The rule used to be buy a home priced at 3 times your income. Is that possible in NC?

For decades, real estate agents gave potential homebuyers a general guideline for how much house they could afford — about two and half times their annual income.

But across the nation and especially in the Triangle, that guidance is no longer close to matching reality. Still-rising house prices (and home insurance premiums) are crushing many would-be homeowners’ dreams.

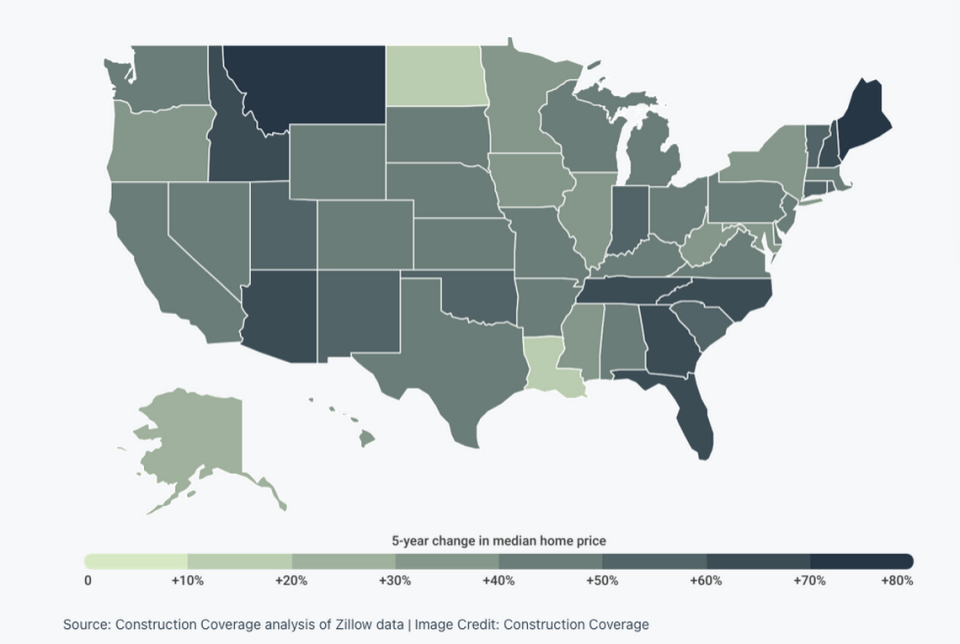

In Raleigh, the median home price now sits at $434,407 — up 55.8% over the past five years — as increasing demand and rising land and material costs drive up prices. Meanwhile, the median income is $75,424.

That’s a home price-to-income ratio of 5.8, according to a new study by Construction Coverage — more than double what people used to think of as affordable.

“While the year-over-year wage growth in the U.S. remains above pre-pandemic levels, the benefit has been limited,” the report’s author, Jonathan Jones, said. He cited inflation and house prices that “have skyrocketed” as the main factors driving the ratio higher. “Household incomes have failed to keep up.”

In Durham, the ratio is at 5.2. The median home price stands at $340,336, while the median income is $65,534.

In Cary, where median income is much higher than the rest of the region, it’s significantly lower at 4.7 and on par with the country as a whole. The median home price is $498,838, but the median income is $106,304.

Statewide, the median home price is $322,527. The median income is $67,481; the home price-to-income ratio is 4.8.

Asheville has the highest ratio (7.2). The median home price is $462,515; and the median income is $64,548. In High Point, which has the lowest ratio (3.6), the median home price is $229,034, and median income is $63,930.

The study used data from the Zillow Home Value Index and the U.S. Census Bureau’s 2022 American Community Survey.

Growing affordability crisis

Incomes trailing behind house-price growth is not a new trend in the U.S. But the rate of change has accelerated the widening affordability gap, say experts.

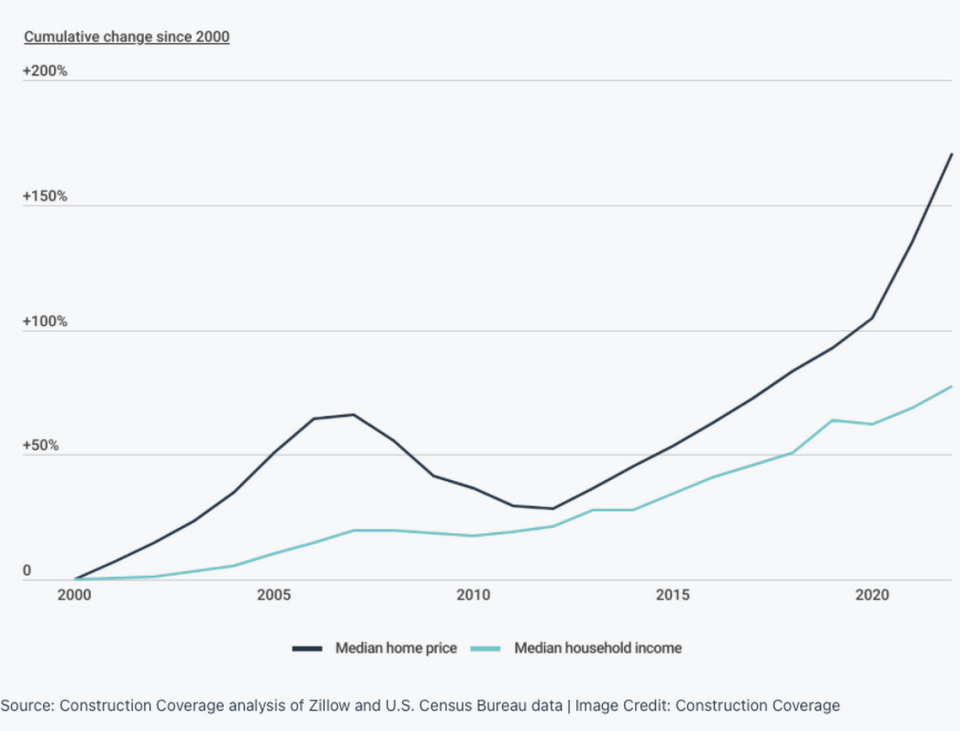

From 2000 to 2022, the median annual household income in the U.S. increased by 77.6%, from $41,990 to $74,580, while the median home price nearly tripled — a 170% increase — from $123,086 to $332,826, the report noted.

On an inflation-adjusted basis, household incomes increased by just 4.5% since 2000, while home prices increased by 59.1%.

Widespread inventory shortages and persistent demand for housing will likely keep home prices (and price-to-income ratios) historically high,” Alexander Hermann, a senior research associate at Harvard University’s Joint Center for Housing Studies, noted in a separate study earlier this year.

The result is a growing housing affordability crisis, squeezing the so-called “missing middle” — people earning 80% to 120% of the median income.

In the Triangle, first-time buyers are increasingly turning to smaller, more affordable alternatives: townhouses or condos.

They’re also expanding their search to bedroom towns like Zebulon and Knightdale further east and Pittsboro out west, where deals are more likely.

On the Market

Keep up with the latest Triangle real estate news by subscribing to On the Market, The News & Observer's free weekly real estate newsletter. Look for it in your inbox every Thursday morning. Sign up here.

Yahoo Finance

Yahoo Finance