UK Growth Companies With High Insider Ownership To Watch In July 2024

As the UK economy shows signs of rallying, with positive GDP figures and a buoyant FTSE 100, investors are closely watching market trends and company fundamentals. In this context, growth companies with high insider ownership can be particularly compelling, as they often suggest a strong alignment between management’s interests and shareholder returns.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

Name | Insider Ownership | Earnings Growth |

Plant Health Care (AIM:PHC) | 34.7% | 121.3% |

Petrofac (LSE:PFC) | 16.6% | 124.5% |

Gulf Keystone Petroleum (LSE:GKP) | 12% | 44.4% |

Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 23.5% |

Helios Underwriting (AIM:HUW) | 23.1% | 14.7% |

Belluscura (AIM:BELL) | 38.6% | 121.7% |

Velocity Composites (AIM:VEL) | 27.8% | 173.3% |

Mothercare (AIM:MTC) | 15.1% | 41.2% |

Judges Scientific (AIM:JDG) | 11.5% | 25.3% |

Hochschild Mining (LSE:HOC) | 38.4% | 42.6% |

We're going to check out a few of the best picks from our screener tool.

Energean

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Energean plc is an oil and gas company focused on the exploration, production, and development of energy resources, with a market capitalization of approximately £1.93 billion.

Operations: The company generates revenue primarily from its exploration and production activities, totaling approximately $1.42 billion.

Insider Ownership: 10.6%

Earnings Growth Forecast: 15.6% p.a.

Energean, a growth-oriented company with significant insider ownership, demonstrates robust potential despite some challenges. Its earnings are expected to grow by 15.6% annually, outpacing the UK market prediction of 12.5%. Additionally, Energean's revenue growth forecast at 11% annually exceeds the UK market's 3.5%. However, it faces issues like high debt levels and shareholder dilution over the past year. Recent activities include a dividend declaration and positive production guidance for 2024, underscoring its operational momentum.

Navigate through the intricacies of Energean with our comprehensive analyst estimates report here.

Our expertly prepared valuation report Energean implies its share price may be lower than expected.

Playtech

Simply Wall St Growth Rating: ★★★★☆☆

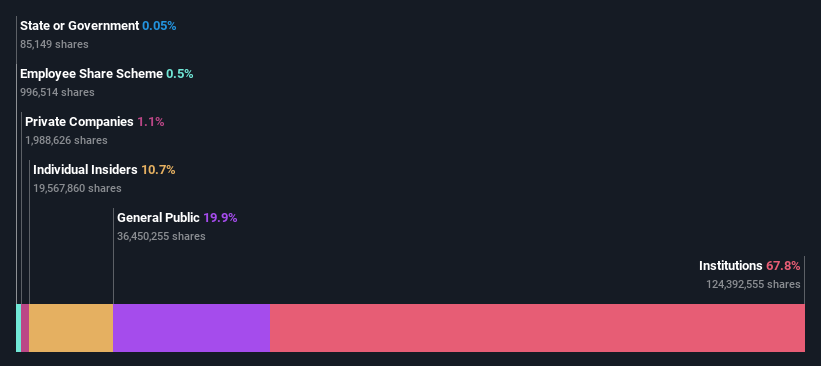

Overview: Playtech plc is a global technology company specializing in gambling software, services, content, and platform technologies with a market capitalization of approximately £1.57 billion.

Operations: Playtech's revenue is derived from several segments, including €684.10 million from Gaming B2B and €946.60 million from Gaming B2C, with additional contributions of €18.20 million from HAPPYBET and €73.40 million from Sun Bingo and other B2C activities.

Insider Ownership: 13.5%

Earnings Growth Forecast: 20.6% p.a.

Playtech, a UK-based growth company with high insider ownership, is poised for substantial earnings growth at 20.62% annually over the next three years, outstripping the UK market's 12.5%. Despite low forecasted return on equity and modest revenue growth predictions of 4% per year, Playtech trades at a significant discount of 52.9% below its estimated fair value and is expected to see a stock price increase of 37.2%. Recent strategic partnerships, like that with MGM Resorts for live casino content from Las Vegas venues Bellagio and MGM Grand, highlight its innovative approach to expanding its market reach globally.

TBC Bank Group

Simply Wall St Growth Rating: ★★★★☆☆

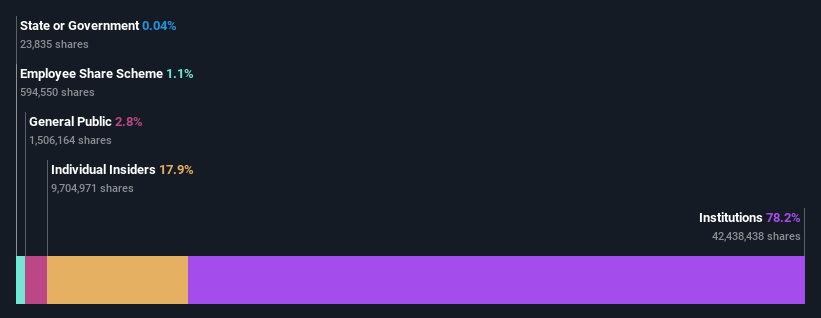

Overview: TBC Bank Group PLC operates primarily in Georgia, Azerbaijan, and Uzbekistan, offering a range of services including banking, leasing, insurance, brokerage, and card processing with a market cap of approximately £1.59 billion.

Operations: The company generates its revenue from a variety of financial services such as banking, leasing, insurance, brokerage, and card processing in Georgia, Azerbaijan, and Uzbekistan.

Insider Ownership: 18%

Earnings Growth Forecast: 15.2% p.a.

TBC Bank Group, a UK-listed entity with substantial insider ownership, reported a robust first quarter with net income rising to GEL 292.81 million from GEL 248.67 million year-over-year. Despite this growth, the company's revenue is projected to increase at a slower pace than some peers, and it struggles with a high bad loans ratio of 2.1%. However, its recent GEL 75 million share buyback program underscores a commitment to shareholder value and confidence in future performance.

Turning Ideas Into Actions

Discover the full array of 62 Fast Growing UK Companies With High Insider Ownership right here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include LSE:ENOG LSE:PTEC and LSE:TBCG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance