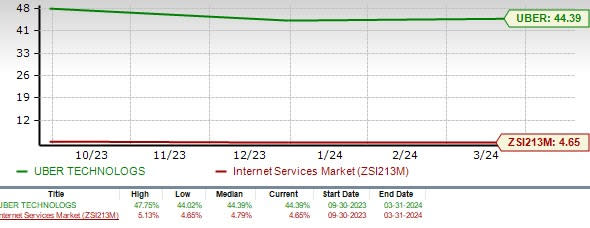

UBER Falls 14% From 52-Week High: Thinking of Buying the Dip?

Shares of Uber Technologies UBER, a leading ride-hailing company, have not been performing well of late, having declined 5.7% in the past three months. The stock is currently trading at 14% off its 52-week high hit on Mar 4.

Three-Month Price Performance

Image Source: Zacks Investment Research

Shares have been on a downward trend ever since the company incurred a loss in the first quarter of 2024, the results of which were reported in May. On the contrary, its rival Lyft Inc. LYFT recently provided rosy targets for 2027 at its Investor Day.

Given the recent weakness in UBER shares, investors might be tempted to buy the stock. But is this the right time to buy UBER? Let’s find out.

UBER’s Fundamental Strength

For long-term investors, a single quarter’s results are not so important. They would rather base their investment decision on the underlying fundamentals. UBER scores impressively on that front, driven by its strong operating model.

Diversification is imperative for big companies to reduce risks and UBER has excelled in this area. It has engaged in numerous strategic acquisitions, geographic and product diversifications and innovations. Uber’s endeavors to expand into international markets are commendable and provide it with the benefits of geographical diversification. Prudent investments enable it to extend services and solidify its comprehensive offerings.

Even though Uber’s primary business is ride-sharing, it has diversified into food delivery and freight over time. Both its ride-sharing and delivery platforms are growing in popularity. This is generating strong demand, which, along with new growth initiatives and continued cost discipline, are driving the company’s results.

With online order volumes remaining impressive, UBER’s delivery business continues to grow. This ensures that the business remains in good shape. Encouraged by the performance of the segment during the pandemic, Uber is making constant efforts to expand its Delivery operations. Continued recovery in the Mobility business is encouraging. Following the removal of the COVID-19 restrictions, the company is seeing continued improvement in demand for Mobility.

Highlighting its financial strength, UBER’s board of directors authorized up to $7 billion in share repurchases earlier this year. Validating its fundamental strength, UBER was added to the much sought-after S&P 500 index in December last year. With a portfolio of 500 leading companies that have approximately 80% coverage of the available market capitalization, the S&P 500 is widely regarded as the best single measure of large-cap U.S. equities.

In line with its objective of becoming emission-free in the United States and Canada by 2030, UBER aims to promote the use of electric vehicles. To that end, San Francisco-based UBER is working with Tesla TSLA.

Factors That May Deter Investors

UBER faces its share of challenges. The performance of the Freight unit due to the slowdown in freight demand is concerning. Freight revenues fell to $1.284 billion in the first quarter of 2024, down 8% from the year-ago period, due to lower revenue per load and volume and the challenging freight market cycle. Additionally, Uber has been grappling with labor unrest for some time.

Despite the company’s efforts to improve operational efficiency and strategic growth initiatives, we are concerned about its high debt levels. Long-term debt increased 66.6% to $9.5 billion at 2023-end from 2019 levels. Notably, UBER went public in 2019.

Long-Term Debt to Capitalization

Image Source: Zacks Investment Research

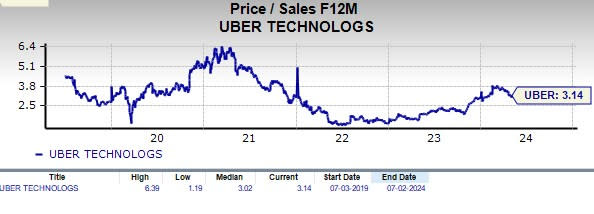

UBER’s valuation picture is also not quite impressive. Going by the trailing 12-month price/sales ratio, the company’s shares currently trade at levels higher than its five-year median.

Image Source: Zacks Investment Research

Final Thoughts

We can safely conclude that investors should refrain from rushing to buy UBER now as it is facing quite a few challenges. Instead, they should monitor the company’s developments closely for a more appropriate entry point. For those who already own the stock, it will be prudent to stay invested for solid long-term prospects. The stock’s Zacks Rank #3 (Hold) supports our thesis.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Lyft, Inc. (LYFT) : Free Stock Analysis Report

Uber Technologies, Inc. (UBER) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance