U.S. Steel's (X) Q1 Earnings and Revenues Surpass Estimates

United States Steel Corporation X logged a profit of $199 million or 78 cents per share in first-quarter 2023, down from a profit of $882 million or $3.02 per share in the year-ago quarter.

Barring one-time items, adjusted earnings per share were 77 cents per share, down from $3.11 a year ago. The figure, however, topped the Zacks Consensus Estimate of 61 cents.

Revenues fell around 15% year over year to $4,470 million in the reported quarter. It, however, beat the Zacks Consensus Estimate of $4,068.8 million.

U.S. Steel’s results were impacted by lower prices across Flat-Rolled, Mini Mill and U.S. Steel Europe units in the first quarter. However, the company’s overall shipments rose around 7% year over year in the quarter to 3,951,000 tons.

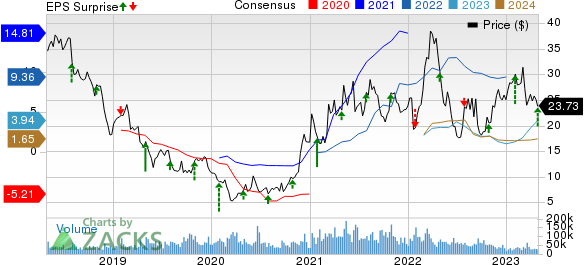

United States Steel Corporation Price, Consensus and EPS Surprise

United States Steel Corporation price-consensus-eps-surprise-chart | United States Steel Corporation Quote

Segment Highlights

Flat-Rolled: The segment recorded a loss of $7 million in the reported quarter, compared with a profit of $529 million a year ago.

Steel shipments in the segment went up roughly 17% year over year to 2,278,000 tons. Average realized price per ton in the unit was $1,012, down around 26% year over year.

Mini Mill: The segment recorded a profit of $12 million in the quarter, down from a profit of $278 million in the year-ago quarter. Shipments were 659,000 tons, up around 30% year over year. Average realized price per ton was $794, down around 42% year over year.

U.S. Steel Europe: The segment posted a loss of $34 million, compared with a profit of $264 million in the year-ago quarter. Shipments in the segment fell around 20% year over year to 883,000 tons. Average realized price per ton for the unit was $909, down around 18% year over year.

Tubular: The segment posted a profit of $232 million in the reported quarter, up from a profit of $77 million a year ago. Shipments rose roughly 2% year over year to 131,000 tons. Average realized price per ton for the unit was $3,757, up roughly 60% year over year.

Financials

At the end of the quarter, the company had cash and cash equivalents of $2,837 million, down around 1% year over year. Long-term debt fell roughly 0.4% year over year to $3,901 million.

Outlook

U.S. Steel said that its focus on being the best partner for its customers through best operations has expanded the benefits of an improved market and further market share gains, which the company expects to continue through the balance of 2023. It expects to deliver stronger second-quarter results on higher steel prices.

Price Performance

The company’s shares are down 22.2% in the past year compared with the industry’s 0.7% rise.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

U.S. Steel currently carries a Zacks Rank #1 (Strong Buy).

Other top-ranked stocks worth considering in the basic materials space include Steel Dynamics, Inc. STLD, PPG Industries, Inc. PPG and Linde plc LIN.

Steel Dynamics currently sports a Zacks Rank #1. The Zacks Consensus Estimate for STLD's current-year earnings has been revised 36.5% upward in the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Steel Dynamics’ earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 10.7%, on average. STLD has gained around 22% in a year.

PPG Industries currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for PPG's current-year earnings has been revised 9.5% upward in the past 60 days.

PPG Industries’ earnings beat the Zacks Consensus Estimate in three of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 6.8%, on average. PPG has gained around 9% in a year.

Linde currently carries a Zacks Rank #2. The Zacks Consensus Estimate for LIN’s current-year earnings has been revised 0.9% upward in the past 60 days.

Linde beat Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 5.9% on average. LIN’s shares have gained roughly 17% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

United States Steel Corporation (X) : Free Stock Analysis Report

PPG Industries, Inc. (PPG) : Free Stock Analysis Report

Linde PLC (LIN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance