TSX Growth Companies With High Insider Ownership And Minimum 38% Earnings Increase

The Canadian market has experienced a mix of fluctuations recently, with a 1.5% drop over the last week but an overall increase of 9.1% over the past year. In this context, companies with strong insider ownership and significant earnings growth, such as those increasing earnings by at least 38%, are particularly noteworthy for their potential resilience and alignment of interests between shareholders and management.

Top 10 Growth Companies With High Insider Ownership In Canada

Name | Insider Ownership | Earnings Growth |

goeasy (TSX:GSY) | 21.7% | 15.8% |

Payfare (TSX:PAY) | 15% | 46.7% |

Propel Holdings (TSX:PRL) | 40% | 36.4% |

Allied Gold (TSX:AAUC) | 22.5% | 68.2% |

Aritzia (TSX:ATZ) | 19% | 51.2% |

ROK Resources (TSXV:ROK) | 16.6% | 159.6% |

Aya Gold & Silver (TSX:AYA) | 10.2% | 51.6% |

Silver X Mining (TSXV:AGX) | 14.2% | 144.2% |

Ivanhoe Mines (TSX:IVN) | 13% | 65.5% |

Almonty Industries (TSX:AII) | 12.3% | 105% |

Below we spotlight a couple of our favorites from our exclusive screener.

Allied Gold

Simply Wall St Growth Rating: ★★★★★☆

Overview: Allied Gold Corporation, operating in Africa, focuses on the exploration and production of mineral deposits with a market capitalization of approximately CA$0.71 billion.

Operations: The company generates revenue from three primary mines: Agbaou Mine at CA$141.39 million, Bonikro Mine at CA$192.71 million, and Sadiola Mine at CA$342.34 million.

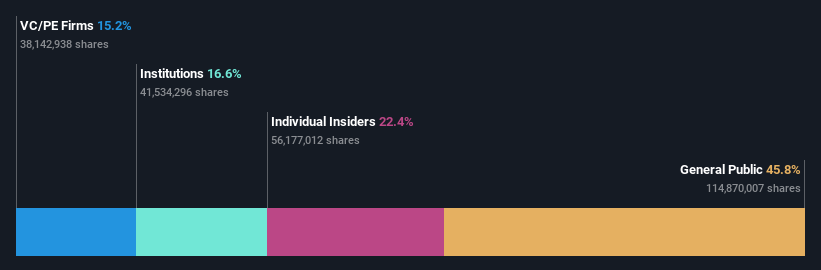

Insider Ownership: 22.5%

Earnings Growth Forecast: 68.2% p.a.

Allied Gold, a growth-oriented company with significant insider ownership, has shown promising operational performance with increased gold production and sales in Q1 2024. The firm recently reaffirmed its robust production guidance up to 2026, aiming for substantial yearly increases. Financially, Allied turned around from a net loss last year to lesser losses this quarter while substantially increasing revenue. Insider transactions over the past three months indicate strong confidence from management, aligning with analysts' expectations of significant stock price appreciation and profitability within three years.

Click here and access our complete growth analysis report to understand the dynamics of Allied Gold.

Aritzia

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aritzia Inc. is a company that designs, develops, and sells women's apparel and accessories in the United States and Canada, with a market capitalization of approximately CA$4.29 billion.

Operations: The company generates CA$2.33 billion from its apparel and accessories segment.

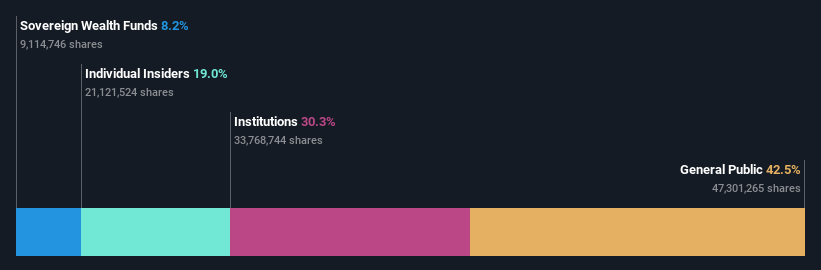

Insider Ownership: 19%

Earnings Growth Forecast: 51.2% p.a.

Aritzia, a Canadian retailer, reported a decrease in net income to CAD 78.78 million from CAD 187.59 million year-over-year, despite a slight increase in sales to CAD 2.33 billion. The company forecasts revenue growth of 8% to 12% for fiscal 2025, indicating resilience and expansion plans. Insider transactions have been modest with recent share buybacks totaling CAD 30 million. Analysts predict robust future earnings growth at an annual rate of 51.19%, although current profit margins have declined to 3.4%.

Navigate through the intricacies of Aritzia with our comprehensive analyst estimates report here.

Our valuation report here indicates Aritzia may be undervalued.

Vitalhub

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vitalhub Corp. offers technology solutions for health and human service providers across Canada, the U.S., the UK, Australia, Western Asia, and other international markets, with a market capitalization of CA$392.35 million.

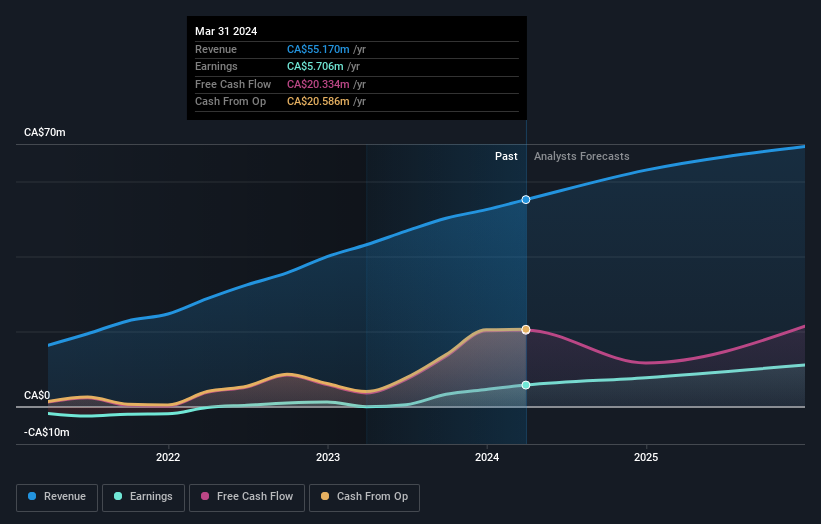

Operations: The company generates CA$55.17 million from its healthcare software segment.

Insider Ownership: 15.1%

Earnings Growth Forecast: 38.1% p.a.

Vitalhub, a Canadian tech firm focusing on healthcare solutions, has shown promising growth with recent strategic moves including a significant partnership with Lumenus Community Services to enhance data management and client outcomes. The company reported a substantial year-over-year revenue increase to CAD 15.26 million in Q1 2024 and an impressive net income rise. Despite shareholder dilution last year, insider buying trends remain strong, underscoring confidence from within. Earnings are expected to grow significantly over the next three years, outpacing the market forecast.

Key Takeaways

Access the full spectrum of 31 Fast Growing TSX Companies With High Insider Ownership by clicking on this link.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSX:AAUC TSX:ATZ and TSX:VHI.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance