maureen Quill, stated, “We will continue to service many of these clients through our core lines of business and look forward to maintaining and growing those relationships. We are confident our clients will have a smooth and seamless transition for distribution services through both UMB’s and ACA Foreside’s continued focus on delivering best-in-class service."

CEO at ACA Group, Patrick Olson, mentioned, “We are excited about the opportunities this acquisition brings to our strategic growth vision alongside the ability to expand our market presence and deliver exceptional value to our clients and stakeholders."

UMBF is focused on growing inorganically. In April 2024, the company announced its plan to acquire Heartland Financial in an all-stock transaction valued at around $2 billion. This deal will further diversify its business, adding scale to its consumer and small business capabilities. Also, the merger will add California, Minnesota, New Mexico, Iowa and Wisconsin to UMB Financial’s existing footprint, thereby creating a presence in the Midwest and Southwest markets. It also strengthens the company’s presence in its existing markets.

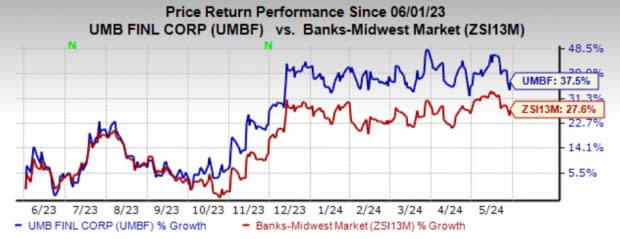

Over the past year, shares of UMBF have gained 37.5% compared with the industry’s growth of 27.6%.

Image Source: Zacks Investment Research

Currently, UMBF sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

Other Stocks to Consider

Some other top-ranked finance stocks worth mentioning are First Community Bankshares, Inc. FCBC and Origin Bancorp, Inc. OBK.

First Community Bankshares’s earnings estimates for 2024 have been revised upward by 8.8% in the past 30 days. The company’s shares have gained 4.5% over the past three months. At present, FCBC sports a Zacks Rank of 1.

Origin Bancorp’s 2024 earnings estimates have revised upward marginally in the past 30 days. The stock has gained 5% over the past three months. Currently, OBK also sports a Zacks Rank #1.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UMB Financial Corporation (UMBF) : Free Stock Analysis Report

First Community Bancshares, Inc. (FCBC) : Free Stock Analysis Report

Origin Bancorp, Inc. (OBK) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance