Turkey Bond Inflow Figures Swell With Local Banks Buying Abroad

(Bloomberg) -- Turkish banks have found a roundabout way to access cheaper lira liquidity abroad, and in doing so are inflating figures for foreign purchases of lira-denominated government bonds.

Most Read from Bloomberg

Kamala Harris Is Having a Surprise Resurgence as Biden’s Campaign Unravels

Singapore Couples Are Marrying Earlier to Buy Homes, Leading Some to Regret

Biden’s Fourth of July Shrouded by Pressure to Drop 2024 Bid

Nasdaq 100 Up 1% as US Yields Tumble on Fed Wagers: Markets Wrap

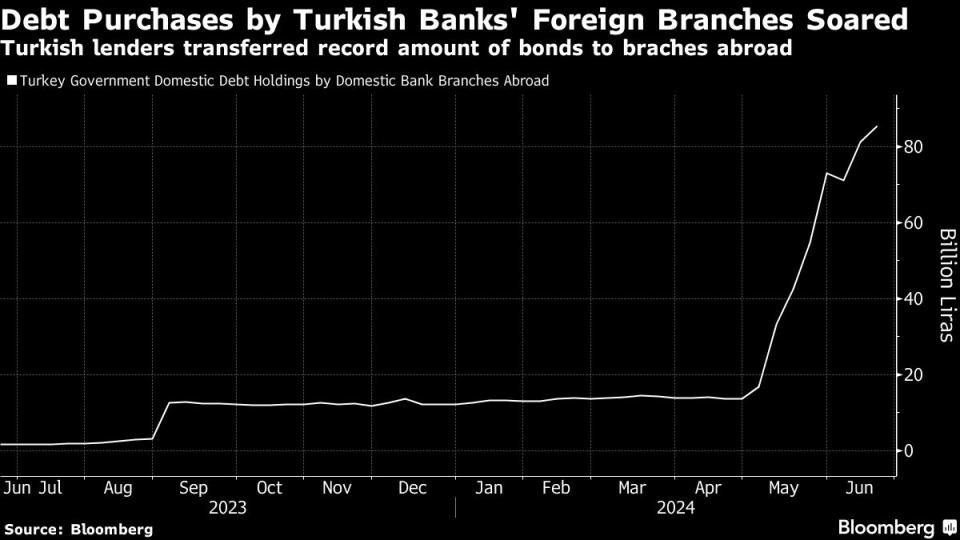

Lira-denominated government debt has attracted a net $8.3 billion in overseas purchases in the past three months alone, data from the central bank shows. While some of that can be attributed to a revival of foreign interest in Turkey following a policy turnaround last year, bond traders say a sizeable proportion of the apparent inflows is actually coming from Turkish banks.

That’s because the banks have been selling or lending bonds to foreign counterparts, then buying them back via forward trades, according to traders who spoke to Bloomberg on condition of anonymity. Such transactions help the lenders to access lira liquidity at cheaper rates than they can at home.

“The appetite for Turkish bonds and currency products has indeed increased, but the actual inflows into local-currency government debt isn’t as big as it appears,” said Onur Ilgen, head of Treasury at MUFG Bank Turkey AS in Istanbul. “That’s because most of the inflows come to very short-term products amid brokered deals by foreign branches of Turkish banks.”

Fueling the trade is an oddity of the Turkish market caused by increased foreign investor holdings of Turkish liras and Turkish restrictions on currency swaps. The combination of the two has made it cheaper at times to borrow liras abroad than to borrow them inside Turkey, with offshore overnight rates falling to as much as 20 percentage points lower than the domestic yield above 50%.

Rates Discrepancy

The discrepancy in rates gives Turkish banks an incentive to use their foreign branches to borrow liras, and then invest them in government bonds. The lenders can then sell those bonds to foreign institutions, or lend them out, transactions that are recorded by the central bank as inflows. It’s unclear how much of the $8.3 billion in inflows is due to such trades, and the central bank declined to comment on them.

Debt purchases by Turkish lenders’ branches abroad have boosted foreign-inflow figures for lira bonds, but are “not entirely overseas investments,” according to Tufan Comert, an emerging market strategist at BBVA in London.

Meanwhile foreign investors are still exhibiting caution in taking on duration in Turkish bonds, with many positions for now focused on the currency instead, either via forward contracts and the carry trade, or shorter-term debt. Bank of America strategists calculate that positioning in forwards could now exceed $20 billion.

While some big-name foreign firms, including Amundi SA, Fidelity Investments and Abrdn Plc, have turned more constructive on local-currency Turkish debt recent months, others say they’re waiting to see inflation slow considerably or bond yields rise toward more attractive levels before buying in.

Overseas investors “tend to go for the highest-yielding notes with the shortest possible duration, so the quality of the inflows doesn’t appear to be very high for the time being,” BBVA’s Comert said.

Most Read from Bloomberg Businessweek

Dragons and Sex Are Now a $610 Million Business Sweeping Publishing

For Tesla, a Smaller Drop in Sales Is Something to Celebrate

The Fried Chicken Sandwich Wars Are More Cutthroat Than Ever Before

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance