TSX Growth Leaders With High Insider Ownership July 2024

Amidst a robust first half of 2024, the Canadian market has shown resilience with notable gains, particularly in sectors less exposed to technology. This performance sets an optimistic backdrop for investors looking at the remainder of the year. High insider ownership in growth companies is often viewed as a positive marker, suggesting that those with intimate knowledge of their companies see long-term value and potential in their investments, aligning well with current market trends and economic conditions.

Top 10 Growth Companies With High Insider Ownership In Canada

Name | Insider Ownership | Earnings Growth |

Vox Royalty (TSX:VOXR) | 12.3% | 58.7% |

goeasy (TSX:GSY) | 21.5% | 15.5% |

Payfare (TSX:PAY) | 15% | 46.7% |

Propel Holdings (TSX:PRL) | 40% | 36.4% |

Allied Gold (TSX:AAUC) | 22.5% | 71.7% |

Magna Mining (TSXV:NICU) | 10.6% | 95.1% |

Artemis Gold (TSXV:ARTG) | 31.7% | 48.8% |

Aya Gold & Silver (TSX:AYA) | 10.3% | 51.6% |

Ivanhoe Mines (TSX:IVN) | 12.6% | 66% |

Almonty Industries (TSX:AII) | 12.3% | 105% |

Let's dive into some prime choices out of from the screener.

Aya Gold & Silver

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aya Gold & Silver Inc. is a company that focuses on the exploration, evaluation, and development of precious metals projects in Morocco, with a market capitalization of approximately CA$1.83 billion.

Operations: The company generates its revenue primarily from the Zgounder Silver Mine in Morocco, totaling CA$37.48 million.

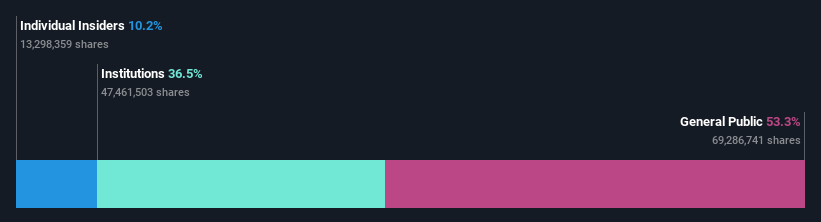

Insider Ownership: 10.3%

Earnings Growth Forecast: 51.6% p.a.

Aya Gold & Silver has seen substantial insider buying over the past three months, indicating strong internal confidence despite a recent shareholder dilution. The company's profit margins have decreased from last year, but earnings are projected to grow by 51.64% annually, outpacing the Canadian market's forecast of 14.6%. Additionally, Aya's revenue growth is also expected to significantly exceed the national average with a forecast rate of 42.7% per year. Recent high-grade drill results from its Zgounder Silver Mine underscore ongoing operational advancements and exploration success, supporting its robust growth trajectory in a competitive sector.

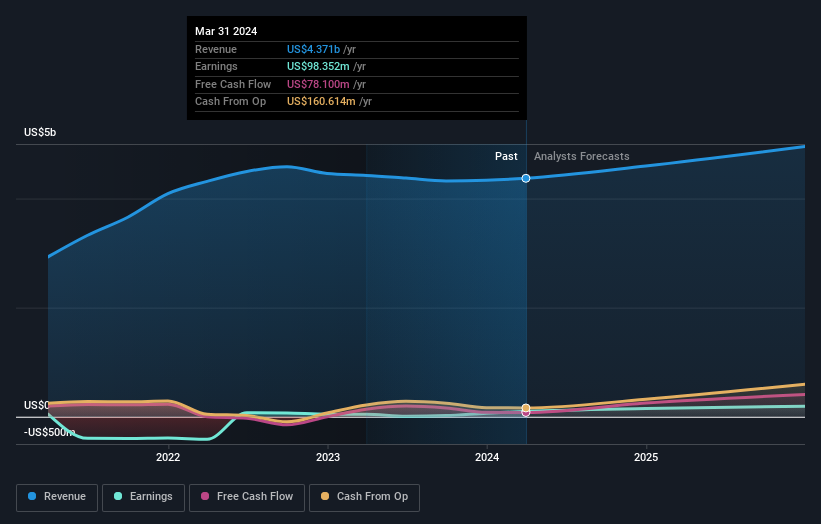

Colliers International Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Colliers International Group Inc. operates globally, offering commercial real estate professional and investment management services, with a market capitalization of approximately CA$7.77 billion.

Operations: The company generates revenue through its operations in the Americas (CA$2.53 billion), Asia Pacific (CA$616.58 million), Investment Management (CA$489.23 million), and Europe, Middle East & Africa (EMEA) at CA$730.10 million.

Insider Ownership: 14.2%

Earnings Growth Forecast: 38.3% p.a.

Colliers International Group has recently taken on significant projects, such as assisting Diamondhead Casino Corporation with property marketing and financing. Despite a leadership transition with CEO Tony Horrell retiring in 2025, the company maintains strong growth prospects, forecasting a revenue increase of 9.5% annually. However, challenges include insufficient operating cash flow to cover debt and substantial insider selling over the past three months, which may raise concerns about internal confidence in the company’s short-term prospects.

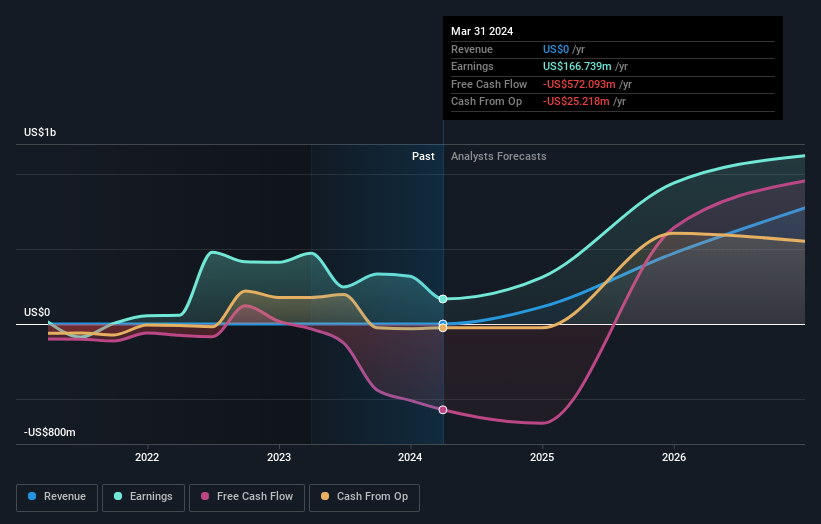

Ivanhoe Mines

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ivanhoe Mines Ltd. is a company that focuses on the mining, development, and exploration of minerals and precious metals primarily in Africa, with a market capitalization of approximately CA$24.83 billion.

Operations: The firm primarily generates revenue from the mining, development, and exploration of minerals and precious metals in Africa.

Insider Ownership: 12.6%

Earnings Growth Forecast: 66% p.a.

Ivanhoe Mines Ltd. has demonstrated robust growth prospects, particularly with the recent completion of its Phase 3 concentrator at the Kamoa-Kakula Copper Complex ahead of schedule and on budget. This development is poised to significantly boost copper production, reinforcing Ivanhoe's strategic expansion initiatives in the Democratic Republic of the Congo. However, challenges persist such as recent substantial insider selling and a net loss reported in Q1 2024, which could raise concerns about its near-term financial stability.

Click to explore a detailed breakdown of our findings in Ivanhoe Mines' earnings growth report.

The valuation report we've compiled suggests that Ivanhoe Mines' current price could be inflated.

Summing It All Up

Reveal the 28 hidden gems among our Fast Growing TSX Companies With High Insider Ownership screener with a single click here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSX:AYA TSX:CIGI and TSX:IVN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance