Have UDR, Inc. (NYSE:UDR) Insiders Been Selling Their Stock?

We'd be surprised if UDR, Inc. (NYSE:UDR) shareholders haven't noticed that the President & COO, Jerry Davis, recently sold US$484k worth of stock at US$48.38 per share. However, the silver lining is that the sale only reduced their total holding by 5.2%, so we're hesitant to read anything much into it, on its own.

View our latest analysis for UDR

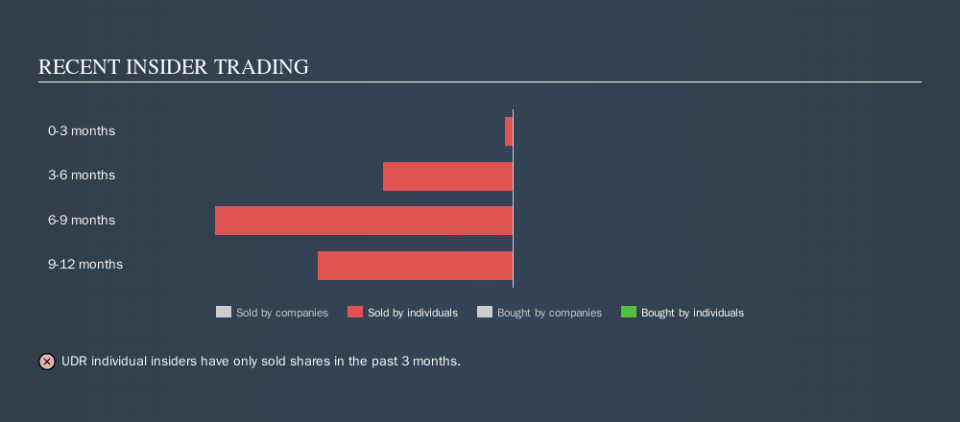

The Last 12 Months Of Insider Transactions At UDR

Over the last year, we can see that the biggest insider sale was by the Chairman & CEO, Thomas Toomey, for US$2.3m worth of shares, at about US$45.06 per share. That means that even when the share price was below the current price of US$48.30, an insider wanted to cash in some shares. As a general rule we consider it to be discouraging when insiders are selling below the current price, because it suggests they were happy with a lower valuation. While insider selling is not a positive sign, we can't be sure if it does mean insiders think the shares are fully valued, so it's only a weak sign. We note that the biggest single sale was only 2.9% of Thomas Toomey's holding.

All up, insiders sold more shares in UDR than they bought, over the last year. You can see the insider transactions (by individuals) over the last year depicted in the chart below. By clicking on the graph below, you can see the precise details of each insider transaction!

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: insiders have been buying them).

Does UDR Boast High Insider Ownership?

For a common shareholder, it is worth checking how many shares are held by company insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. UDR insiders own about US$164m worth of shares (which is 1.1% of the company). I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

So What Does This Data Suggest About UDR Insiders?

Insiders sold UDR shares recently, but they didn't buy any. And our longer term analysis of insider transactions didn't bring confidence, either. While insiders do own a lot of shares in the company (which is good), our analysis of their transactions doesn't make us feel confident about the company. If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

But note: UDR may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance