UK Growth Companies With High Insider Ownership In July 2024

As the United Kingdom braces for significant political and economic events, including a pivotal election, market watchers observe a cautious yet steady approach in the FTSE 100. In such times, growth companies with high insider ownership can be particularly compelling as they often demonstrate aligned interests between management and shareholders, potentially offering stability amidst market volatility.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

Name | Insider Ownership | Earnings Growth |

Gulf Keystone Petroleum (LSE:GKP) | 10.8% | 47.6% |

Plant Health Care (AIM:PHC) | 30.7% | 121.3% |

Petrofac (LSE:PFC) | 16.6% | 124.5% |

Foresight Group Holdings (LSE:FSG) | 31.8% | 33.1% |

Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 25.5% |

LSL Property Services (LSE:LSL) | 10.8% | 33.3% |

Velocity Composites (AIM:VEL) | 27.8% | 143.4% |

Judges Scientific (AIM:JDG) | 11.5% | 25.3% |

Afentra (AIM:AET) | 37.2% | 64.4% |

Mothercare (AIM:MTC) | 15.1% | 41.2% |

Let's dive into some prime choices out of from the screener.

Judges Scientific

Simply Wall St Growth Rating: ★★★★★☆

Overview: Judges Scientific plc is a company that designs, manufactures, and sells scientific instruments, with a market capitalization of approximately £677.42 million.

Operations: The company generates revenue primarily through its Vacuum and Materials Sciences segments, totaling £63.60 million and £72.50 million respectively.

Insider Ownership: 11.5%

Earnings Growth Forecast: 25.3% p.a.

Judges Scientific has demonstrated a mixed financial landscape with a notable decline in profit margins from 11% to 7% over the past year. Despite this, earnings are expected to grow by 25.32% annually, outpacing the UK market's growth rate of 12.6%. Insider activity shows more buying than selling, reinforcing confidence in management's commitment. However, high debt levels and significant one-off items have impacted its financial results, suggesting potential volatility in its performance trajectory.

Dive into the specifics of Judges Scientific here with our thorough growth forecast report.

Our valuation report unveils the possibility Judges Scientific's shares may be trading at a premium.

Foresight Group Holdings

Simply Wall St Growth Rating: ★★★★★☆

Overview: Foresight Group Holdings Limited is a company that manages infrastructure and private equity investments across the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market capitalization of approximately £551.42 million.

Operations: The company generates revenue through its segments in infrastructure (£84.17 million), private equity (£47.35 million), and Foresight Capital Management (£9.80 million).

Insider Ownership: 31.8%

Earnings Growth Forecast: 33.1% p.a.

Foresight Group Holdings has shown promising growth, with revenue increasing to £141.33 million and net income to £26.43 million this year. Its earnings are expected to grow by 33.1% annually, outstripping the UK market forecast of 12.6%. Despite a dividend yield of 4.64%, coverage by earnings remains a concern. Recent actions include maintaining dividends and completing a modest share buyback, reflecting stable insider confidence without extensive buying or selling reported recently.

Playtech

Simply Wall St Growth Rating: ★★★★☆☆

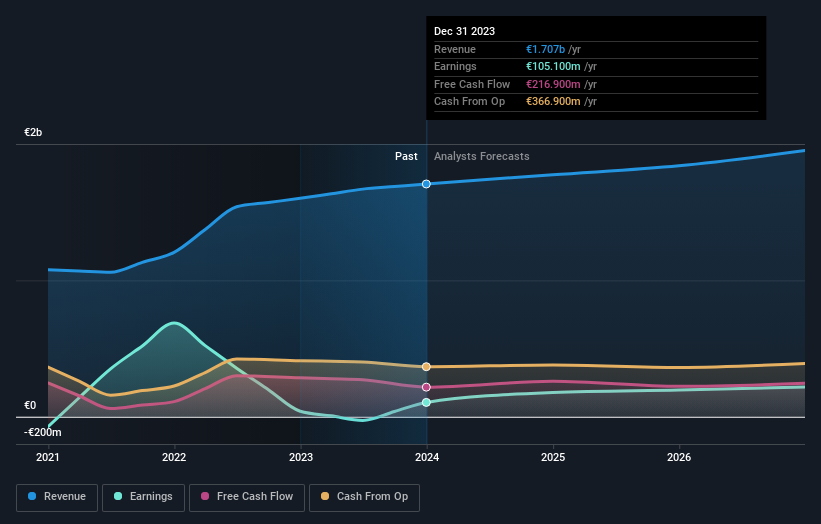

Overview: Playtech plc is a global technology company specializing in gambling software, services, content, and platform technologies with a market capitalization of approximately £1.42 billion.

Operations: The company generates revenue primarily through its Gaming B2B and Gaming B2C segments, which contributed €684.10 million and €946.60 million respectively, along with smaller contributions from HAPPYBET and Sun Bingo totaling €91.60 million.

Insider Ownership: 13.5%

Earnings Growth Forecast: 20.6% p.a.

Playtech, a UK-based gaming software company, recently partnered with MGM Resorts to provide live casino content from Las Vegas, enhancing its service offerings. Although trading 56.8% below its estimated fair value and experiencing significant earnings growth of 158.9% last year, future revenue growth is projected at a modest 4% annually. Despite these challenges, earnings are expected to grow by 20.62% per year. Changes in executive roles aim to strengthen governance as the company continues to innovate and expand its market presence.

Click here and access our complete growth analysis report to understand the dynamics of Playtech.

Upon reviewing our latest valuation report, Playtech's share price might be too pessimistic.

Turning Ideas Into Actions

Click through to start exploring the rest of the 62 Fast Growing UK Companies With High Insider Ownership now.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include AIM:JDG LSE:FSG and LSE:PTEC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance