UBS: Wall Street's forecast for 2017 looks 'irrationally exuberant'

Forecasting earnings for 2017 is arguably Wall Street’s most controversial task. After all, earnings are the most important driver of stock prices in the long run.

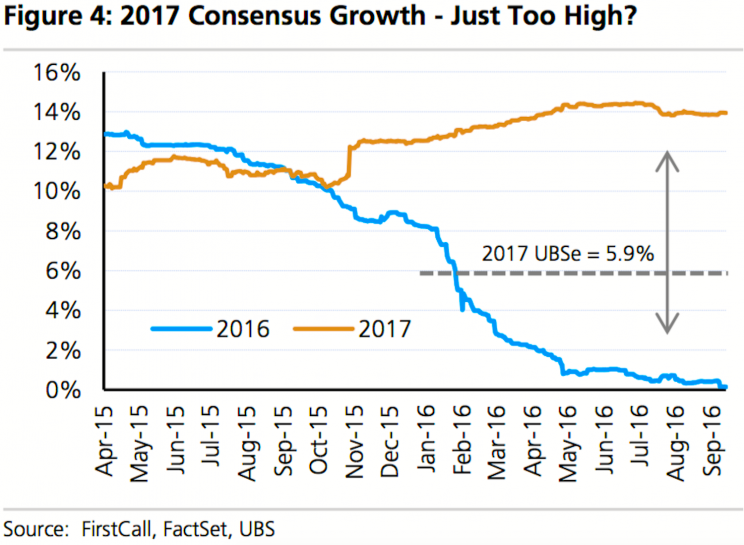

With stock prices near all-time highs and valuations stretched, forecasts for earnings would have to be optimistic. Indeed, FactSet data show that analysts are expecting earnings to jump an impressive 13.4% year-over-year in 2017, following what’s expected to be no growth in 2016.

But history, for what it’s worth, doesn’t bode well for that big growth number.

Check out this chart from UBS’s Julian Emanuel, which shows how estimates for 2016 and 2017 earnings growth have evolved in the past two years. As 2016 happened, 2016’s earnings estimates were adjusted down.

In his note to clients, Emanuel characterizes these 2017 forecasts as “irrationally exuberant.” He believes it is just one of many risks that make the stock market vulnerable.

“The sideways market of July and August, historic in its lack of movement over seven listless weeks, has yielded to a resumption of volatility as uncertainty surrounding US politics, excessive earnings optimism for 2017 (see chart) and the newest concern, Global Central Bankers’ changed messaging with regard to their willingness to provide accommodation in line with market expectations has brought pressure to bear on the S&P 500,” Emanuel wrote.

Emanuel joins his peers at Goldman Sachs and Deutsche Bank, who have been warning clients of downside.

Valuations are stretched

The stock market has exhibited a bout of volatility in recent weeks, leaving investors and traders wondering if the next big move will be up or down. The consensus seems to be leaning toward the latter.

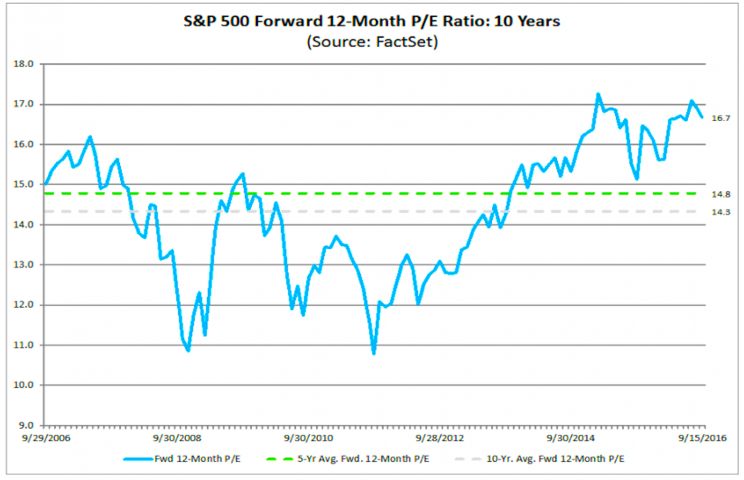

For the past five years, the S&P 500 (^GSPC) has trended higher as earnings and expectations for earnings growth have been lackluster. This divergence is capture by the growing price/earnings (P/E) ratio, a measure of stock market value.

Currently, the forward 12-month P/E ratio, which is based on forecasts for earnings growth in the next 12 months, is high at around 16.7. This is far above the 5-year average over 14.8 and the 10-year average of 14.3.

To be clear, P/E ratios will drift from the averages for years. Nowhere is there a rule that the stock market should make sense. Still, elevated valuations bring no comfort to investors.

–

Sam Ro is managing editor at Yahoo Finance.

Read more:

Tom Lee: The market ‘NEEDS TO BOUGHT AGGRESSIVELY’

Deutsche Bank: ‘An 8-10% S&P decline looms’

Morgan Stanley: ‘We think the US stock market is going higher’

Yahoo Finance

Yahoo Finance