Turkey’s Inflation Cools Faster Than Expected in Turnaround

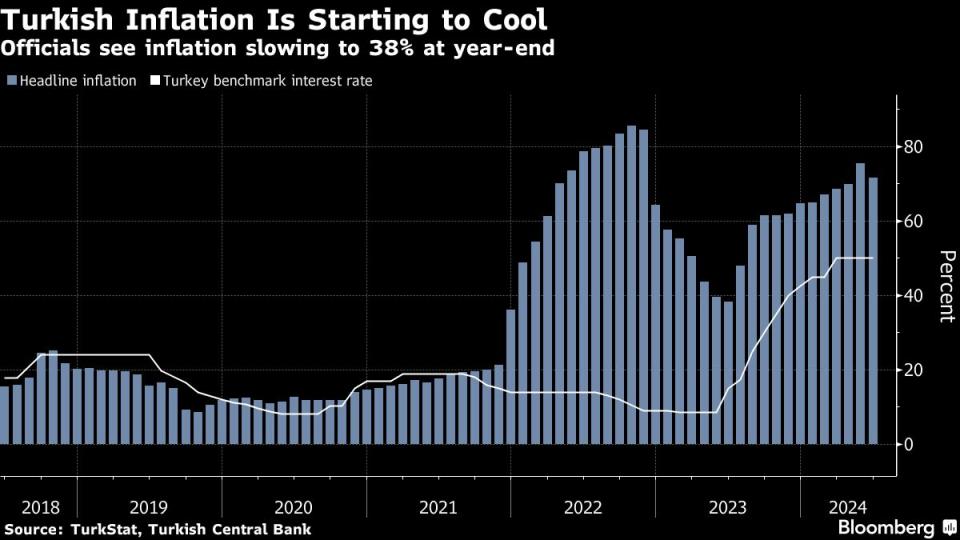

(Bloomberg) -- Turkish inflation eased for the first time in eight months, a faster-than-estimated slowdown from a peak reached in May that puts consumer prices on course for a steep deceleration during the summer months.

Most Read from Bloomberg

Biden Struggles to Contain Pressure to Abandon Reelection Bid

China Can End Russia’s War in Ukraine With One Phone Call, Finland Says

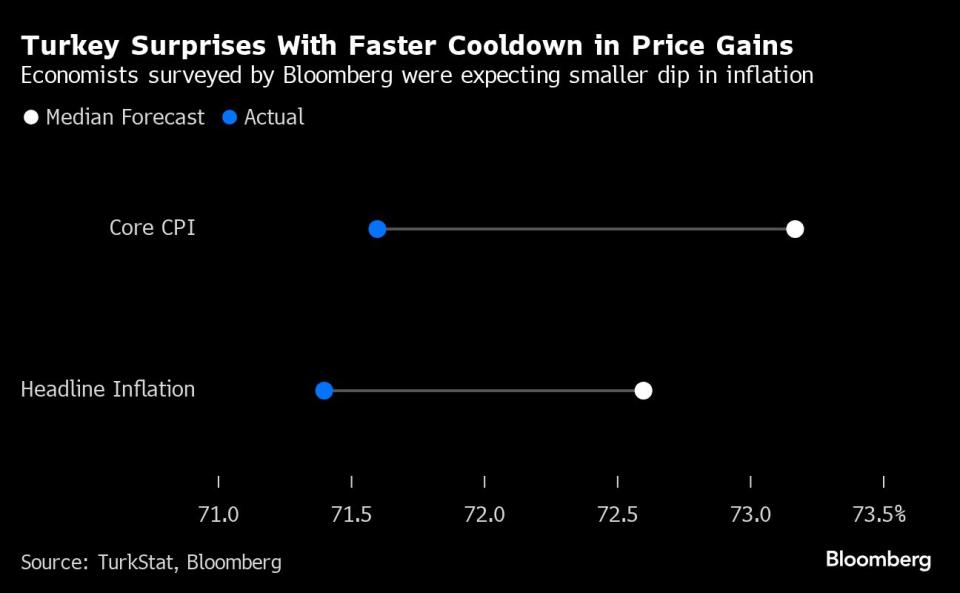

Data on Wednesday showed headline inflation slipped to 71.6% in June, from 75.5% the previous month. Monthly price growth, the central bank’s preferred gauge, came in at 1.6%, the lowest in more than a year.

No economist surveyed by Bloomberg predicted such an abrupt deceleration. The median forecasts of analysts were for an annual rate of 72.6% and a 2.2% monthly gain.

“The disinflation process has begun,” Treasury and Finance Minister Mehmet Simsek said on X.

The government’s lira bonds rallied after the data release, with the yield on two- and 10-year securities falling 122 basis points and 54 basis points, respectively. The Turkish currency briefly erased losses and was trading little changed as of 2:35 p.m. in Istanbul.

Turkey is starting to turn the page on two years of a severe cost-of-living squeeze caused by one of the world’s fastest rates of price growth. Officials are optimistic that the letup will mark the start of rapid disinflation following an aggressive monetary tightening cycle that raised the key interest rate by over 40 percentage points to 50% in less than a year.

Investors are closely watching how the deceleration unfolds as they pile into local assets. The trajectory ahead will also determine when rate cuts move back to the agenda of policymakers who’ve been telegraphing a hawkish message by warning their approach will remain tight “until a significant and sustained decline in the underlying trend” of monthly inflation.

Inflation may slow to “50% or even slightly lower” in August, said Tufan Comert, director of global markets strategy at BBVA in London.

“After that, the fall in inflation will slow down as the favorable base effect starts to dissipate, but the effect of the tight monetary policy, and hence the cooldown in the economy, will become more effective,” Comert said.

Still, many economists see inflation ending the year above the central bank’s goal of 38%, with a steep price slowdown in July and August driven largely by the statistical effect of a high base from 2023.

Price gains in Istanbul, Turkey’s commercial hub, aren’t slowing at nearly the same pace as seen nationwide. The city’s retail inflation barely changed in June from May in annual terms while dropping slightly on a monthly basis to 3.4%, according to the Istanbul Chamber of Commerce.

Policymakers pointed to “the high level of and the stickiness in services inflation,” according to the minutes of the central bank’s most recent rate meeting, warning that “inflation expectations, geopolitical risks, and food prices keep inflationary pressures alive.”

Simsek said earlier this week it was “important” for inflation to slow below 42% — the upper range of the central bank’s year-end forecasts but still about eight times the official 5% target rate.

“Last year’s price acceleration means annual inflation in the coming months will be lower, creating an illusion of disinflation,” said Erik Meyersson, chief emerging markets strategist at SEB AB, in a post on X. “It will be important to monitor other measures of inflation.”

What Bloomberg Economics Says...

“Gains in food and clothing items came in lower than our expectations, but underlying trends show price gains are still hot in some sectors, including services where annual inflation remained above 95%.”

— Selva Bahar Baziki, economist. Click here to read more.

While inflation expectations are falling among market participants, the outlook of households is proving more stubborn, with price growth seen at 71.5% a year from now.

Unanchored expectations can fuel front-loaded spending if consumers believe prices will accelerate further in the future. The central bank has said domestic demand still at “inflationary levels.”

Even so, tighter policies are trickling through to the economy.

A measure of Turkish manufacturing activity compiled by the Istanbul Chamber of Industry and S&P Global has been below the 50-mark that separates expansion from contraction for three months, with companies raising their selling prices in June to the least extent in four and a half years.

Moving forward, the focus will be more on the fiscal efforts made to complement the central bank’s approach. Until now, expansionary measures like an early retirement plan and strong wage growth at the start of the year have “limited or diluted the effect of policy tightening,” said Barclays Plc economist Ercan Erguzel.

--With assistance from Joel Rinneby and Tugce Ozsoy.

(Updates with central bank discussion in 12th paragraph.)

Most Read from Bloomberg Businessweek

China’s Investment Bankers Join the Communist Party as Morale (and Paychecks) Shrink

The Fried Chicken Sandwich Wars Are More Cutthroat Than Ever Before

Dragons and Sex Are Now a $610 Million Business Sweeping Publishing

For Tesla, a Smaller Drop in Sales Is Something to Celebrate

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance