Tyler Technologies Q1 Earnings: Surpasses Analyst Revenue Forecasts with Strong SaaS Growth

Revenue: Reported at $512.4 million, an increase of 8.6% year-over-year, surpassing estimates of $507.15 million.

Net Income: GAAP net income reached $54.2 million, significantly up by 75.4% from the previous year, exceeding the estimated $88.62 million.

Earnings Per Share (EPS): GAAP EPS was $1.26, reflecting a substantial increase from the prior year but fell short of the estimated $2.04.

Subscription Revenue: Grew by 11.7% to $313.2 million, driven by a robust 22% increase in SaaS revenues.

Free Cash Flow: Declined by 10.1% to $57.2 million, indicating a decrease from the previous year's $63.6 million.

Annual Guidance: Revised total revenue expectations for 2024 to range between $2.110 billion and $2.140 billion, with non-GAAP EPS forecasted between $9.10 and $9.30.

Operational Highlights: GAAP operating income surged by 48.9% to $67.0 million, showcasing strong operational efficiency and profitability.

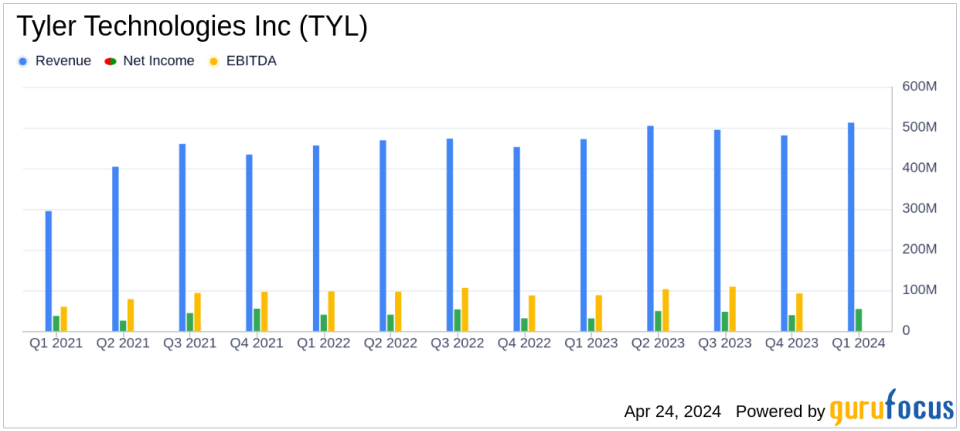

Tyler Technologies Inc (NYSE:TYL) released its 8-K filing on April 24, 2024, reporting impressive first-quarter results for the period ending March 31, 2024. The company announced a total revenue of $512.4 million, an 8.6% increase year-over-year, surpassing the estimated revenue of $507.15 million projected by analysts. This growth was significantly fueled by a robust 22% increase in SaaS revenues.

Tyler Technologies, a leading provider of integrated software and technology services for the public sector, continues to demonstrate strong financial health and market leadership. The company's core products, including Munis, Odyssey, and various payment solutions, play a pivotal role in enhancing the operational efficiencies of local government entities.

Financial Performance Insights

The company's GAAP net income saw a remarkable rise, reaching $54.2 million, or $1.26 per diluted share, which represents a 75.4% increase compared to the same period last year. This performance exceeded the estimated earnings per share of $2.04. Non-GAAP net income also showed a significant increase to $94.7 million, or $2.20 per diluted share. Recurring revenues, which form the backbone of Tyler's revenue stream, were reported at $430.5 million, marking an 8.8% increase from the previous year.

Despite the strong revenue and income figures, Tyler Technologies observed a slight decline in cash flow from operations, which decreased by 3.8% to $71.8 million. Free cash flow also saw a reduction, down 10.1% to $57.2 million.

Operational and Strategic Developments

Lynn Moore, Tyler's president and CEO, highlighted the company's continued success in the SaaS domain, noting the 13th consecutive quarter of SaaS growth exceeding 20%. The company's strategic focus on cross-selling and enhancing its product offerings has evidently paid dividends, contributing to the strong quarterly performance.

In response to the positive results, Tyler Technologies has revised its full-year guidance for 2024. The company now expects total revenues to be in the range of $2.110 billion to $2.140 billion and has set the GAAP diluted earnings per share forecast between $5.27 and $5.47. Non-GAAP diluted earnings per share are projected to be between $9.10 and $9.30.

Challenges and Market Outlook

Despite the optimistic performance, Tyler Technologies faces challenges such as fluctuations in transaction-based revenues and the need to continuously innovate to stay ahead in a competitive market. The company's ability to maintain high growth rates in SaaS and manage operational efficiencies will be crucial in sustaining its market leadership.

Overall, Tyler Technologies' first-quarter results reflect a robust financial and operational position, driven by strategic initiatives and strong demand for its SaaS offerings. The company's upward revision of its full-year guidance further underscores its confidence in continued growth and operational success.

Investor Relations and Future Projections

Investors and stakeholders are encouraged to participate in the upcoming conference call scheduled for April 25, 2024, to discuss these results in detail. Further information is available on Tyler Technologies' investor relations website.

As Tyler Technologies continues to navigate the complexities of the public sector software market, its ability to adapt to technological advancements and client needs will likely determine its trajectory in the competitive landscape.

Explore the complete 8-K earnings release (here) from Tyler Technologies Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance