Twilio Inc (TWLO) Q1 2024 Earnings: Surpasses Revenue Forecasts with Strategic Focus on ...

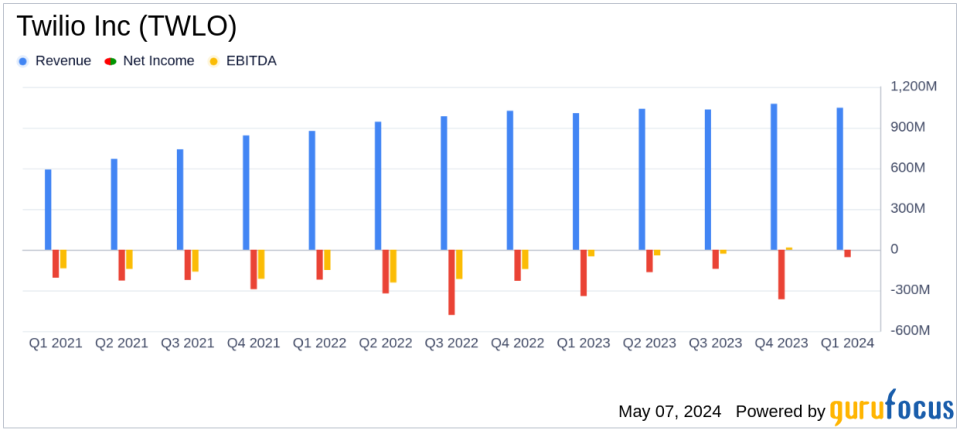

Revenue: $1.05 billion in Q1 2024, up 4% year-over-year, surpassing estimates of $1.032 billion.

Non-GAAP Income from Operations: $160 million in Q1 2024, an increase from $103.8 million in Q1 2023, with raised full-year guidance to $585 to $635 million.

GAAP Loss from Operations: Reduced to $44 million in Q1 2024 from $264.1 million in Q1 2023, marking an 83% improvement year-over-year.

Non-GAAP Net Income Per Share: $0.80 in Q1 2024, up from $0.47 in Q1 2023, exceeding the estimated $0.60.

Free Cash Flow: Reported at $177.3 million in Q1 2024, a significant recovery from a negative $114.5 million in Q1 2023.

Active Customer Accounts: Grew to over 313,000 as of March 31, 2024, up from over 300,000 as of March 31, 2023.

Dollar-Based Net Expansion Rate: Recorded at 102% in Q1 2024, slightly down from 106% in Q1 2023.

On May 7, 2024, Twilio Inc (NYSE:TWLO) disclosed its first-quarter earnings for 2024, revealing a revenue of $1.05 billion, which marks a 4% increase year-over-year and surpasses the estimated $1.032 billion. This performance is detailed in their recent 8-K filing. Twilio, a leading cloud-based communications platform, continues to enhance customer engagement through its comprehensive suite of services, including voice, video, chat, and SMS messaging.

Financial Performance and Strategic Enhancements

Twilio's Q1 performance also highlighted a significant reduction in GAAP loss from operations, which improved by 84% to $44 million year-over-year. The non-GAAP income from operations was reported at $160 million, a substantial increase from the previous year's $103.8 million. This improvement reflects Twilio's enhanced operational efficiency and disciplined financial strategy.

The company also reported a non-GAAP net income per share of $0.80, outperforming the estimated $0.60 and showing a notable rise from the $0.47 reported in Q1 2023. This growth is supported by a robust increase in active customer accounts, now totaling over 313,000, up from 300,000 a year earlier.

Operational Highlights and Future Outlook

Twilio's operational strategy has been focused on achieving greater financial discipline and innovation, as emphasized by CEO Khozema Shipchandler. The company's commitment to driving profitability is evident in its raised full-year guidance for non-GAAP income from operations, now expected to be between $585 million and $635 million. Additionally, Twilio has reaffirmed its organic revenue growth forecast for 2024, projecting an increase of 5% to 10%.

The company's balance sheet remains strong with $672.6 million in cash and cash equivalents and a significant free cash flow of $177.3 million for the quarter, a dramatic improvement from the negative free cash flow reported in the same period last year.

Challenges and Market Position

Despite its positive performance, Twilio faces challenges, including maintaining its growth rate in a highly competitive environment and managing the impacts of macroeconomic conditions. However, its strategic initiatives, such as the $3 billion share repurchase program, underline a commitment to shareholder value and confidence in its financial health.

Twilio's ongoing innovation, market expansion, and customer engagement strategies position it well for sustained growth. As the company continues to navigate market dynamics and invest in key areas, it remains a significant player in the interactive media industry.

Conclusion

Twilio Inc's Q1 2024 results not only exceeded revenue expectations but also showcased a strategic pivot towards profitability and operational efficiency. With increased guidance and a strong financial position, Twilio is poised for continued success in the evolving digital communication landscape.

Explore the complete 8-K earnings release (here) from Twilio Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance