Tyson Foods (TSN) Q2 Earnings Top Estimates, Sales Up Y/Y

Tyson Foods, Inc. TSN posted second-quarter fiscal 2021 results, with the top and the bottom line increasing year over year. Further, earnings and sales surpassed the Zacks Consensus Estimate.

The company’s performance in the reported quarter reflected sales growth in all the segments. The company continued to see robust growth in the retail business, while its foodservice business saw rebound in the quarter. That said, dismal volumes in almost all segments and rising inflation across the supply chain was a concern. Nevertheless, it continues to focus on its long-term strategy and is well placed to boost growth.

Quarter in Detail

Adjusted earnings came in at $1.34 per share, which beat the Zacks Consensus Estimate of $1.11. Moreover, the bottom line surged 68% year over year.

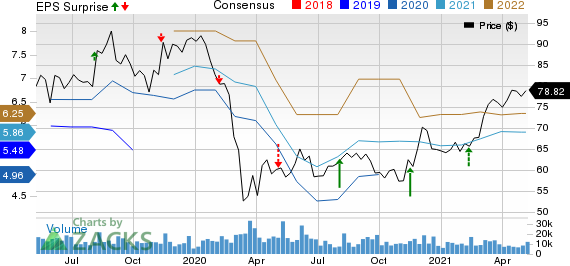

Tyson Foods, Inc. Price, Consensus and EPS Surprise

Tyson Foods, Inc. price-consensus-eps-surprise-chart | Tyson Foods, Inc. Quote

Total sales came in at $11,300 million, which increased 3.8% from $10,888 million reported in the year-ago quarter. The top line surpassed the Zacks Consensus Estimate of $11,204 million. Gains from average price change were 7.5%, while total volumes declined 3.7%.

Gross profit in the quarter came in at $1,253 million, up from $1,021 million reported in the prior-year quarter. Gross profit, as a percentage of sales, came in at 11.1%, up from 9.4% reported in the year-ago quarter. Tyson Foods’ adjusted operating income soared 43% to $739 million. Moreover, adjusted operating margin expanded from 4.7% to 6.5% in the quarter.

During the quarter, the company incurred nearly $95 million as direct incremental expenses associated with COVID-19, which put pressure on results to an extent.These include team member costs, production facility sanitization, testing for coronavirus, donations, product downgrades, rendered product and professional fees. Apart from these factors, indirect COVID-19 costs included expenses associated with raw materials, transportation, underutilization and reconfiguration of plant, premiums offered to cattle producers and discounts on pricing.

Segment Details

Beef: Sales in the segment increased to $4,046 million from $3,979 million reported in the year-ago quarter. Volume declined 5.8% year over year due to lower live cattle processed stemming from impacts of severe winter weather and tough labor environment. Average sales price increased 7.5% on the back of solid beef products demand.

Pork: Sales in the segment increased to $1,477 million from $1,266 million reported in the year-ago quarter. Sales volume declined 0.5% year over year thanks to reduction in live hogs processed due to severe winter weather. Average sales price increased 17.2% owing to strong demand conditions.

Chicken: Sales in the segment increased to $3,553 million from $3,397 million reported in the year-ago quarter. Sales volume fell 3.2% due to pandemic-led reduced production throughput, disruptions associated with severe winter weather, lower hatch rate and a tough labor environment. Average sales price increased 7.8% due to favorable sales mix and market conditions.

Prepared Foods: Sales in the segment increased to $2,164 million from $2,080 million reported in the year-ago quarter. Prepared Foods’ sales volume declined 4.2% due to reduction in the foodservice channel stemming from reduced demand and lower production throughput. Average sales price increased 8.2% due to favorable product mix and pass through of higher raw material costs.

International/Other: Sales in the segment were $487 million, up from $465 million reported in the year-ago quarter. Sales volume inched up 1.2%, while average sales price increased 3.5%.

Other Financial Updates

The company exited the quarter with cash and cash equivalents of $877 million, long-term debt of $9,784 million and total shareholders’ equity (including non-controlling interests) of $16,070 million. In the first six months of fiscal 2021, cash provided by operating activities amounted to $1,349 million.

Total liquidity was about $2.6 billion as of Apr 3, 2021. Management expects liquidity to remain more than the company’s minimum target of $1 billion. The company projects capital expenditures to be in the lower end of $1.3-$1.5 billion for fiscal 2021.

Outlook

For fiscal 2021, USDA expects domestic protein production (chicken, beef, pork and turkey) to improve less than 1% compared with fiscal 2020 levels. On an adjusted basis, the company expects its Prepared Foods unit to remain flat in fiscal 2021 year on year. The Pork segment is expected to remain lower than in fiscal 2020. Moreover, the Beef segment is expected to deliver better performance in fiscal 2021 compared with fiscal 2020 levels. The Chicken unit is likely to deliver lower results in fiscal 2021. Management anticipates sales in the bracket of $44-$46 billion in fiscal 2021, reflecting solid beef markets countered by rising costs.

Segment-Wise Guidance for Fiscal 2021

For the Beef segment, USDA projects domestic production to increase nearly 3% in fiscal 2021. For Pork, domestic production growth is likely to be up by less than 1%, per the USDA. Further, USDA forecasts domestic production in the Chicken segment to be slightly lower in fiscal 2021 compared with fiscal 2020 levels.

For the Prepared Foods segment, the company continues to focus on responding to the changing consumer behavior and rising costs. Finally, the company expects better results from its operations in the International/Other segment.

We note that shares of this Zacks Rank #3 (Hold) company have gained 20.6% in the past three months compared with the industry’s rise of 1.6%.

Some Solid Staple Bets

Medifast, Inc. MED, currently sporting a Zacks Rank #1 (Strong Buy), has a trailing four-quarter earnings surprise of 12.7%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

B&G Foods, Inc. BGS currently carrying a Zacks Rank #2 (Buy), has a trailing four-quarter earnings surprise of 4.2%, on average.

Pilgrim’s Pride Corporation PPC, currently carrying a Zacks Rank #2, has a long-term earnings growth rate of 27%.

Zacks Top 10 Stocks for 2021

In addition to the stocks discussed above, would you like to know about our 10 best buy-and-hold tickers for the entirety of 2021?

Last year's 2020 Zacks Top 10 Stocks portfolio returned gains as high as +386.8%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2021 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tyson Foods, Inc. (TSN) : Free Stock Analysis Report

B&G Foods, Inc. (BGS): Free Stock Analysis Report

Pilgrims Pride Corporation (PPC): Free Stock Analysis Report

MEDIFAST INC (MED) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance