Uber CFO to Step Down in Most Senior Executive Exit Since IPO

(Bloomberg) -- Uber Technologies Inc. Chief Financial Officer Nelson Chai is planning to leave the ride-hailing company, according to people familiar with the matter, marking the most significant executive departure since the company went public in 2019.

Most Read from Bloomberg

Israel Quietly Embeds AI Systems in Deadly Military Operations

Russia Takes ‘Temporary’ Control of Danone, Carlsberg Assets

History Says It’s Time to Buy Long-Term Bonds as Peak Rates Near

Chai informed Chief Executive Officer Dara Khosrowshahi of his intentions to move on, though a decision on timing hasn’t been made, the people said, asking not to be named discussing non-public information.

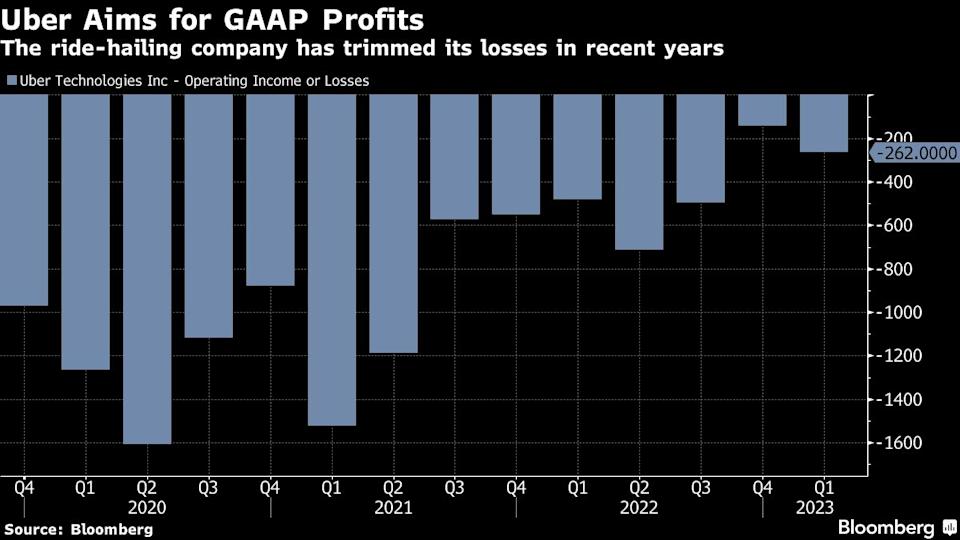

“Over the past five years, Nelson has been essential to putting Uber on secure financial footing, steering the company from billions of dollars in losses,” to improved earnings, strong free cash flow and heading toward an operating profit, an Uber spokesman said in a statement. “We are not going to comment on any executive’s potential career decisions during a quiet period.”

Chai’s pending departure caps a nearly five-year tenure for the financial-industry veteran that has included important milestones. After being tapped in 2018 by Khosrowshahi to guide Uber through its initial public offering and fix its balance sheet, the 58-year-old was tasked with bringing Wall Street discipline to a freewheeling tech company that was blowing through startup capital to fund explosive growth. Uber had been operating without a CFO for more than three years until Chai came on board.

Chai oversaw some of Uber’s biggest highs and lows as a public company. San Francisco-based Uber made several multibillion-dollar deals, like the $2.65 billion acquisition of Postmates in 2020 and logistics operator Transplace for $2.25 billion the following year, purchases that helped Uber diversify beyond rides. When the pandemic decimated demand for ride-hailing, Uber’s bookings fell by as much as 80% and the company cut more than 6,000 employees.

The following year, Chai steered Uber to its first-ever quarter of positive adjusted Ebitda. While the metric strips out some expenses, it served as a strong signal to investors that Uber was moving past its growth-at-all-costs phase.

Uber generated adjusted Ebitda of $186 million in 2022. While the company has yet to post an annual profit on a generally accepted accounting principles basis, Chai and Khosrowshahi have signaled that’s the next goal.

Ratings firm Moody’s Investors Service lifted the company’s credit grade earlier this year, citing substantial improvements in profitability and cash flow generation that it expects to be sustained.

Before Uber, Chai had been a longtime lieutenant of Wall Street veteran John Thain — the former top-ranking executive at Goldman Sachs Group Inc. Chai later went on to take senior roles at the New York Stock Exchange, Merrill Lynch and CIT Group, crossing paths again with Thain.

At Merrill Lynch, Chai and Thain helped the bank weather the 2008 financial crisis, selling the firm to Bank of America Corp. in what was seen as a coup to avoid a possible collapse. The pair left soon after the deal, only to be reunited at commercial lender CIT Group.

Right before he joined Uber, Chai was CEO of insurance company Warranty Group Inc., which was backed by private equity giant TPG before its sale to Assurant Inc.

Most Read from Bloomberg Businessweek

South Korea’s Archaic Rental System Is Costing People Their Life Savings

A Japanese Company Bans Late-Night Work. A Baby Boom Soon Follows

©2023 Bloomberg L.P.

Yahoo Finance

Yahoo Finance