UBS Group (UBS) Seeks Capital Demand Clarity From Swiss Government

UBS Group AG UBS is asking the Swiss authorities to clarify how much additional the bank will need to hold in capital buffers after acquiring Credit Suisse. Investors are concerned that the negotiations could be delayed for months.

The sources stated that some top executives at the bank had been relieved by the government's 'too-big-to-fail' recommendations released in April, which were unexpectedly flexible and modest following Credit Suisse's collapse.

Concerns have been raised, nevertheless, after Stefan Walter — the new head of the Swiss Financial Market Supervisory Authority (FINMA) — stated that he would want to see UBS maintain more capital.

It is not clear if the $15-$25 billion in additional capital that UBS Group may require to hold, as stated by the finance minister in April, is in addition to the $19 billion it has already committed to holding to reflect its expanded size.

The collapse of Credit Suisse last year undermined faith in Switzerland's reputation for stability, pushing the country to establish a more resilient financial sector. Capital-related suggestions are central to these initiatives.

The Financial Stability Board, an international organization overseeing the global financial system, warned this year that Switzerland should tighten its control over the banking industry.

UBS's executives think additional obligations could put it at a competitive disadvantage compared with its peers in the United States and Europe.

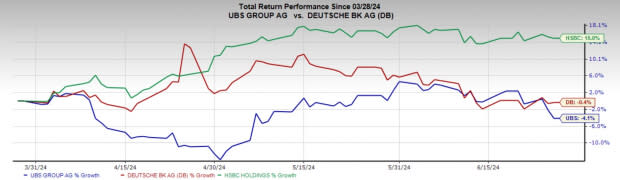

Owing to such uncertainty, in the past three months, UBS Group’s shares have dropped 4.1% compared with Deutsche Bank’s DB fall of 0.4%, while HSBC Holdings plc HSBC increased 15% in the said time frame.

Image Source: Zacks Investment Research

In April 2024, UBS announced a new two-year share repurchase program to buy back up to $2 billion worth of common stock. The company targets to have a progressive dividend policy and to increase share repurchases in 2026 compared with 2022 levels.

Tougher rules may compel UBS to sell more assets to create additional capital, affecting its intentions to return cash to shareholders.

As of March 31, 2024 end, UBS’s common equity tier (CET) 1 capital ratio was 14.8%, while DB and HSBC's CET 1 capital ratio was 13.4% and 15.2%, respectively, as of March 31, 2024.

The new regulations from Switzerland will probably take effect in late 2025 or early 2026. Early in 2025, the Federal Council is anticipated to release a draft of the measures, which will be followed by a possible six-month consultation period.

In May, FINMA’s Walter expressed support for the ‘full capitalization’ of the bank's subsidiaries. This implies that in addition to the $19 billion it is willing to hold, UBS might need to raise its capital.

If UBS Group offers a sound strategy to unwind the bank in the case of a crisis and other too-big-to-fail measures to reinforce the regulator's powers are passed, FINMA — whose opinions the government considers when approving the rules — may demand less capital, according to the source.

The prospect of further capital demands comes at a critical time for UBS. According to the bank's first-quarter data, new liquidity requirements went into effect earlier this year, requiring it to set aside additional liquidity in the event of stress.

At present, UBS Group carries a Zacks Rank of 3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Deutsche Bank Aktiengesellschaft (DB) : Free Stock Analysis Report

UBS Group AG (UBS) : Free Stock Analysis Report

HSBC Holdings plc (HSBC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance