UFP Technologies Inc (UFPT) Surpasses Q1 Earnings Estimates with Strong Growth in MedTech

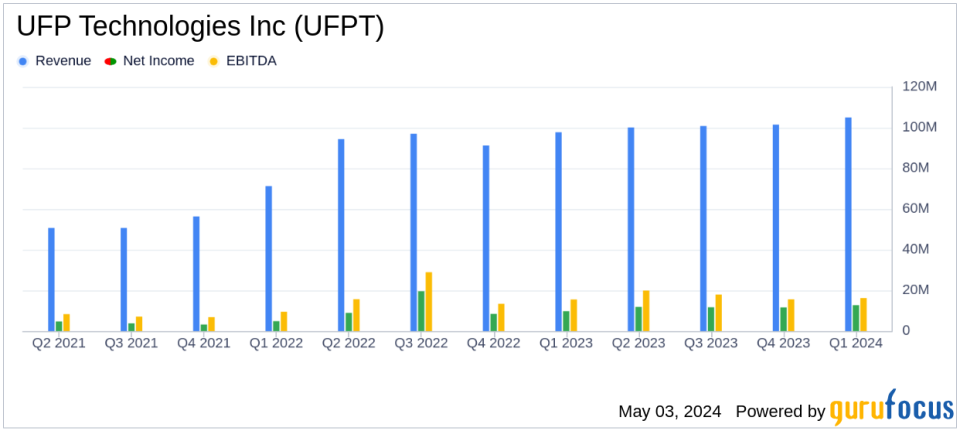

Revenue: Reported at $105.0 million, showing a 7.4% increase year-over-year, slightly below the estimate of $106.97 million.

Net Income: Reached $12.7 million, up 30.3% from the previous year, surpassing the estimated $11.91 million.

Earnings Per Share (EPS): Achieved $1.64 per diluted share, exceeding the estimated $1.53.

Gross Margin: Decreased to 28.6% from 29.4% in the previous year.

Operating Income: Increased by 24% to $15.9 million from the prior year's $12.8 million.

Adjusted EBITDA: Grew by 6.5% to $20.7 million from $19.5 million in the same quarter of the previous year.

Strategic Developments: Highlighted progress in the MedTech sector and expansion in the Dominican Republic, alongside a robust pipeline of acquisition opportunities.

On May 1, 2024, UFP Technologies Inc (NASDAQ:UFPT) released its 8-K filing, announcing a robust start to the year with record first quarter results. The company, a pivotal designer and custom manufacturer for the medical market, reported a net income of $12.7 million, or $1.64 per diluted share, for the quarter ended March 31, 2024. This performance notably exceeded the analyst estimates of $1.53 EPS and $11.91 million net income, highlighting a significant 30.3% increase from the $9.7 million net income of the previous year.

Company Overview

UFP Technologies Inc serves as a critical component of the medical device supply chain, specializing in products ranging from single-use medical devices to complex packaging solutions. The company's expertise in converting raw materials through advanced manufacturing techniques makes it a valued partner in the medical sector, particularly in areas such as minimally invasive surgery and infection prevention.

Financial Performance Insights

The company's revenue for the quarter stood at $105.0 million, up 7.4% from $97.8 million in the same quarter the previous year, driven by a 7.4% growth in sales across both its MedTech and Advanced Components segments. This growth was primarily fueled by increased revenues from robotic surgery and infection prevention, despite some ongoing challenges in other segments like orthopedics and patient surfaces. Notably, the revenue slightly missed the analyst expectations of $106.97 million.

Despite the revenue shortfall, UFP Technologies managed to enhance its operating income by 24% to $15.9 million, up from $12.8 million in Q1 2023. This improvement is attributed to the completion of expansion activities in the Dominican Republic and enhanced operations in Mexico, which grew by 47% over the prior year. However, gross margins saw a slight decline to 28.6% from 29.4% in the previous year, impacted by operational adjustments and market conditions.

Strategic Developments and Future Outlook

Chairman & CEO R. Jeffrey Bailly emphasized the strategic advancements made during the quarter, including the integration of new talent and the signing of significant long-term customer and vendor agreements. These developments are expected to bolster UFP Technologies' platform for future growth. The company also has an active pipeline of acquisition opportunities, which are currently in the due diligence phase, promising potential expansion and diversification.

With a strong balance sheet characterized by only $34 million in debt and continued strategic initiatives, UFP Technologies is well-positioned to sustain its growth trajectory and enhance shareholder value in the upcoming periods.

Conclusion

UFP Technologies Inc's Q1 earnings report paints a picture of a company that is not only growing in terms of revenue and profitability but also strategically positioning itself for sustained long-term growth. The company's ability to exceed earnings per share estimates while actively expanding its operational and strategic horizons bodes well for its future prospects, making it a noteworthy entity for investors within the medical devices and manufacturing sector.

For detailed financial figures and further information, please refer to the official SEC filing.

Explore the complete 8-K earnings release (here) from UFP Technologies Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance