U.S. Dollar Index Futures (DX) Technical Analysis – Euro Plunge Triggers Dollar Index Breakout Rally

The U.S. Dollar is trading higher against a basket of major currencies early Monday with most of the gains being driven by a plunge in the Euro and British Pounds. The greenback is also trading higher against the commodity-linked Canadian Dollar, but gains are being offset by increasing demand for the safe-haven Swiss Franc and Japanese Yen.

At 08:46 GMT, December U.S. Dollar Index futures are trading 98.365, up 0.229 or +0.23%.

Last week, it was all about the Fed and U.S. interest rates, today it’s all about the Euro and the sea of red from Euro Zone PMI reports. The Euro is plunging, while driving up the U.S. Dollar Index following the release of fresh data from the Euro Zone’s largest economy that suggested the ongoing economic slump could be worsening.

German Manufacturing PMI fell to 41.4 in September, down from August’s 43.5 and well below trader expectations for a recovery to 41.4. The German Services PMI read at 52.5, a decline on August’s 54.8 and well below expectations for a reading of 54.3. The Composite PMI came in at 49.1, below the 51.7 economists had been expecting.

Daily Technical Analysis

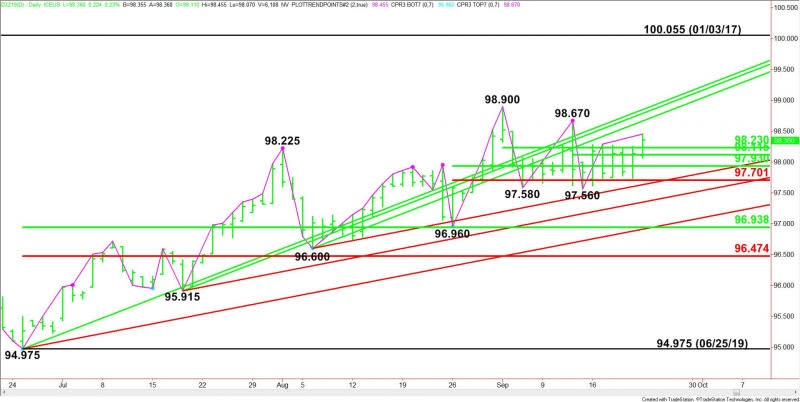

The main trend is down according to the daily swing chart, but a new main bottom has been established at 97.560.

A trade through 98.670 will change the main trend to up. A move through 97.560 will signal a resumption of the downtrend.

The index is garnering support on Monday after crossing to the strong side of a minor pivot at 98.230. This level is new support.

Additional retracement level support comes in at 98.110, 97.930 and 97.700.

Daily Technical Forecast

Based on the early price action, the direction of the December U.S. Dollar Index the rest of the session on Monday is likely to be determined by trader reaction to the pivot at 98.230.

Bullish Scenario

A sustained move over 98.230 will indicate the presence of buyers. If this move creates enough upside momentum then look for the rally to possibly extend into a series of uptrending Gann angles at 98.665, 98.790 and 98.850. Overtaking these angle will put the index in a bullish position. Crossing to the strong side of tops at 98.670 and 98.900 will also signal a change in trend.

Bearish Scenario

A failure to hold 98.230 will signal the return of sellers. This could trigger a labored break with potential downside targets coming in at 98.110, 97.930, 97.700 and 97.630.

Overview

If the breakout over 98.230 continues then look for upside momentum to drive the index into 98.665 to 98.900.

This article was originally posted on FX Empire

More From FXEMPIRE:

GBP/USD Daily Forecast – Sterling Retreats After Failed Break Above 1.2500

EUR/USD Mid-Session Technical Analysis for September 23, 2019

Global Markets Fall, EU Manufacturing Recession Deepens, Trade Talks Productive But Yield No Results

Oil Price Fundamental Daily Forecast – Weak German PMI Data Raises New Concerns Over Demand

U.S. Dollar Index Futures (DX) Technical Analysis – Euro Plunge Triggers Dollar Index Breakout Rally

Yahoo Finance

Yahoo Finance