The Turkish lira is climbing ahead of Sunday's snap elections

Thomson Reuters

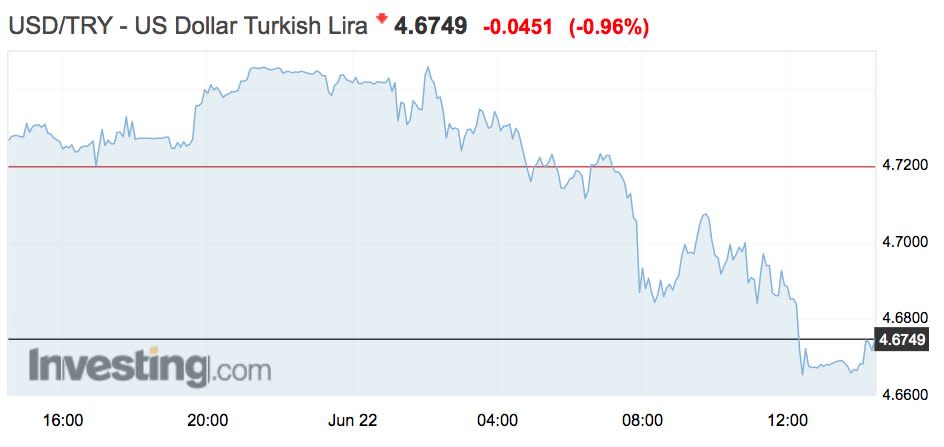

The Turkish lira was up more than 1% on Friday.

That's ahead of a historic presidential election this weekend.

The lira rose Friday ahead of Turkey's historic snap elections this weekend, which will also mark the country's shift from a parliamentary system to a more powerful presidency.

The lira was up 1.3% to 4.6672 versus the dollar at 2 p.m. ET. Turkey's central bank has been trying to prop up the lira ahead of the election, raising rates earlier this month for the third time in two months to 17.75%.

But Jameel Ahmad of FXTM said investors have largely ignored those rate hikes amid expectations that President Tayyip Erdogan, a self-proclaimed "enemy" of interest rates, will win the election, which he moved up by more than a year as his opponents began gaining ground.

"The view of Erdogan is that low interest rates will encourage investment into Turkey because investors will become encouraged to take advantage of lower borrowing costs," Ahmad said. "This view is not economically incorrect, but it also does not fully take into account the dangerous effect the Lira depression is having on the Turkish economy."

The lira hit an all-time low last month after Erdogan said in an interview with Bloomberg TV that he would exert more influence over the economy, raising concerns about the independence of Turkey's central bank under another Erdogan term.

Ahmad said investors need to closely monitor how the lira reacts to the election "in case it causes a ripple effect on other global markets." If the lira hits another record low, it could lower risk appetite for other emerging markets currencies which he said are already vulnerable amid global trade tensions and a stronger dollar.

"We can’t afford to look at the weekend Turkey election as an idiosyncratic event," Ahmad said.

Turkey's fiscal policies are also at risk of weighing on the lira in the near-term. A team of Morgan Stanley strategists led by Hans Redeker wrote in a research note that the lira is likely to continue to weaken post-election should there be no change to its "imbalanced" growth model.

"The credit expansion and loosening fiscal policy will continue to worsen the imbalance and keep the current account deficit wide," Redeker wrote.

The lira is down 23% against the dollar this year.

investing.com

NOW WATCH: Trump pitched peace to Kim Jong Un with this Hollywood-style video starring Kim as the leading man

See Also:

Disappointing photos show what cruise ships actually look like in real life

30 behind-the-scenes secrets about Chip and Joanna Gaines' 'Fixer Upper'

SEE ALSO: Oil is rallying after OPEC reportedly strikes a deal to raise production

Yahoo Finance

Yahoo Finance